Internet penetration and adoption of digital media in India is growing at an unprecedented rate, which is creating huge opportunities to tap into the unchartered arena of digital space in newer ways.

Internet penetration and adoption of digital media in India is growing at an unprecedented rate, which is creating huge opportunities to tap into the unchartered arena of digital space in newer ways.

The ever-evolving digital industry and the advancement of technology opens various opportunities to interact with the audiences. Marketers can now choose innovative ways to reach out to their target audience and cater to the demand to create unforgettable experiences for them.

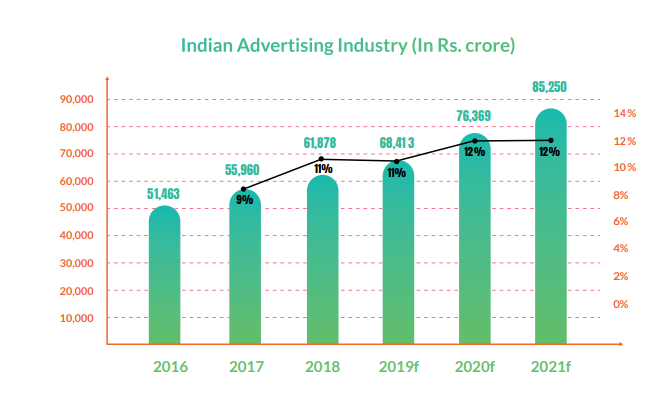

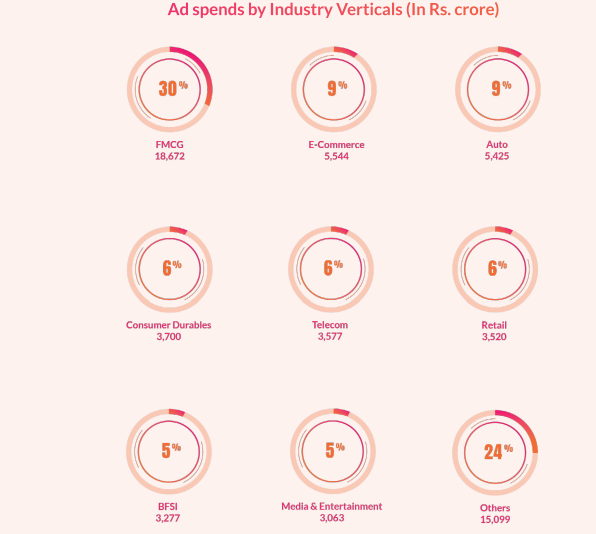

As of 2018, the Indian advertising market stands at Rs. 61,878 crore ($8.76 billion) and is estimated to grow with a CAGR of 10.62% till 2021 to reach a market size of Rs. 85,250 crore ($12.06 billion).

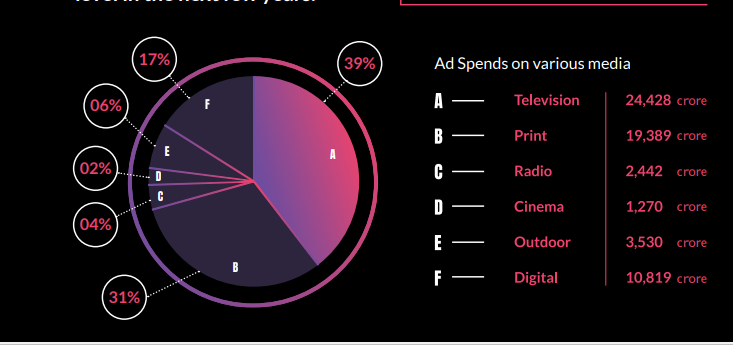

The digital advertising market size is around Rs. 10,819 crore ($1.3 billion) and the estimated CAGR growth will be 31.96% and the market will expand to Rs. 24,920 crore ($3.52 billion).

Television and print take the largest share of media spends at 70% aggregated followed by digital media at 17%. Digital will contribute 29% of the ad market size by 2021.Digital transformation is being adopted at a substantial scale, which in turn, is increasing the adoption of digital media at a rapid pace.

