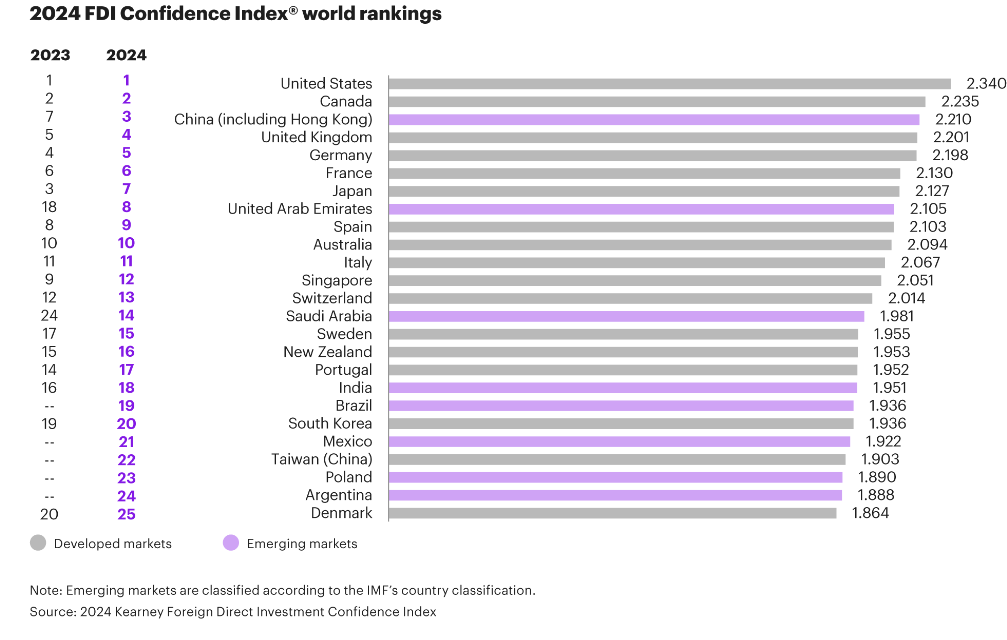

The United States takes the top ranking for the 12th consecutive year

The strength of the US economy—the fastest growing in the G7—and rebounding consumer sentiment likely supported this score. Canada also makes a strong showing, maintaining its second-place rank and forming part of the top five markets for the 12th consecutive year. China jumps from 7th position to 3rd, which could be explained in part by its loosening of capital controls for foreign investors in Shanghai and Beijing in September 2023. And Japan drops from 3rd to 7th, likely reflecting the continuing economic woes of the market, which entered a recession in Q4 2023. Overall, this year’s survey revealed investors’ preference for developed markets, which accounted for 17 of the 25 markets on the Index. However, emerging markets continue to build their presence on the list, with the United Arab Emirates and Saudi Arabia in particular experiencing meteoric rises from 18th to 8th and 24th to 14th, respectively.

The second annual ranking for emerging markets welcomes newcomers to the top 25

China, the United Arab Emirates, Saudi Arabia, India, Brazil, Mexico, Poland, and Argentina make up the top eight positions, and they are the only emerging markets included in the world rankings. Regionally, the Americas has the most markets on the list with nine, followed by Asia Pacific at seven, the Middle East and Africa at five, and Europe at four. Southeast Asia continues to show its strength, with Thailand, Malaysia, Indonesia, and the Philippines all among the top 15. Seven of the 25 markets on the Index—Poland, Chile, Romania, Peru, Hungary, Uruguay, and Oman—joined the list for the first time.

Results suggest investor optimism is high and has the potential to grow even more in the next three years …

A striking 88 percent said they were planning to increase their FDI in the next three years—6 percent more than last year. Furthermore, 89 percent—up from 86 percent in 2023—said they regarded FDI as more important to their corporate profitability and competitiveness in the next three years. And the level of net optimism on the global economy rose markedly as well. While the optimism level grew only marginally to 64 percent, net pessimism decreased notably from 35 to 29 percent compared with last year.

… but key risks related to geopolitical tensions and a restrictive regulatory environment loom large

Investors anticipate continued geopolitical tensions in 2024. Eighty-five percent think an increase in geopolitical tensions will affect investment decisions, and firms are making decisions to nearshore and/or friendshore as a reaction to these lingering geopolitical pressures. Investors also anticipate that a more restrictive business regulatory environment in both developed and emerging markets is likely to pose risks in the year ahead. The proliferation of industrial policies and trade restrictions, including those related to emerging technologies, suggest more regulatory complexity that investors will need to monitor and comply with across markets.

This year’s thematic section results underscore how rapidly AI is proliferating …

A striking 72 percent of investors say they are making significant or moderate use of AI in their business operations. They anticipate their businesses will use AI for customer service and chatbots, automation of manual processes, and supply chain enhancement. Further, 63 percent of investors say their organization will make significant or moderate increases in AI usage to guide their investment decisions. Investors cite cost or efficiency savings and decision-making accuracy as the top benefits they gain when using AI in their decision-making.

… and investors anticipate even greater use of AI on the horizon

AI’s disruptive potential will transform the global economy and demand rapid changes from businesses, and the firms we surveyed are preparing to adapt accordingly. Notably, 64 percent of investors say they anticipate that their organization will expand their use of AI in making investment decisions over the next three years, with 41 percent anticipating a “significant” or “moderate” increase. In contrast, just 8 percent anticipate a decrease in the use of AI for investment decisions over this period. However, capturing a competitive advantage in AI will be determined not only by investment, but also by the regulatory environment in which those investments are made. Investors overwhelmingly agree (82 percent) that AI policies and regulations will influence the degree of their AI investment, underscoring the importance of regulation keeping pace with the AI boom.