A large chunk of India’s population lies on the outskirts of the formal economy. Living in far-flung corners of the country, illiteracy and a lack of connectivity are common reasons why consumers in these areas remain unbanked. Moreover, banks in rural areas are few and far in-between, making it difficult for many people to reach them during working hours.

A large chunk of India’s population lies on the outskirts of the formal economy. Living in far-flung corners of the country, illiteracy and a lack of connectivity are common reasons why consumers in these areas remain unbanked. Moreover, banks in rural areas are few and far in-between, making it difficult for many people to reach them during working hours.

The government, however, is making efforts to broaden financial inclusion and has recently introduced several programmes to address these obstacles, including Jan Dhan Yojana and Smart Cities.

Impetus provided by Demonetisation

In November 2016, the government announced the demonetisation of high-value currency in India, leading to prolonged cash shortages and disruption in the economy. While there were several objectives behind the demonetisation, increased digitisation and the integration of the formal and informal economies were among those that began to take shape. The shortage of hard cash for daily purchases led to the quick adoption of e-payment portals, e-wallets and digital transactions. Additionally, the cash volatility encouraged people to warm up to the concept of payments banks.

This adoption of digital transactions, however, was primarily taking place in the urban areas, largely because companies enabling digital transactions, like e-wallets, e-portals etc. hadn’t covered rural areas till then. As a result, consumers in the hinterland felt the effects of demonetisation more severely. In fact, as much as 38% of the rural population didn’t even have bank accounts.

The Domestic Remittance Opportunity For The Rural Economy

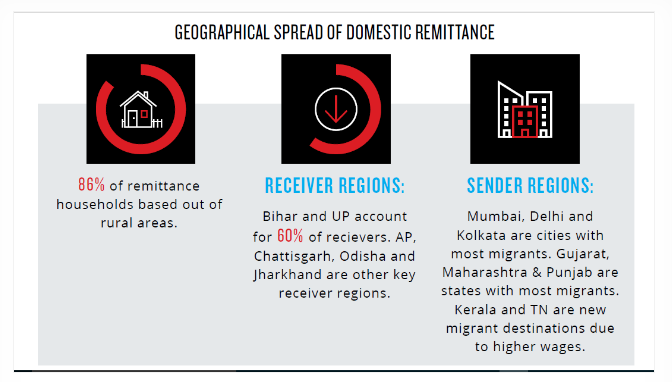

Remittance, or the transfer of money between two people (rather than a payment for goods or services), is a basic financial activity for many rural Indians; it’s also a key untapped business opportunity for players looking to facilitate the abundance of money transfers. Payments banks can provide a ready solution to the current domestic remittance scenario. There are 120 million migrant workers in India, and more than 80% live in the inadequately connected rural areas. Additionally, migrants who hail from villages but work in towns and cities make 80% of the country’s domestic remittances.

According to the National Remote Payments Survey by National Council of Applied Economic Research, and additional insights using Nielsen’s forecasting technique, domestic remittance in India is valued at more than INR 900 billion per year, including non-traditional modes of transfer. Rural India’s contribution is over INR 700 billion per year.

Of the INR 700 billion worth of domestic remittances that happen in rural India, traditional channels comprise a mere 40%, or INR 300 billion. The rest of the remittance happens via non-traditional remittance modes. Given the high risk of non-traditional remittance modes, there is a huge scope to expand traditional remittance avenues like payments banks.