Two years after small subscriber losses ultimately erased $200B in shareholder value, Netflix has almost fully recovered its peak share price, and kicks off the latest round of media and entertainment earnings with the wind at its back.

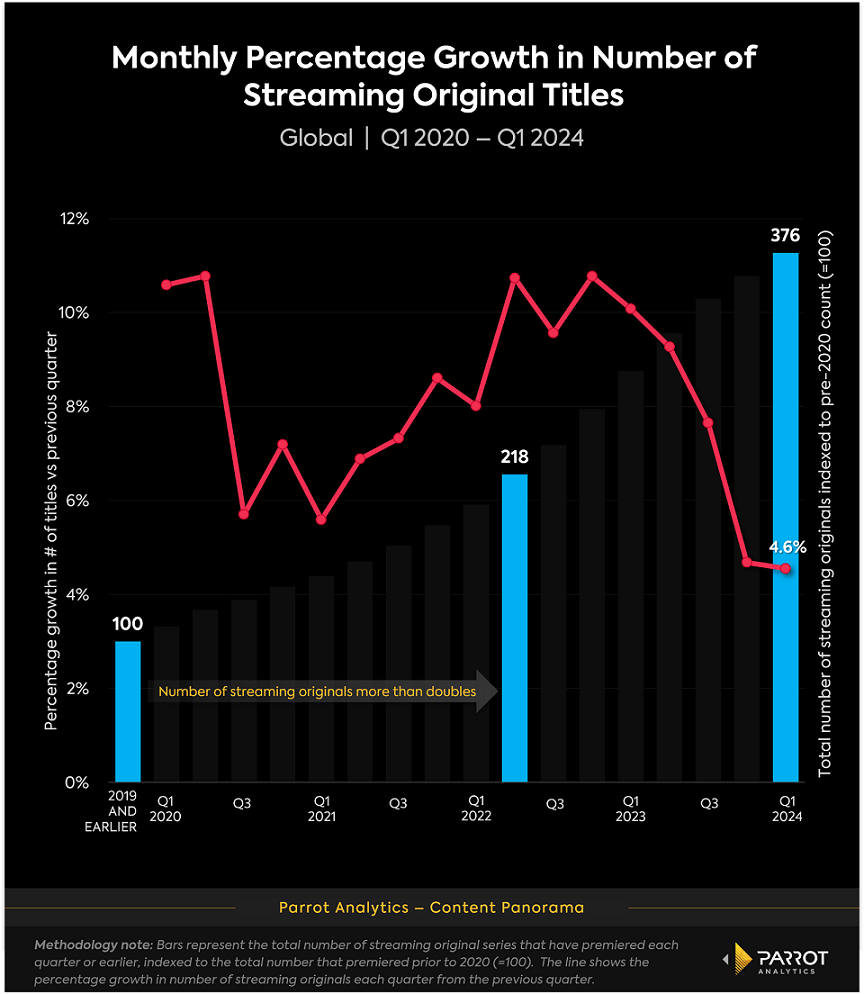

A supply side analysis of the global streaming landscape with Parrot Analytics’ Content Panorama reveals an industry that has pumped the brakes on the output of new content in recent quarters.

It is against this backdrop that Netflix has been solidifying its dominance. When analyzing key metrics such as subscribers, profitability, and audience demand, it is clear that Netflix is pulling away from the competition and everyone else is fighting for second place.

The streaming giant has now grown its global market share of demand for these streaming original series for two quarters in a row, a first in the modern streaming era (Q4 2019-present). The global share of demand for Netflix’s originals steadily shrank over the past four years as competition increased, from 55.7% in Q1 2020 to 33.3% in Q3 2023, before bouncing back up to 33.9% as of Q1 2024.

While that gain may seem small, even the slightest rebound in this increasingly crowded space is a remarkable show of force that has translated to massive subscriber gains. Last quarter, when Netflix reported it added 13 million subscribers, it blew away consensus estimates. On Thursday when the company reported earnings for the first quarter of 2024 it again exceeded analyst expectations, adding 9.3 million subscribers. A major factor driving Netflix’s increase in demand share has been its ability to dominate supply, allowing the company to recover from last year’s strikes and pump out new content faster than the competition.

