Anticipate With Analytics: The Future Of FMCG

Anticipate With Analytics: The Future Of FMCG

Globalization has given Indians infinitely more choices than we have ever had and connected us to the world, but in return, it has also left us with an Achilles heel. Increased trade and interdependence between nations has exposed the country to the effects of economic slowdowns in different parts of the world. Whether as a mere precaution or a sign of actual crisis, India has seen frequent bouts of uncertainty since the global financial meltdown in 2008. And the frequency of these slowdowns has left the market looking for a plan to both predict and prepare for economic turbulence.

Consumer sentiment and business behaviour have always been indicative of industry trends. Studying such patterns, along with macro-economic indicators like gross domestic product (GDP) and index of industrial production (IIP) to develop as objective and accurate a metric as possible, can help prepare India Inc.—and particularly the country’s fast-moving consumer goods (FMCG) industry—to cross any bridge of economic uncertainty that might appear on the horizon.

DEVELOPING A PREDICTIVE MODEL FOR ECONOMIC SLOWDOWN

The Reserve Bank of India (RBI) Technical Advisory Group lists the major macro-economic indicators of a slowdown to be GDP, IIP, wages of factory workers and monthly registered unemployment figures. However, the need for accuracy demands that we narrow this list down to eliminate those factors that are dependent on variables, like seasonal changes. For instance, GDP comprises the three major components of agriculture, service and manufacturing. Of these, agricultural trends are primarily seasonal in nature and the services sector follows a fixed pattern, making both unreliable indicators of economic activity. The manufacturing sector is critical for India’s GDP, which has the potential to reach USD 1 trillion by 2025 and contribute approximately 25-30% to India’s GDP from the current contribution of 15-16%. Hence, it becomes even more imperative to consider the manufacturing sector as a determinant (in this case, the dependent variable in our model) for an accurate predictive model.

Apart from manufacturing, the following key measures have historically shown a link with an impending economic slowdown. Consequently, the following independent variables are included in the model.

Foreign Institutional Investments (FII): FIIs are investors or investment funds that are registered in a country outside the countries they operate in. Hedge funds, insurance companies, pension funds and mutual funds can all be FIIs. Based on the crisis in 2008, one of the first effects of economic slowdown is the outflow of FIIs from the equity market.

Depreciation Of The Rupee And Its Effects: Currency depreciation results in higher import costs of goods, which cause consumer goods to become expensive. For a country like India, the cumulative impact of the high cost of importing necessary commodities, inflation and reduced economic activity increases the pressure on consumers’ disposable incomes. In 2008, FIIs and companies converted funds raised locally into foreign currency to tackle external obligations, resulting in a depreciation of the rupee. Special drawing rate (SDR) effectively monitors depreciation of currency.

Balance Of Trade: A positive trade balance is a sign of a healthy economy since it points to a trade surplus where the country exports more than it imports.

THE EFFECTIVENESS OF THE MODEL

When the measures listed above–both dependent (manufacturing) and independent (FIIs, SDR and balance of trade) –are put together in a statistical model, they can be strongly indicative of an impending recession in the economy. When put to test against all previous slowdowns, the model predicted all the earlier instances with very high precision levels. Being dynamic in nature, the model will prove to be the most effective when updated periodically.

The robustness of the model was put to test against historical instances of slowdown, and precision levels were found to be high. Expectedly, while the precision levels varied over periods of slowdown, it remained well within the confidence level of 90% and above across instances.

WHAT DRIVES FMCG SALES?

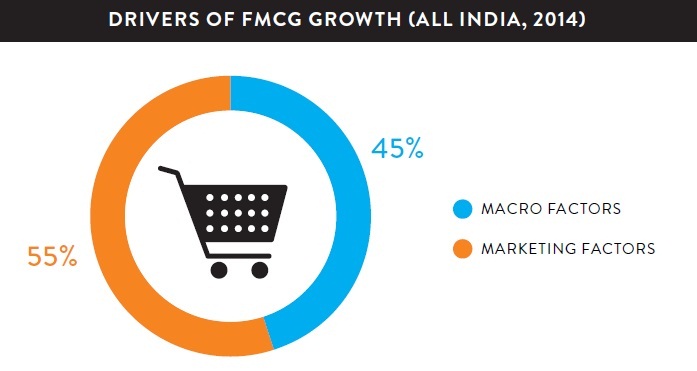

Past studies by Nielsen have shown that FMCG sales in India are driven by a number of controllable and uncontrollable factors. While the uncontrollable ones include macro factors like GDP, inflation and employment rates, the controllable factors include marketing levers like advertising and distribution.

Our recent statistical modeling and analysis has shown that about 55% of FMCG sales are influenced by marketing factors and the rest by macro-economic factors. This is noteworthy, as it clearly indicates that even in cases of a lackluster prognosis of the economy, there is still a strong chance for driving growth for FMCG brands.