As the flow of company Q2 2020 financial reports nears its end, the picture of the true economic impact of COVID-19 on the media sector has become far clearer. The TV advertising market, as Ampere expected, has been significantly negatively impacted. The theatrical market has collapsed, and the limited reopening has provided scant respite for afflicted companies in the value chain. Pay TV revenues have been placed under further pressure from acceleration in the competing subscription online video market, from consumer household budget pressures, and from the lockdown sports hiatus.

As the flow of company Q2 2020 financial reports nears its end, the picture of the true economic impact of COVID-19 on the media sector has become far clearer. The TV advertising market, as Ampere expected, has been significantly negatively impacted. The theatrical market has collapsed, and the limited reopening has provided scant respite for afflicted companies in the value chain. Pay TV revenues have been placed under further pressure from acceleration in the competing subscription online video market, from consumer household budget pressures, and from the lockdown sports hiatus.

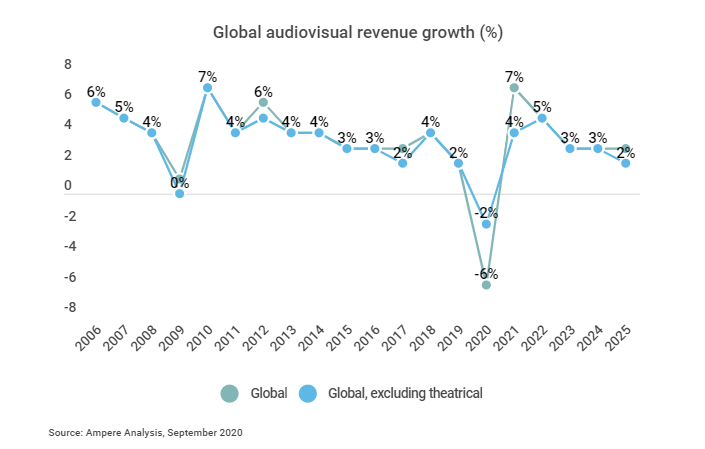

We now expect that the market changes caused by the pandemic—and the associated policy responses—will drive a year-on-year decline in global audiovisual sector revenue of over 6%. To place this in context, in the immediate aftermath of the 2008 financial crisis, the world’s TV, film and video market actually grew by 1%.

The unusual circumstances of the current economic downturn—notably the social distancing measures employed across many countries—mean that certain market segments such as theatrical have been affected disproportionately. But even stripping out the impact of the beleaguered cinema sector, the global audiovisual market will shrink by 2% this year, its worst performance in many decades.

Nonetheless, amid the gloomy outlook, there are opportunities for those firms that can adapt to the new market norm most rapidly. Q3 guidance from media owners reveals that ad spend is returning quickly, particularly in the online and addressable space. Commissioner announcements indicate that in certain markets production and commissioning activity is restarting with a vengeance—the current content backlog and lack of fresh new series will particularly favour those firms that can accelerate filming and post-production of their big Scripted shows. Telco H1 results show that broadband growth in many markets has been boosted above pre-COVID levels, and early details from the latest wave of our quantitative consumer polling illustrates that greater numbers of consumers have been introduced to new modes of viewing and paying for content, expanding the addressable online video opportunity still further.

In nominal terms—and working on the assumption that major media markets do not return to national lockdown—we are expecting the wider sector’s revenues to have recovered to 2019 levels by the end of 2021. And although the composition of the sector will have been reshaped significantly by then, there are many reasons to feel optimistic about the future of the TV and film market.

Source : Ampere Analysis