Consumption Soars & SVOD Gains

Consumption Soars & SVOD Gains

Q2 2020 Report Highlights Growing Depth Of The Streaming Video Economy In Four Markets: Indonesia, The Philippines, Singapore & Thailand

Key Highlights

Netflix and Viu drive premium demand

Vidio extends SVOD growth in Indonesia

iQIYI, WeTV gain in key markets

HBO Go steadily grows in select markets

TrueID leads telco OTT rankings

Total video streaming minutes on mobile grew 30% Q/Q in Q1 2020 across four Southeast Asia markets and a further 19% Q/Q in Q2 to reach 657 billion, according to a study published today by Media Partners Asia (MPA). The report, entitled Southeast Asia Online Video Consumer Insights & Analytics: A Definitive Study, was first published in May 2020 and has been updated to cover research from Q2 2020 across Indonesia, the Philippines, Singapore and Thailand. The report leverages MPA’s proprietary AMPD Research platform.

YOUTUBE, NETFLIX & VIU

According to the report, global AVOD market leader YouTube’s share of streaming minutes was 84% in Q2 2020, driven by free-to-air (FTA) TV content, music and user-generated kids content. Ex-YouTube, total streaming minutes grew 57% to reach 107 billion in Q2 versus 68 billion in Q1. Global SVOD market leader Netflix had 39% share, driven by significant growth in Indonesia, the Philippines and Thailand along with steady growth in Singapore. Leading regional freemium OTT operator Viu had 17% share, driven by Indonesia, the Philippines and Thailand.

Other notable players with material 20% share in aggregate of total streaming minutes ex-YouTube in the four markets included Indonesia’s Vidio, China’s iQIYI, which is expanding slowly across Southeast Asia; WeTV and Line TV in Thailand; and iflix. In Q2, iflix’s assets were acquired by Tencent, which also owns WeTV.

SVOD GROWTH

Total cumulative SVOD net additions in the four SEA markets reached 3 million in Q2 2020. Total SVOD paying subs, unadjusted for overlapping users or subscriptions, reached ~10 million in Q2 2020 versus ~7 million in Q1 2020. In Indonesia, SVOD has a long way to go but is showing encouraging signs of growth driven by affordable plans by key operators catering to the mobile mass market. Similar trends are occurring in Thailand though from a higher base. Philippines and Singapore continue to grow steadily.

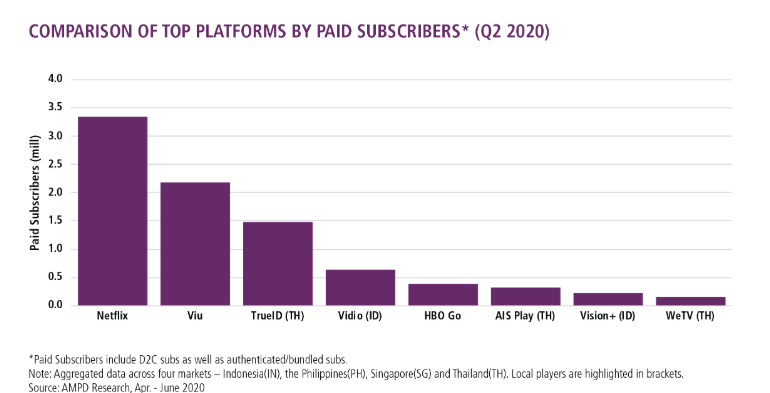

Netflix remains the largest SVOD player across the four markets with more than ~3.3 million subscribers across the four markets with Viu in second place with an estimated 2.2 million paying subs. Netflix has grown significantly in 1H 2020 on the back of mobile pricing and the popularity of its Korean content, International / US Originals and local acquisitions. Much of freemium operator Viu’s success is driven by its Korean day-and-date dramas & series as well as a handful of local acquisitions and originals in markets such as Thailand.

Other notable gainers include: (1) Emtek / SCMA-owned Vidio in Indonesia, a freemium operator which had 632,000 paying subs in Q2 2020, growing to 804,000 by mid-September and (2) HBO Go with ~400,000 paying and authenticated subscribers in Q2 2020 on mobile, driven largely by direct subs in Indonesia, Thailand and the Philippines. Amongst the big telco aggregators, the most significant is TrueID in Thailand with 1.5 million paying and authenticated subscribers in Thailand.

Commenting on the report’s findings in Q2 2020, MPA executive director Vivek Couto said:

“Online video consumption continued to soar through the pandemic in Southeast Asia during 1H 2020. The growth of premium video services has been significant with a greater scale of consumers paying for online video in large emerging such as Indonesia, the Philippines and Thailand. Global, local & regional platforms are rolling out more affordable OTT plans, catering to a large mobile broadband universe, while also investing in premium entertainment. It’s only the beginning with plenty of more work, investment and execution to be done to create sustained, recurring demand for paid legal SVOD services.”