Netflix, Disney+ and other streaming services, for the most part, are growing quickly and globally, and making news headlines daily based on the success – or failures – of their efforts.

Netflix, Disney+ and other streaming services, for the most part, are growing quickly and globally, and making news headlines daily based on the success – or failures – of their efforts.

As a result, media and entertainment companies of all shapes and sizes, regional and local, are looking for ways to establish their own OTT (over-the-top) streaming services and searching for answers about how to survive and thrive in a fiercely aggressive market.

At Capgemini, we decided to take a closer look at this (r)evolution as the market becomes more crowded and more competitive. Our study aims at better understanding how data unleashes differentiation and competitive edge across strategic dimensions such as content sourcing, customer acquisition, customer loyalty and lifetime value, cost optimization.

We organized one-hour interviews with close to 50 senior media industry executives and experts in various companies. The interviews were run between July and September 2020 and geographically span the globe from APAC to the Americas. Our discussions included broadcasters, telcos, right holders, pure players and key vendors.

What follows is an examination of our study, including some best practice tips, what it will take to be relevant in the market, and how to play a winning hand in a very strategic new game.

OTT Streaming Shakes-up the M&E Industry

OTT Streaming Becomes the Main Form of Content Consumption

Online streaming has ushered in a rapid progression these last 10 years, driven by the Netflix disruption and its explosive growth since 2010, and is increasingly becoming the main choice of video consumption for consumers.

A Global Phenomenon

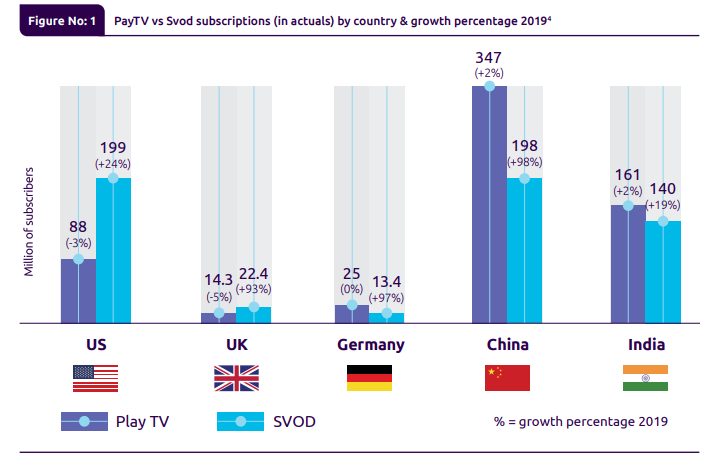

In 2017, SVOD services lagged behind Pay TV globally, but they are now poised to overtake Pay TV in more than 30 countries by the end of 20201.In the UK in 2018, Netflix surpassed the prestigious Sky satellite TV in number of subscribers, pushing Sky to develop its own OTT service, which is now Sky’s major growth driver.

The rise of streaming is not limited to English-speaking countries. While the United States is still far ahead, the evolution of OTT is beginning to accelerate elsewhere. India is experiencing a full-on expansion. Likewise, in China and Germany, OTT is starting to cannibalize Pay TV . As a result of EMEA and APAC growth, Netflix now has more subscribers outside of the U.S. than inside.

Advertising-Based Model Accelerates the Industry’s Entry into a New Era

Traditional TV audiences are eroding. The younger generation is flocking to OTT and nonlinear channels. Public broadcasting in Europe is also making the move

to streaming, and demonstrating success in reaching incremental audiences.

However, standalone SVOD business models are not sustainable for everyone. In order to support the investmentintense content business, platforms need to reach the right threshold of scale for their subscriber bases, which is a huge challenge in a fragmented space. Furthermore, with the multiplication of SVOD services, viewers are becoming overwhelmed with too many choices and not willing to pay for multiple subscription fees. If subscribers flee, who will support the investment?

Eyes and ad dollars shift from linear to on-demand

As consumption and attention shift away from traditional television, enter advertisers, who are looking for new ways to reach their audiences through OTT. As a result of this new and burgeoning platform, OTT ad spending is also growing. Pixilate reports a whopping 330% rise in worldwide programmatic OTT/CTV ad transactions in 2019.

For broadcasters, building a unified distribution of traditional television, and ad-based OTT, became a real differentiator to provide incremental reach for TV ad-campaigns, while maintaining the scale of their audiences and the viability of their business model.

A compelling value proposition for brands

Beyond reaching an incremental audience, ad-based OTT services offer advertisers more attractive and targeted audiences with better attribution and measurement capabilities. Moreover, ad-based OTT services are reinventing the viewing ad-experience to a more premium and less intrusive one, in comparison to other digital services such as YouTube. This brings high value for brands, but it can also test viewers’ tolerance of more advertising.

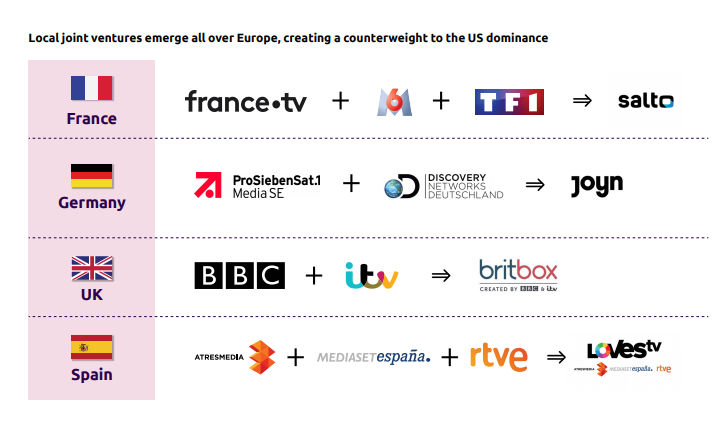

Consolidation and new opportunities for aggregators

In this context, we are seeing a rise of aggregating services that are trying to reduce complexities for the consumer, by combining content from various right holders, or different streaming services, via one interface. These aggregators are mainly telecommunication providers or major tech companies such as Amazon Channel, Jio T +, and a bundle solution partnership by Viacom CBC and Apple.

