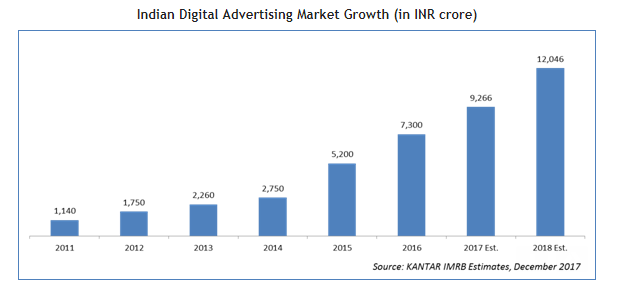

Riding on growing popularity of smartphones, widespread availability of 3G/4G services and surge in internet penetration in the country; digital advertisement spend in the country is now at 15.5% of the overall advertising spend. The Indian digital advertising industry currently stands at INR 9,266 crore and is expected to witness an increase from the current level to reach INR 12,046 crore by 2018.

Riding on growing popularity of smartphones, widespread availability of 3G/4G services and surge in internet penetration in the country; digital advertisement spend in the country is now at 15.5% of the overall advertising spend. The Indian digital advertising industry currently stands at INR 9,266 crore and is expected to witness an increase from the current level to reach INR 12,046 crore by 2018.

Key highlights:

– Digital advertising spend in India is estimated to be around INR 9,266 crore by end of 2017 growing at a rate of 27% over the year 2017.

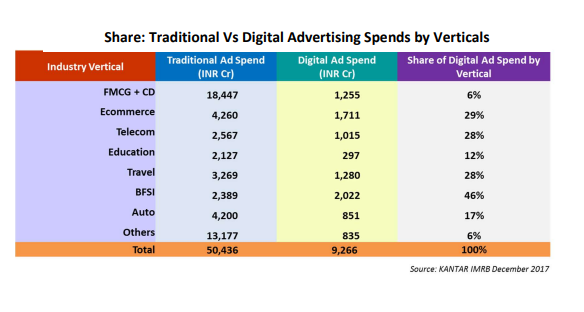

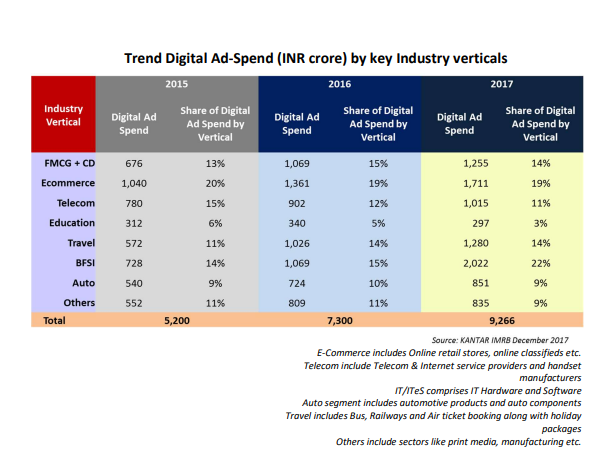

– BFSI, E-Commerce is leading online spends in terms of volume, followed by FMCG & Travel. 68% of the overall digital adds spends comes from this four vertical.

– BFSI brands incurred the highest share of advertising on digital media with 46% of their overall advertising spends on digital followed by Ecommerce and Telecom.

– Ad spends on Search are likely to be INR 2,502 crore followed by Video at INR 1,779 crore. Mobile ads are a key avenue that has shown a 34% growth over last year one year.

– Social Media (LinkedIn/Facebook/Twitter, etc.) and Mobile ad markets are likely to be at INR 1,668 crore and 1,761 crore respectively.

– As digital ads can be customized as per target audience, consumers feel more connected to the ads. From consumer’s view point, a large number of those who view online advertisements feel that these helped them in finding the right product they search for. Viewers also mentioned online ads as being informative.

