Carat’s latest global advertising expenditure forecasts, covering 59 markets across the Americas, Asia Pacific and EMEA, show advertising spend remains buoyant in 2016, increasing overall by US$23 billion in 2016 to hit US$538 billion – a +4.5% year-on-year increase compared to 2015.

Carat’s latest global advertising expenditure forecasts, covering 59 markets across the Americas, Asia Pacific and EMEA, show advertising spend remains buoyant in 2016, increasing overall by US$23 billion in 2016 to hit US$538 billion – a +4.5% year-on-year increase compared to 2015.

Despite a slight decline from the +4.7% previously forecast in the Carat Ad Spend report from September 2015, due to lowered expectations in China and Brazil, advertising spend will be supported by general market stability in 2016 driven by prolific media events including the US presidential elections, the Rio 2016 Olympics and Paralympics, as well as the UEFA EURO 2016 football championship. The predicted 2016 growth rates in major markets China and Brazil of +5.8% and +6.8% respectively will however continue to outpace the global advertising market growth rate.

The positive outlook for 2016 is expected to continue into 2017 with Carat’s forecast predicting a steady year-on-year global advertising growth of +4.5%, based on a continuing global economic growth.

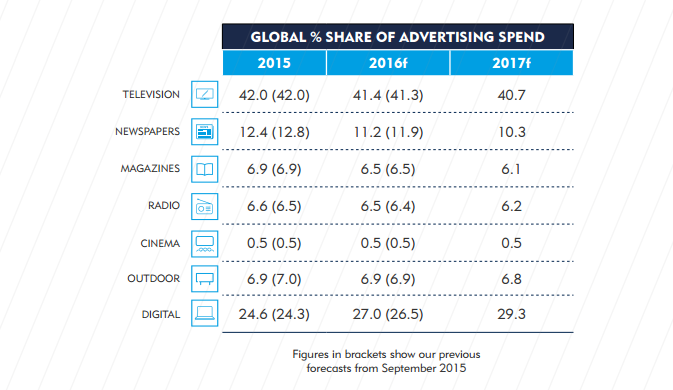

The strength of Digital spend continues to be the key driver of growth in the global advertising market, with a predicted US$18.5 billion increase in spend in 2016, a +15.0% year-on-year growth rate, outpacing previous predictions from the September 2015 report of +14.3%.As a leading media type now across 12 of the markets analysed, Carat’s first forecasts for 2017 reveal that Digital will continue to grow at double-digit levels of +13.6%, and will account for 29.3% of all advertising spend globally.

Key Trends from the Report

• Sustained growth in global advertising spend predicated in 2017 of +4.5%, in line with continuing global economic growth expectations for next year.

• Overall, global advertising spend in 2016 will be supported by general advertising market stability driven by major media events in 2016, including US presidential elections, the Rio 2016 Olympics and Paralympics, and the UEFA EURO 2016 football championship. Total advertising spend is expected to hit US$538 billion this year.

• Global forecasts for 2016 have been slightly revised down from the +4.7% previously forecast in the September 2015 report, to +4.5% following changes to regional advertising forecasts in Asia Pacific and Latin America, due to lowered expectations in China and Brazil based on economic conditions.

• Advertising spend in North America remains strong with +4.6% expected growth in 2016 fuelled by the upcoming US presidential elections which are solely forecast to generate US$6 billion spend in the US.

• Western Europe remains stable with year-on-year growth of +2.8% in 2015. Advertising spend in the region is expected to continue to grow consistently at an estimated +3.1% in 2016 and 2017, outpacing predications from the September 2015 report (+2.9% for 2016), mostly driven by growth in the UK and Spain.

• Advertising spending in the C&EE region is forecast to return to positive growth in 2016 at +2.2%, revised up from predictions in September 2015 (+1.6%), and a further +4.0% in 2017, mainly driven by increased stabilisation in the Russian advertising market.

• In Asia Pacific, the Indian advertising market continues to be buoyant as growth prospects in the country remain high at +12.0% in 2016 and +13.9% in 2017.

• Digital media spend continues to grow at double digit prediction levels of +15% in 2016, outpacing Carat’s forecasts in September 2015, and a further +13.6% in 2017. Digital media’s share of total advertising spend continues to expand year on year, targeting a forecast of 27% share in 2016, exceeding earlier predictions in the September 2015 report, and expanding further to 29.3% of total advertising spend in 2017.

• The continued growth of Digital is driven by Mobile, Online Video and Social Media, increasingly becoming more prevalent components of advertising investment. Mobile continues to show the highest spend growth across all media in 2016, with a year-onyear estimated increase at +37.9% in 2016.