What these services have in common is that their value proposition is focused around ease of use, guidance and support for users who are lost or annoyed by an overload of OTT platforms.

These aggregators must excel at user experience and unlock key aspects of the value proposition including ease of use and guidance. The more fragmented the market, the more complicated clear guidance gets, and thus, the need for more aggregators.

The crowded market will see OTT players appear and disappear, depending on their popularity. Thus, aggregators need to be agile to quickly integrate and partner up with the right platforms. Choosing and adapting to partners will be a key differentiator for aggregators; however, it will be made difficult because OTT platforms have highly fluctuating content and brands.

Lastly, aggregators will require a high level of regulatory maturity, since they combine national and international content, along with various methods of data consumption and user content.

With so many new streaming services emerging, consumers are beginning to crave (re-)aggregation. Device/ technology companies players like Amazon (through Fire) or Roku, but also strong MVPDs/telcos through their set-top-boxes are in a great position to play that role”

Christian Kurz,SVP Global Insights ViacomCBS

Content is King, but DATA Emerges as Key Success Factor

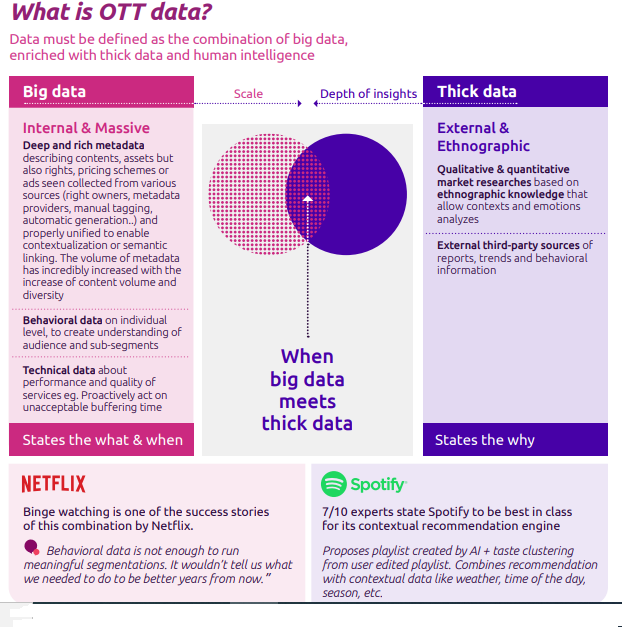

Data underlies all and challenges the core business of media and entertainment companies. Our research reveals that content, by far, is considered as the key differentiator and at the core of the value proposition for most OTT, followed by user experience and brand. Besides content, brand, and customer experience, a fourth key pillar for differentiation emerges: Data and analytics.

Using data as a strategic asset is a key lever for creating differentiated content, brand, and user experience, and is also a vital enabler of market differentiation and profitability.

The Privacy challenge

OTT platforms face a major challenge sharing data with their programming partners to allow data-driven advertising in a privacy-compliant manner. Trust is a key component when developing brand loyalty as a scalable offering and the best way to win trust is to make sure consumer privacy protections are in place between OTT platforms, content companies and advertisers.

OTT platforms need a cloud data platform that can let them easily turn the dial up on privacy, but still allow for the transparent data access and sharing necessary to build audiences and measure campaigns. Snowflake has built in all the controls and capabilities that deliver orchestrated privacy and security, without impacting performance or scale”

Bill Stratton,VP of Media Strategy at Snowflake

Raise The Stake Or Fold

The Direction Is Set Towards a Data-Powered Media & Entertainment Industry.

With OTT and streaming services, the media and entertainment industry has truly entered the age of data. The growth of digital media consumption, the launch of direct-to-consumer services and the advancement of advertising-based business models have made data strategically vital.

The development of these models is increasingly making companies data dependent, with the realization that customer and operational data can bring business value at every step of the creative and distribution processes.

The direction of being data dependent is set by the social media and technology giants who have put data, analytics and AI at the core of their business and operational models. Facebook and Google are the main players today, equally competitive in end-user attention and advertising dollars attractiveness.

Acceleration Is Required To Stay Relevant and Attractive For Subscribers, Content Providers Or Advertisers.

In an algorithm-driven competition, failing to extend reach and to deeply personalize the entertainment experience, will threaten long-term survival. Media & Entertainment companies need consequently to assess their competitive positions, revisit strategic capabilities and protect content and client assets.

It is equally true as companies are more and more vertically integrated (ownership of production and distribution).The direction is set.

Becoming “data-powered” requires the understanding of leaders’ best practices and to address 3 dimensions simultaneously:

1. Put data at the heart of the media company strategy together with Content, UX and Branding

2. Enhance Value Propositions and Experiences for both customers and advertisers leveraging data

3. Adopt ‘data-in-motion’ operating models, capabilities and architectures

Becoming Data-Powered Ultimately Reinforces The Local And Societal Mission And Role Of Media Companies.

The age of data creates challenges for the Media & Entertainment industry as they need to learn and balance creativity, tech and data from production to distribution or monetization. At the same time, it creates unique opportunities to differentiate the role of medias in contrast to the global algorithm “dictate” of social media.

Media & Entertainment companies must become more intelligent, trustable and relevant by leveraging both data and people to safeguard media creativity, independence and diversity.

The future is now.