– The growth in spend on digital advertising is expected to continue, at a rate of 30% over the next year and the total spend is expected to touch INR 12,046 crore by end of 2018

FMCG, Consumer Durables & E-commerce are the top 3 verticals

The digital advertising spends in India was estimated to be around INR 9,266 crore at the end of 2017, growing at a rate of 27% over 2016. The growth in spends on digital advertising is expected to continue at a CAGR of 30% to touch INR 12,046 crore by December 2018.

These are the latest findings of the ‘Digital Advertising in India 2017’ report, jointly published by the Internet and Mobile Association of India (IAMAI) and Kantar IMRB, . According to the report, Digital advertising spend is about 16% of the total ad-spends in the country (estimated to be INR 59,000 Cr).

The report finds that Search takes the lion’s share of digital ad spending. 27% of total digital ad spends (INR 2,502 crore) is made on search. This is followed closely by spends on video and mobile which is around 19% with ad spend being INR 1,779 crore and 1,761 crore respectively. Spends on social media stand at 18% with ad spend around INR 1,668 crore and least being display ads with only 16% with total ad spend being only INR 1,483 crores. Spend on mobile advertising (SMS/In-app ads) also recorded high YoY growth of 34% from INR 1,314 crore in 2016 to around 1,761 crore in 2017. This is because advertising on mobile is considered to be innovative and conveys the message clearly. Also in-app Advertising Avenue is currently being explored and used across various industry sectors since it is believed to fetch better monetization.

In terms of total spend, BFSI lead the digital ad-spend with spends around INR 2022 crore, followed by Ecommerce. A comparison of these verticals in terms of share of spends on Traditional vs. Digital show that BFSI brands incurred the highest share of advertising on digital media with 46% of their overall advertising spends are digital, followed by E-Commerce, Telecom and Travel.

Another interesting trend is the growth of ‘Native ads’ as a popular option. These ads operate as a connector between advertisers and publishers. It solves a problem for them by providing consumers with content that does not disrupt their online experience and is more likely to be seen by them.

Moreover, from a consumer’s perspective, the proportion of Internet users who believe that online ads are informative and that they help them in finding the right product/service they were searching for, is greater than 2016. More important, there has been an increase in the number of consumers who felt that relevance of digital advertising has increased.

Challenges-

Digital advertising industry has managed to increase its share, owing to technology advancements and innovations.

Digital advertising is the destiny of tomorrow, be it programmatic, analytics or various online media strategies will be the driving forces of communication within digital ecosystem. Industry stakeholders are anticipating challenges specifically in terms of the view ability as well as usage of ads. Programmatic advertising is expected to negatively impact digital advertising industry. Security and privacy of the content is the expected challenge within this type of advertising. Stakeholders would like industry bodies to bring in place, some kind of anti-ad fraud products and cyber security software that are able to identify and potentially exclude non-human traffic. This will reduce the risk and therefore will enhance the usage within all the stakeholders.

Indian consumers are comparatively less receptive to display advertising. Consumers are seen actively filtering unwanted content through ad-blocking software, mental firewalls, banner blindness, as a result of which most online advertising is ineffective.

Audience customization and content management are also some of the major challenges within digital advertising. Due to the exponential growth of advertising across platforms, ad-blockers have been created to curb inappropriate and recurring advertisements. While this allows for better browsing, advertisers will have to innovate their offerings and move beyond simple display ads on websites to garner attention and sales.

The evolution of new agencies in the past few years, along with numerous intermediaries viz. agencies, publisher networks, etc. has left the value chain fragmented and the marketer now has to decide from several options, thereby making the process more complex and tedious.

In addition to the mentioned challenges, there is a need to develop infrastructure developed to understand the ad conversions/ sales and ROI co-relation for digital advertisements.

