Since launching in 2012, Netflix has grown rapidly in Europe. By 2016, it had launched its services across the whole of Europe, and passed the $1 billion revenue milestone.

Since launching in 2012, Netflix has grown rapidly in Europe. By 2016, it had launched its services across the whole of Europe, and passed the $1 billion revenue milestone.

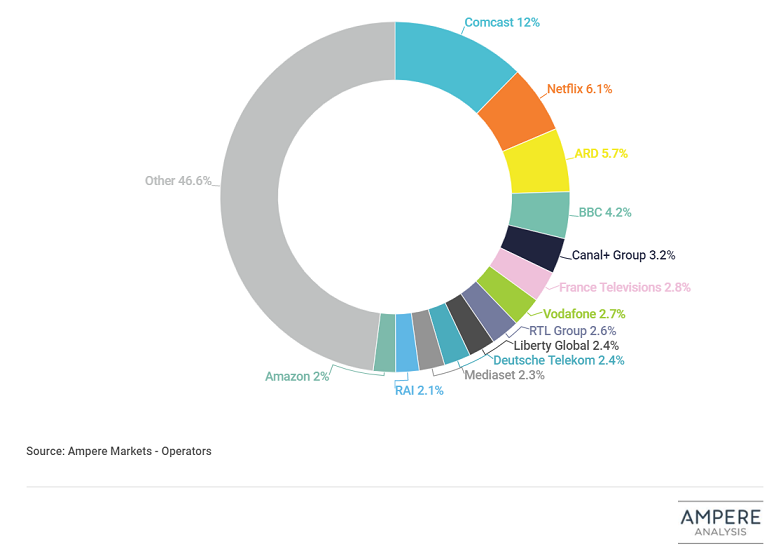

By 2017, it had the largest customer tally of any subscription TV business in Europe. And by 2020, it reached another milestone. Last year, Netflix had become the second largest entity in Europe in terms of revenues, behind only Comcast (which owns Sky’s operations in Europe), and overtaking the German public broadcaster ARD. It would seem that there is no limit to Netflix’s meteoric rise as it helps itself to a greater portion of the audio-visual revenues. In 2020, Netflix alone accounted for more than 6 per cent of all European TV revenues.”

While Netflix has enjoyed success across the continent, local broadcasters are facing increased pressures. The coronavirus pandemic has thrown the TV advertising market into decline, compounding and accelerating the woes of traditional and established brands. And while Netflix’s pockets are getting deeper, local entities are struggling to compete. Over the next few years, Netflix alone is set to be better funded than many leading commercial broadcasters, and its scale means that it is able to produce quantities of high-quality content that most of its local competitors cannot match. This global vs. local imbalance will further accelerate the online viewing shift, which is now beginning to shift to older demographics as well as young.

Source:Ampere Analysis