Buy; Target: Rs430 | Emkay Global Financial Services

Buy; Target: Rs430 | Emkay Global Financial Services

Sony Pictures Networks India (SPNI) and ZEEL have signed a definitive agreement to merge ZEEL with and into SPNI. Under the deal, the entities’ linear networks, digital assets, production operations and program libraries will be combined.

Post deal closing, SPNI will have a cash balance of USD1.5bn, including USD1.06bn through a rights issue by the current SPNI shareholders and a fund infusion from ZEEL promoters. With a 50.9% stake, Sony will retain management control of the new entity.

With the merger agreement signed, key things to watch out for now will be Invesco’s support for the merger, timely regulatory approvals, smooth integration, strategic roadmap for OTT investments, and recovery in Zee’s viewership share in select core markets.

We have adjusted our pro-forma estimates assuming that the benefits from the merger will start reflecting from FY24 vs. FY23 earlier. Maintain Buy with a revised Mar’23E TP of Rs430 (11x Mar’24E pro-forma broadcasting EBITDA).

Unraveling the deal: We have segregated the deal structure and equity capital increase into five parts:

1) sub-division of SPNI (transferee company)

2) Rs79.5bn rights issue by Sony Pictures Entertainment Inc (SPE)

3) share issuance to ZEEL promoters for Rs11bn infusion

4) share swap for 100 shares held in ZEEL with 85 shares of SPNI

5) share issuance to the shareholders of BEPL (Bangla Entertainment Pvt Ltd), which is wholly owned by SPNI promoters. ZEEL promoters will get a 2.11% stake in the merged entity in lieu of the non-compete agreement, and they will have the option to increase their stake from 3.99% to a maximum of 20% through open market purchases. In the merged company, ZEEL promoters will continue to be classified as promoters.

Outlook

The deal structure and valuations are in line with the non-definitive agreement signed by both parties in Sept’21. We continue to highlight that this deal is positive for ZEEL shareholders as it will resolve investor concerns around governance, board composition and funding for future expansion (through the cash pile at the merged entity). The merged entity will be the market leader in India with a comprehensive bouquet of offerings, and will have the necessary balance sheet strength to invest in digital businesses and acquisition of sports rights. We strongly believe that acquiring the rights to a major cricket event (IPL or ICC India cricket series) will play a critical role in the OTT platform’s significant facelift, which could lead to a valuation re-rating as well.

Merger synergies include:

1) enhanced bargaining power with content producers, distributors and advertisers; 2) cost optimization by shutting down tailend channels; and 3) other scale benefits. The recovery of Zee’s market share loss in Hindi GEC and select regional markets is key in the near term. Key risks: 1) integration challenges; 2) cultural issues; 3) delayed regulatory/shareholder approvals; 4) sustained slowdown in ad revenues; 5) higher-than-estimated losses from the digital business; and 6) significantly low OTT monetization.

The Draft Scheme of Merger in detail

We have divided the deal structure into 5 parts for easy understanding

1) Sub-division of the share capital of the Sony Pictures Networks India Private Limited (Transferee Company) and the issuance and allotment of bonus shares by way of a bonus issue.

2) Issuance of: a) 265mn equity shares of the Transferee Company to the existing shareholders of the Transferee Company, against an infusion of Rs79.6bn by way of a rights issue; and b) 36.5mn equity shares of the Transferee Company to Essel Holdings Limited, a promoter entity in Mauritius (“Essel Mauritius”) and a wholly owned subsidiary of Essel Mauritius, against the infusion of Rs11bn.

3) SPE Mauritius Investments Limited will pay to Essel Mauritius an aggregate USD equivalent of Rs11bn toward non-compete obligations.

4) The merger of BEPL into the Transferee Company and the consequent issue of equity shares of the Transferee Company to the shareholders of BEPL.

Issuance of 133 fully paid-up equity shares of Rs1 of the Transferee Company to the shareholders of BEPL for every 10 fully paid up equity shares of Rs10 held by the shareholders of BEPL (dissolution without winding up of the company and BEPL).

5) Issuance of 85 fully paid-up equity shares of Rs1 of the Transferee Company to the shareholders of ZEEL for every 100 fully paid up equity shares of Rs1 held by ZEEL shareholders.

Appointment of Mr. Punit Goenka as the Managing Director and CEO of the Transferee Entity under terms set out in the Scheme; and amendment of the Articles of Association of the Transferee Company.

Shareholding structure

As per the terms of the deal, Sony Pictures Entertainment Inc (SPE), through a subsidiary, will pay a non-compete fee to certain promoters of ZEEL, which will be used by them to infuse primary equity capital into SPNI, entitling ZEEL promoters (founders) to acquire SPNI shares amounting to about 2.11% of the shares of the combined entity on a post-close basis. After the

deal closing, SPE will indirectly hold a majority stake of 50.86% in the combined company, while ZEEL promoters (founders) will hold a 3.99% stake. The remaining stake will be held by other shareholders of ZEEL.

Increase in ZEEL promoters’ stake in the merged co.