Conclusion-

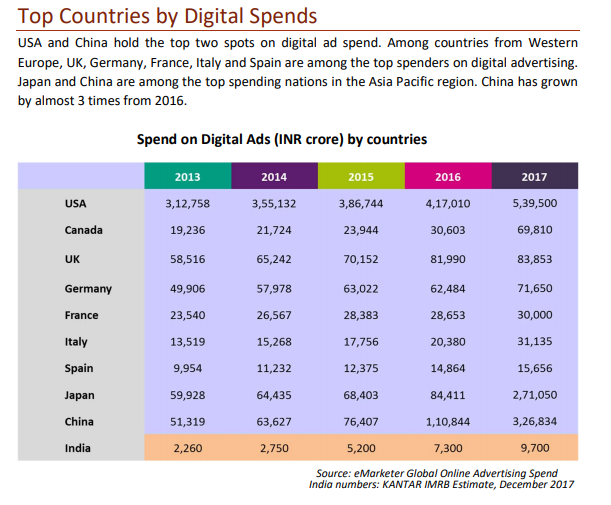

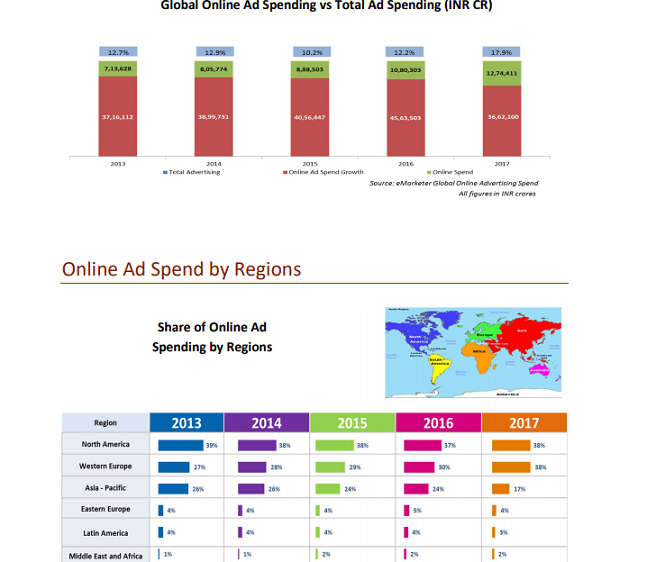

Globally, some regions such as North America have not showcased much movement in terms of their proportions of spend on digital advertising; in fact, some regions have maintained a status quo and also showed a slight decline such as Asia Pacific. Asia Pacific’s share has decreased from 24% in 2016 to 17% in 2017. Though USA and China are holding the top two spots on digital adspends.

With the increasing adoption of Internet and the growing popularity of smartphones, there has been a shift in advertising spends from traditional to digital media. Nowadays, digital medium is preferred because there is a scope of engagement between the brand and the user, unlike traditional medium. To a large extent, content on digital media is customizable as per the target audience. Also, significant time is spent on accessing Internet through mobile phone, because of the portability and seamless compatibility offered by smartphones. While, currently, it accounts for 15.5% of the advertising pie, this is expected to grow further in 2018.

Search continues to lead the digital advertising avenue spends but social media, video & mobile ads are becoming rapidly popular.

Mobile advertising avenue that has grown this year vis-a-vis the last year and is likely to further grow at a faster pace and strengthen its presence in 2017. Also, increased affordability has led to increase in content consumption and hence more opportunity to engage consumers via mobile. Mobile as a medium itself, acts as a rich source engagement experience which makes it an effective marketing medium.

Industry stakeholders continue to be optimistic about the growth of digital advertising with the use of mobile phones as a key access device will continue to grow across the nation (i.e. both urban as well as rural areas). Mobile as medium continues to dominate with share of 80% in digital advertising industry compared to PC.

With an estimated growth of 30% in 2018, digital advertising is expected to reach INR 12,046 crore.

Globally, the Internet remains the fastest-growing medium for advertising compared to others.

Also more and more countries are moving to programmatic advertising and therefore are expected to be the future of digital advertising. To conclude, future of digital advertising lies in increased mobile usage coupled with continuous technology upgradation, richer audience engagement and programmatic advertising.