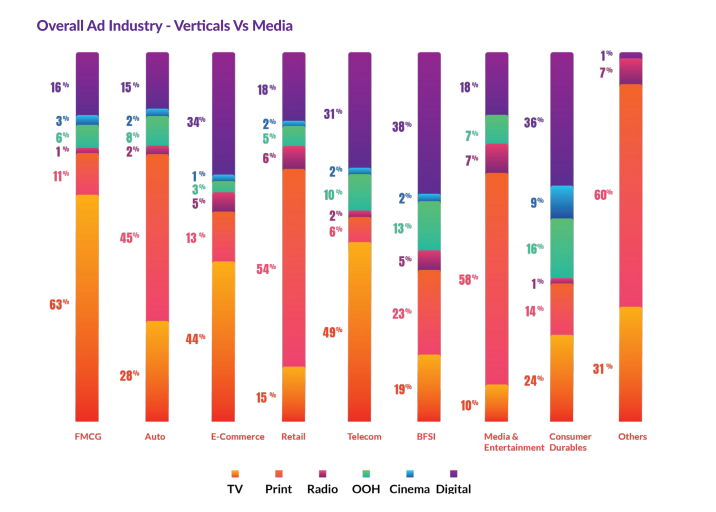

Currently, BFSI is the biggest spender on digital media with a contribution of 38% of all their marketing budgets. This is followed by consumer durables (36%), e-commerce (34%) and telecom (31%). FMCG spends heavily on the television (63%) and the retail sector spends largely on print (54%) medium of advertising.

The main drivers of the growth of digital media will be voice, vernacular and video. Apart from this, some of the other drivers of digital media growth will be engaging mobile experiences based on augmented reality (AR) and virtual reality (VR).

The advertising expenditure on the digital advertising formats is led by social media (29%) followed by search (25%), display (21%) and video (20%). The BFSI vertical spends the largest share of its digital media budget on search (38%), while FMCG spends the largest share of its digital media budget on video (33%).

Currently, 18% of all digital media is bought programmatically and has grown from 15% last year. The major reason for the growth are technological advancements, improvements in data science & analytics, implementation of algorithm to automate various procedures, better ad fraud detection and improved data policies & regulations. The rapid increase in the penetration of mobile devices and internet has led to 47% of digital media spends on mobile devices and is expected to grow at CAGR of 49% to reach spends share of 67% by 2021.

Machine Learning (ML) and artificial intelligence (AI) will see heavy adoption and implementation in various media in the near future. The main drivers of the growth of digital media will be voice, vernacular and video. Apart from this, some of the other drivers of digital media growth will be engaging mobile experiences based on augmented reality (AR) and virtual reality (VR). In the near future, data-driven decision-making and business strategies will be more transformative and will entail building and merging of different types of business models and its implementation.

Commenting on the report, Ashish Bhasin, Chairman & CEO- South Asia, Dentsu Aegis Network said, “Today, you no longer have to sell ‘digital’ to a client. This is the only medium which gives you a very measurable ROI, and almost an immediate impact. We have about 500 million people on the internet today and in the next three to four years, another 300-400 million people will join in. Concurrently, the next phase of internet users will speak regional languages and as a result, you will probably see a lot more advertising in regional languages on digital in the years to come. Dentsu Aegis Network understands this scope. Consequently, we are over-weight on digital. Of our 3500 people, more than 1600 are in our digital agencies. Nearly 48% of our revenues comes from digital at a time when the market average in India is still 15-17%. As leaders in digital, we recognize the need for an industry level research report which not only covers the market size but also gives a direction towards which this industry is moving. The lack of detailed and accurate Digital Advertising Spends is surprising for a medium that lends itself to measurement. It is to fulfil this gap that all the 8 agencies of the Dentsu Aegis Network i.e. Isobar, iProspect, Merkle Sokrati, WatConsult, Dentsu Webchutney, SVG Media/Columbus, Fractal and Amnet collaborated again for the 3rd edition of our Digital Report that extensively covers Digital trends, spends and insights across all sectors. The report has now become the industry standard for Digital Marketing and this year the report summary will also be available on Alexa.”