In modern retail, the use of promotions has slowly escalated to become a now-standard practice that has resulted in a shared reliance among retailers and manufacturers, but decent returns on trade promotion spend are increasingly hard to generate. In fact, the spiraling cost of trade promotions has yielded a diminishing return on investment for many categories. Knowing which categories are more or less sensitive to pricing changes is essential for breaking the promotion addiction and driving growth.

In modern retail, the use of promotions has slowly escalated to become a now-standard practice that has resulted in a shared reliance among retailers and manufacturers, but decent returns on trade promotion spend are increasingly hard to generate. In fact, the spiraling cost of trade promotions has yielded a diminishing return on investment for many categories. Knowing which categories are more or less sensitive to pricing changes is essential for breaking the promotion addiction and driving growth.

While price sensitivity varies by category, it’s helpful to understand what consumers say they would do if prices were to increase by 10%. Not surprisingly, nondiscretionary items, such as dairy, fresh foods and personal-care products, are less price sensitive than discretionary items, such as convenience foods, snacks and alcoholic beverages. For example, only 13% of global respondents say they would stop purchasing dairy products, 15% say they would not buy personal-care products, and 16% say they would not purchase meat or poultry if prices increased by 10%. More than one-third, however, said they would stop purchasing convenience foods (37%) or prepared meals (36%) if prices increased by 10%. For the most part, however, consumers aren’t cutting out categories altogether. Rather, they’re simply buying less.

“It’s time to abandon the presumption that the same promotion strategies work for all categories,” said Steve Matthesen, global president of retail, Nielsen. “Promotion spend needs to be tied to performance, adjusting above-the-line spend based on how well the product or portfolio has delivered on the money invested. Fewer, smaller, better promotions, rather than more, bigger ones, will deliver better returns. Focusing promotions on the most profitable outlets will be critical.”

IN TOUGH TIMES, MORE IS BETTER THAN LESS

Though price increases are a growing reality for consumers, there are ways to drive sales and help consumers cope when prices are rising but wages are not. How can manufacturers make adjustments to keep shoppers coming back when times are tough?

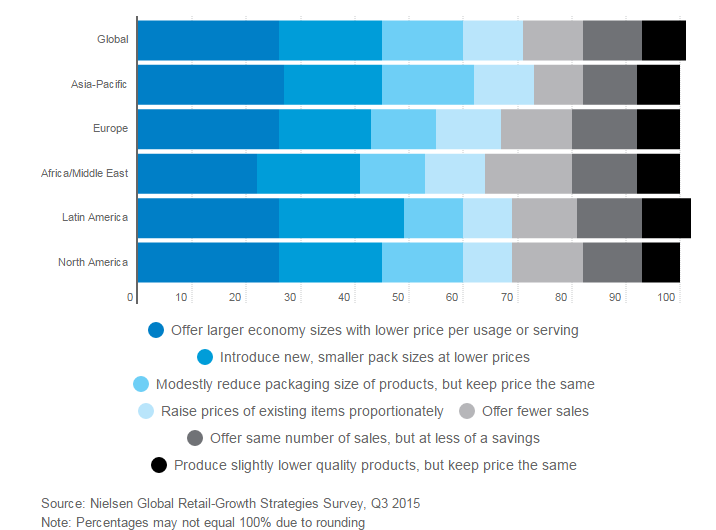

We asked respondents to rank different pricing strategies manufacturers could use if materials costs for food or personal care rose substantially.

The most preferred strategies in every region were for manufacturers to offer larger economy sizes with lower price per use or serving (cited by 26% of global respondents), followed by introducing new, smaller pack sizes at lower prices (19%). Reducing existing package sizes (also called downsizing) was the preference for 15% of global respondents. Sales and promotional strategies were less important. And it’s clear that consumers do not want to compromise on quality, with only 8% of global respondents saying they would sacrifice quality to keep the same price.

MONEY-CRUNCHED CONSUMERS PREFER TO GO BIG

Regional averages: percentage who ranked action as their most preferred savings strategy if prices rose substantially

Other findings from the global Think Smaller for Big Growth report include:

Nearly half (46%) of global respondents say that grocery shopping is something they try to spend as little time as possible doing.

Health and wellness is a top priority for consumers around the world, with 67% saying they actively seek products with healthful ingredients.

In-store add-on services that are the most widely available and used by global respondents include banking (42%), fast food (40%), prepared food (40%) and pharmacy (39%) services.

Price is important, but it’s not everything. Globally, consumers rate high-quality produce (57%), convenient location (56%) and product availability (54%) as more influential in store-selection decisions than the lowest price.