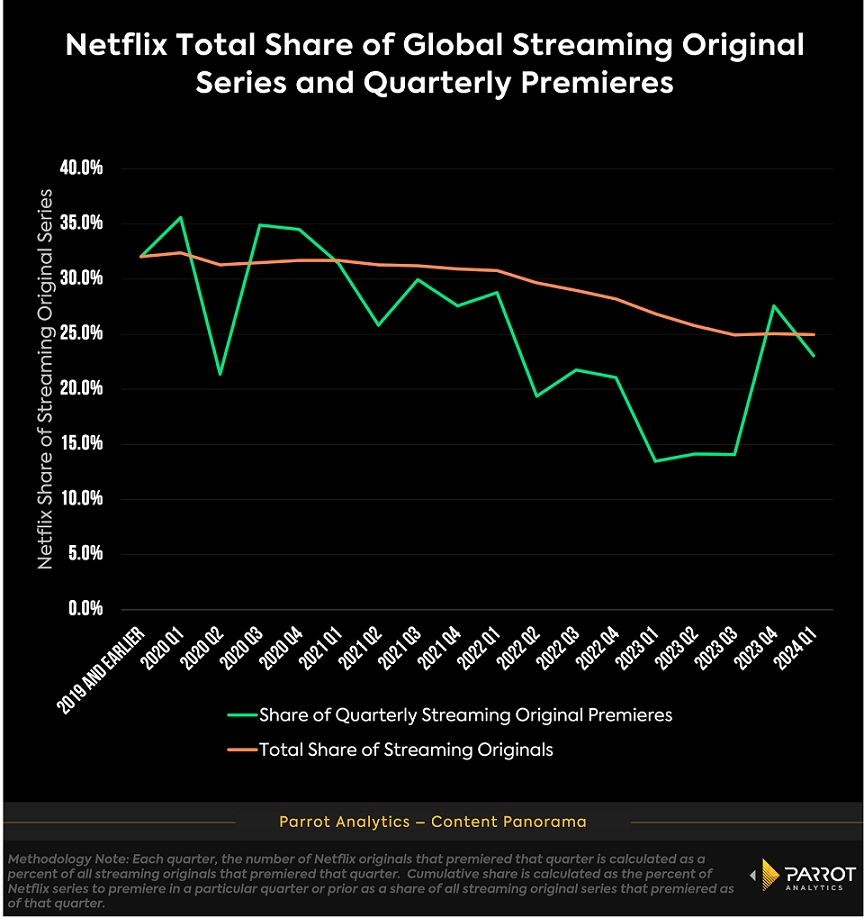

Netflix has been able to pull away from the field because it has a much deeper trench of ready to release content. Looking at the supply share of new premieres during each quarter, the impact of Netflix’s increased competition is even more stark. As recently as Q3 2021, Netflix accounted for 30.2% of all new streaming original titles released globally that quarter. Fast forward to Q3 2023 and Netflix’s share of new streaming originals worldwide was down to 14.7%. However, Netflix reversed this trend big time in Q4 2023 — accounting for 27.4% of new streaming original premieres, nearly doubling its supply share compared to the previous quarter. While that share dropped to 23.1% in Q1 2024, it’s still higher than at any point since Q1 2022. Some competitor platforms have done a better job of holding their own against this streaming behemoth than others.

In a move to shift investor focus to other financial metrics like revenue Netflix also said it would stop releasing subscriber numbers next year. As the company stops disclosing subscribers, the competition may follow suit, only making the industry more opaque. Fortunately, Parrot Analytics modeling shows that the supply of content available on platforms as well as other factors like the demand for these shows and movies are strong predictors of subscribers and other streaming metrics and allow us to estimate these numbers with a high degree of confidence.