With the current count of cellular connections at 970 million and the Cellular Operators Association in India (COAI) expecting this number to reach 1,100 million by 2020, consumers continue to embrace the digital age and they’re rapidly seeking ways to expand their mobile experiences and capabilities.

With the current count of cellular connections at 970 million and the Cellular Operators Association in India (COAI) expecting this number to reach 1,100 million by 2020, consumers continue to embrace the digital age and they’re rapidly seeking ways to expand their mobile experiences and capabilities.

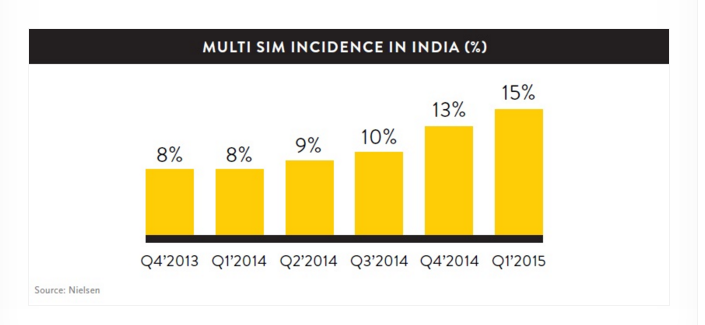

Multi-SIM use is among the latest trends that Indian consumers are taking advantage of, allowing them to switch carriers on the fly with the simple switch of a SIM card. Instead of just carrying one SIM, many mobile users are dual SIM users. This allows them to switch between providers to capitalize on varying price, data and service offers from industry operators.

When customers switch between the operators, they aren’t necessarily leaving one operator permanently, so the change doesn’t represent churn in the real sense of the word. When they switch, however, they do become dormant with the previous operator for periods of time. This practice has intensified the fierce competition between providers in the market, forcing them to offer attractive call rates or tariff plans for both voice calls and mobile Internet. Each operator’s goal is to discourage users from switching to another operator for specific needs by making sure its offers are the best.

Market-leading operators, identified on the basis of their telecom revenues, stand to experience the most customer fluctuations, as smaller service providers tend to make incremental gains in the competitive environment even if they get a small share of subscriber’s minutes. They captialise on this by offering cheaper tariff plans, along with offers on new SIM purchase to attract customers.

According to the Telecom Regularity Authority of India (TRAI), the telecom subscriber base has increased by nearly 12 times in the last 10 years. The average revenue per use (ARPU) that operators collect, however, has shrunk to one-third during the same time period, predominantly because of lower calling rates and multiple competitive operator offers.

Understanding the complete life cycle of mobile usage and on-going research on how to identify the presence of another SIM will be key advantages in navigating the competitive landscape.

MULTI-SIMS MULTIPLY

According to global data, there are 6.4 billion mobile connections and 3.2 billion unique mobile customers globally. That means that each mobile customer owns approximately two SIMs – largely due to multi-device ownership or multi-SIM cards, to take advantage of arbitrage on pricing schemes.

Nielsen studies reveal that 15% of mobile users in India are multi-SIM users, and the proportion is trending upward.