As part of the definitive agreement, the promoters (founders) of ZEEL have agreed to limit the equity that they may own in the combined entity to 20% of its outstanding shares. This clause does not provide the promoters (founders) of ZEEL any preemptive or other rights to acquire the equity of the combined company from Sony Group, the combined company or any other party.

Any shares purchased by the promoters (founders) of ZEEL must be in compliance with all

applicable laws, including any pricing guidelines.

Non-compete agreement

A non-compete and non-solicitation agreement will be executed between SPE Mauritius Investments Limited and Essel Holdings Limited. A non-compete and non-solicitation agreement will be executed between SPE Mauritius Investments Limited and Subhash Chandra, Punit Goenka and Amit Goenka as well.

A good strategic fit

In our view, this merger could turn out to be a win-win situation for both companies as it will strengthen the channel offerings and content portfolio. Although Zee has suffered market share losses in a few channels recently, it could be recouped with increased investments and renewed management focus. Despite having a sizeable channel portfolio of 49 channels spread across various genres, Zee still has gaps in Comedy, Sports and Kids genres. That said, one of the largest gaps in Zee’s portfolio has been in the Sports genre, a business that it sold to SPNI a few years ago. In our view, SPNI’s emphasis on this genre augurs well in bridging this particular gap.

SPNI has also garnered significant market share in some of its Hindi GEC and movie channels, which should also support its overall viewership share. While this helps in enhancing the content portfolio, we do not expect significant consolidation in genres in which there is an overlap (Hindi GEC and movies), primarily due to both companies’ diverse content offerings and the established brand identities of their channels.

The merged company currently has a 27% market share (Sony has a 9% market share and ZEEL has 18%), making it largest broadcasting company in India, surpassing Star India which commands a 24% share. As per media, articles, the merged co’s OTT viewership share would stand at 13-14%.

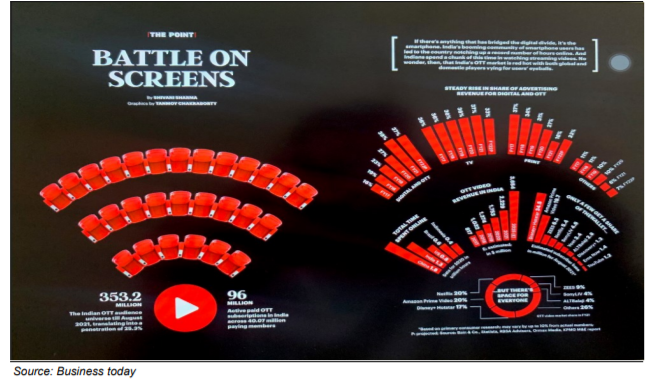

OTT – the next driver for the merged co:

As per media reports, Disney+ Hotstar, Amazon Prime Video and Netflix would corner ~80% subscribers and revenue market share by 2021-end. Disney+ Hotstar will lead in paying customers with an estimated 46mn subs by the end of 2021. As of now, both ZEE5 and SonyLIV are fringe players in the OTT space, with a combined market share of only 13-14%. We are of the view that ZEE+Sony should be using its balance sheet strength to acquire either IPL or ICC India cricket series rights (both currently with Star India) as that would play a critical role in the face-lifting its OTT platform and improving monetization capabilities for existing and potential non-sports content.

Key aspects of the merger and integration

Focus on synergies:

We believe that once the merger moves toward completion (in the next 8- 10 months), focus will be on achieving both revenue and cost synergies. Potential cost synergies

can be higher than stated by management as ZEEL’s employee cost as a % of sales is ~300bps above that of SPNI. In addition, further cost synergies can be achieved by shutting down tail/overlapping channels as well as cutting other corporate overheads. Cost savings on the content front can be attained only in the longer term as contract tenures could be different with various producers and the company might not want to disturb the equilibrium with content producers given the long-term partnerships.

Investment in key sporting event rights for OTT expansion:

If the merged co. is able to win either IPL or India cricket rights for the next 5 years, it can provide strong leverage to its OTT expansion and brand strength.

People integration:

One of the critical aspects will be cultural as both companies are culturally different (SPNI being an MNC and ZEEL a domestic company). Both companies have different content amortization policies. We believe that currently Zee has an aggressive accounting policy for movie rights amortization (straight-line method over a period of 5 years or license period, whichever is shorter), while Sony’s policy details are not available.

This can have impact on our pro-forma estimates.

Pro-forma financials

We have adjusted our pro-forma estimates in line with the merger timelines and expect benefits to start reflecting from FY24 vs. FY23 earlier. Management highlighted that the prime focus area in the beginning would be attaining revenue synergies, after which the attention will be on potential cost rationalization and opex synergies. We are estimating some EBITDA margin expansion in FY24E, driven by opex savings and revenue increase. Currently, we have assumed 6% of revenue synergies. If the merged entity manages to outpace our expectations, EBITDA margin could potentially surprise positively by surpassing 30% levels.

Source:Emkay Global