data.ai’s latest State of App Revenue 2023 reveals never-before-seen insights into the complete picture of mobile monetization.

data.ai’s latest State of App Revenue 2023 reveals never-before-seen insights into the complete picture of mobile monetization.

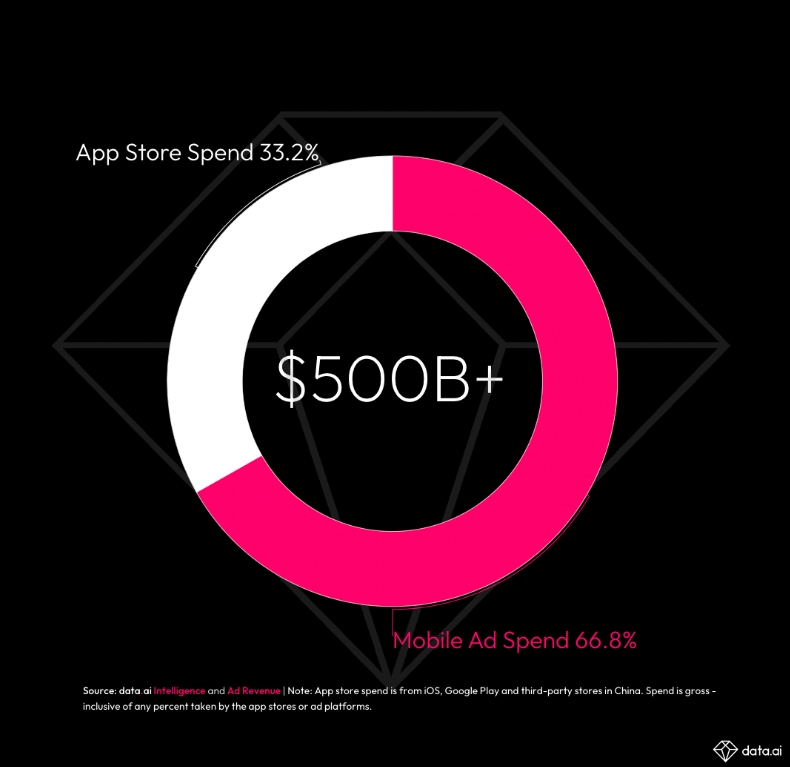

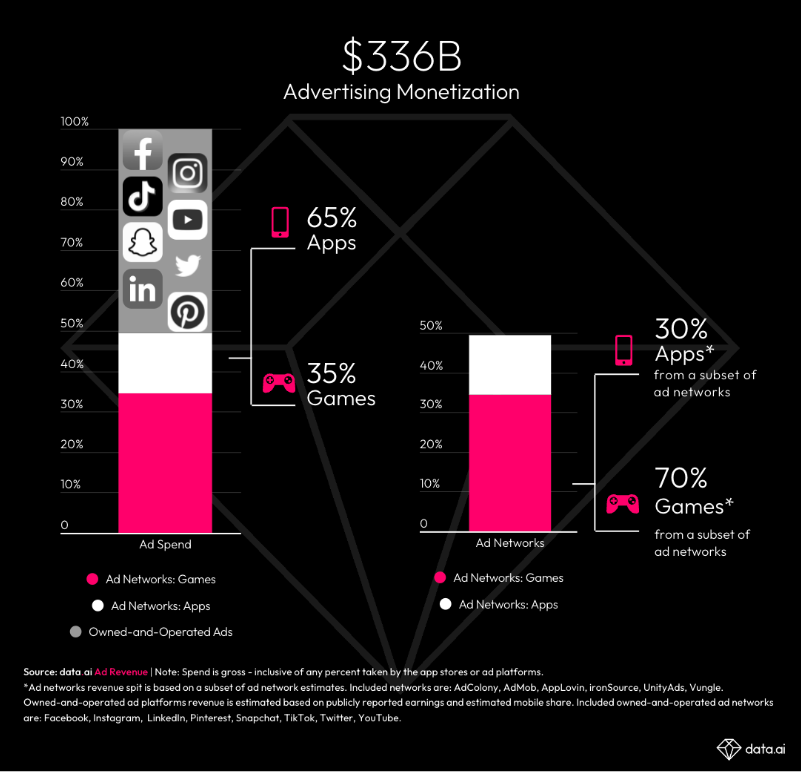

The app economy is worth ~ $500 billion, of which $336B (67%) comes from advertising and $167B (33%) from in-app purchases. Apps including Instagram and TikTok captured roughly 65% of this advertising spend, while games snagged 35%. This is the opposite of the dynamic seen with in-app purchases, where games account for the majority of app store consumer spend at 66%, while apps capture the smaller portion at 34%.

Mobile advertising spend is not only a bigger chunk of the total revenue, but it also grew much faster at 14% YoY in 2022 despite significant headwinds such as General Data Protection Regulation (GDPR) in Europe and Apple’s App Tracking Transparency. App store consumer spend on the other hand decreased slightly in 2022 by 2% YoY as consumers’ budgets tightened amid inflation concerns.

To maximize mobile monetization dollars, market leaders leverage a combination of advertising, one-time in-app purchases and subscriptions as a hybrid model to diversify revenue streams. However, until recently, brands and publishers have been unable to benchmark total revenue on mobile or view their competition’s monetization strategies, hampering their ability to maximize their monetization mix.

Total App Revenue is the ultimate Mobile metric. Powered by cutting-edge AI technology, this first-ever market view combines our products Ad Revenue and In-App Purchases, providing a competitive advantage for in-app advertising, cohort purchases and ad network performance. Our customers can now break down all revenue streams to anticipate monetization opportunities based on shifts in consumer behavior and ad network performance. Visibility into strategic metrics such as Average Ad Revenue Per User (AARPU) and Lifetime Value (LTV), is game changing for competitors and market leaders to improve top-line business performance.

“Total App Revenue provides a clear picture of data we’ve been missing in our business development and model creation. With data.ai, we finally have a way to understand our full revenue streams and benchmark against competitors,” Carlos Salvado, senior market analyst at Rovio Entertainment, says.

Uncovering Once Hidden Revenue Streams on Mobile

As the mobile market grows, competition has increased, requiring monetization strategies to become more sophisticated. Our latest report reveals insights to help you uncover the latest trends, identify what’s working, and improve your monetization tactics.

Key findings include:

Ad Revenue: In 2022, North America was the top region attracting mobile ad dollars, accounting for nearly half of global mobile ad revenue. Asia ranked second at 23% (excluding China), followed by Europe at 19%.

Total App Revenue: 65% of the top 20 apps including TikTok, Instagram, Snap, Twitter, Facebook, and LinkedIn use both in-app purchase and advertising revenue streams. Top games such as Candy Crush Saga and PUBG Mobile, alongside streaming apps including YouTube and Disney+, also use a mixed monetization strategy. On YouTube, while about 90% of revenue comes from advertising, 10% comes from app store purchases to remove these ads.

One-Time In-App Purchases (IAP): One-time-purchase models are gaining mainstream traction outside of games, largely popularized by TikTok’s creator economy model. This was followed by IAP microtransactions in gaming favorites Candy Crush Saga and ROBLOX.

Subscription In-App Purchases: Entertainment apps still command the share of wallet in the US for mobile subscriptions, with YouTube, HBO Max, and Tinder claiming the top three spots.