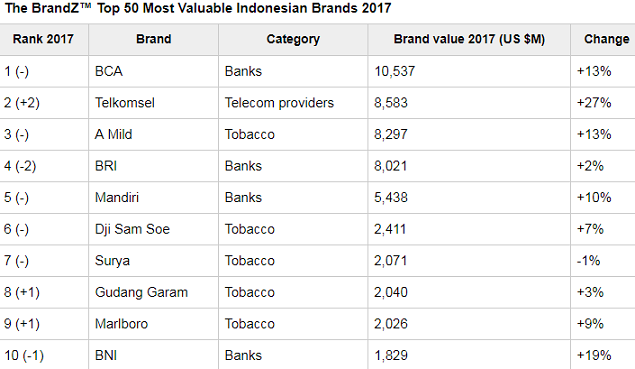

BCA leads the BrandZ™ Indonesia Top 50 for a third year, growing 13% to US$10.5bn

BCA leads the BrandZ™ Indonesia Top 50 for a third year, growing 13% to US$10.5bn

Telkomsel climbs two places to become the country’s second most valuable brand

The total value of the BrandZ™ Top 50 Most Valuable Indonesian Brands 2017, announced today by WPP and Kantar Millward Brown, has grown 8% in the last year to US$71.6 billion. This compares with 2% growth in 2016, and matches the 8% value increase of the BrandZ Global Top 100 2017. The strongest Indonesian brands have responded to rising consumer confidence and spending power by delivering quality products and services, purpose-led innovation and an exceptional experience – all factors that grow brand value.

BrandZ is the largest and most definitive brand valuation platform in the world. The BrandZ Most Valuable Brands rankings are important benchmarks for companies that want to measure and manage their most important intangible asset – their brand.

The gap between the BrandZ Top 50 Most Valuable Indonesian Brands and the BrandZ Top 100 Most Valuable Global Brands is narrowing: the most valuable Indonesian brand Bank Central Asia (BCA) has grown its value 13% to $10.5bn, $800 million less than Nissan, at no.100 in the global ranking. The Indonesia Top 50 are also as effective as the leading Chinese brands, and many top global brands, in driving consumer preference. This is according to the BrandZ Power Index, which measures how predisposed consumers are to buy a brand.

BCA marks its 60th birthday this year, having built a reputation for being accessible, with a strong purpose based on being ‘Always at your side’. It has more than 1,200 branches and 17,000 ATMs, and is also focused on digital innovations such as in-app and video banking.

Reflecting Indonesia’s rapid adoption of mobile technology, Telkomsel has risen two places to no.2, growing 27% to $8.6bn. The brand has used new digital services and powerful communications to embed itself deeply in consumers’ lives. Its promise is embodied in its aspirational #MenjadiYangTerbaik (#BeTheBest) campaign, which highlights the speed and stability of its connections, while encouraging consumers to be the best they can be.

The Banks sector has the highest total brand value. Bank brands occupy four places in the Top 10, and have increased their combined value +9% to $26.5bn. In addition, the two fastest growing Indonesian brands are banks: Sinar Mas (no.38; +50%) and CIMB Niaga (no.41; +44%). This is linked to the fact that access to finance is integral to the development of Indonesia’s economy.

The fastest-growing sector is food and dairy, with a combined value increase of +21% to $3.2bn. There are 15 FMCG brands in the Top 50 – including local household staples, such as noodle brands Indomie (no.13; +18%) and Sarimi (no.42; +18%), and biscuit brand Roma (new). There are also global names that are so well loved they are often considered solely Indonesian – including Sunsilk (no.30; +7%) and Pepsodent (no.19; +4%). FMCG brands excel at meeting a functional need while forging strong emotional connections with consumers.

David Roth, CEO EMEA and Asia, The Store WPP, says: “The BrandZ Top 50 Most Valuable Indonesian Brands represent a slice of modern-day Indonesian life: growth and development, supported by pride in a rich heritage. With continued investment in brand development and expansion, it’s likely we’ll see one or more entering the Global BrandZ Top 100 very soon. There has never been a better time for Indonesian brands to seize international opportunities; they should be inspired by what pioneering Chinese brands have achieved, and look beyond borders.”

Other trends highlighted in this year’s BrandZ Indonesia Top 50 study include:

Mega brands reign supreme. Between them, the Top 5 brands account for 57% of the total value of the entire Top 50 ($40.9bn). This is typical in fast-developing markets.

Local relevance matters. Indonesians’ sense of identity is strengthening as they look to integrate their digital lives with their rich heritage. Local brands have most successfully connected with what it means to be a modern Indonesian, but understanding and responding to this is more about agility than country of origin.

Consumers have embraced ecommerce. Local digital disruptors taking advantage of this include Bukalapak and Tokopedia, which have launched mobile shopping apps. Of the four ‘traditional’ retailers in the Top 50, only Alfa has grown its value (no.28; +10%), but all are investing heavily in new ways to engage shoppers, both online and in stores.

Purpose pays dividends. Indonesian consumers seek to associate themselves with brands they feel are doing good for the world. The brands in the Top 50 that are perceived as having the strongest purpose have increased their value 9% in three years, while those with the weakest purpose have remained static.

Newcomers to the ranking in 2017 are entertainment brand Indosiar (no.43) and biscuit brand Roma (no.50).

Ranjana Singh, WPP Country Manager for Indonesia and Vietnam, comments: “Indonesian consumers are increasingly sophisticated, so having a product or service that does its job well, and is easily available and fairly priced, is no longer enough. Consumers will only fall in love with a brand that can express its promise in richer ways, through true innovation and an experience that is streamlined, personalised, fun and seamless. The interactions the consumer has with the brand along the path to purchase – and beyond – provide opportunities for differentiation, and help cement their relationship with that brand.”

The accelerating growth in value of Indonesia’s brands can also influence how the country is perceived by consumers around the globe. There is a close relationship between how people feel about a country, and their attitudes towards the brands they associate with it. According to the 2017 Best Countries report developed by Y&R’s BAV Group, Indonesia ranks 39th out of 80 major markets based on consumer perception metrics, which include entrepreneurship, heritage and cultural influence. Decision makers around the word recognize the huge potential that Indonesia, the fourth largest population in the world, holds for business. Aided by its abundant natural resources and socio-economic stability, with the immediate task to break free and get ahead of the South-East Asian region.