Fast-track Asia

Fast-track Asia

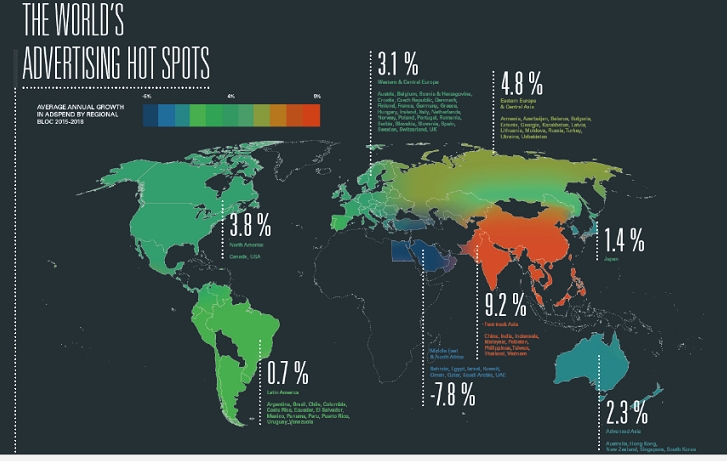

We characterise the rest of Asia as Fast-track Asia (China, India, Indonesia, Malaysia, Pakistan, Philippines, Taiwan, Thailand and Vietnam). These economies are growing extremely rapidly as they adopt Western technology and practices, while benefiting from the rapid inflow of funds from investors hoping to tap into this growth. However, the Chinese economy – the main engine of growth in Fast-track Asia – is finally starting to slow after years of blistering growth, and the ad market is slowing down alongside it. China accounts for 74% of adspend in Fast-track Asia, so its slowdown naturally has a large effect on the region as a whole. We expect ad expenditure in Fast-track Asia to grow 9.7% in 2016, and at an average rate of 9.2% a year between 2015 and 2018, down from 12.0% a year between 2010 and 2015.

Western & Central Europe

The eurozone crisis is not definitively over – Greece’s debts are still unsustainably high, for example – but the region’s ad market has been enjoying solid recovery since 2014. Advertising expenditure grew 3.9% in 2014 and 2015, and is forecast to average 3.1% growth a year to 2018.

Some of the fastest growth is coming from ad markets at the periphery of the eurozone that suffered the most after the financial crisis. Ireland has enjoyed 8% annual growth since 2014, and should continue to do so for the rest of our forecast period. We forecast Spain to grow 6% a year to 2018, after 7% growth in 2015, while Portugal is growing at 4%-5% a year. Even Greece should enjoy 6%-7% annual growth in 2017 and 2018. The slowest growing of the peripheral markets is Italy, which is growing at 2%-4% a year.

Meanwhile, France continues to lag behind with weak business confidence and household consumption, and industrial unrest. We forecast French adspend to grow only 0%-1% a year to 2018.

The UK, the stand-out growth market for the last four years, is finally starting to slow. The slowdown began before the vote to leave the European Union in June, but the ‘Brexit’ result is likely to further weaken growth over the next few years. We forecast 5.4% growth in UK adspend this year, down from 9.2% in 2015, and 3%-4% growth over the next two years.

Eastern Europe & Central Asia

The conflict in Ukraine severely disrupted its domestic ad market, while Russia has suffered from sanctions imposed by the US and the EU, the sanctions it imposed in response, and a withdrawal of international investment. These shocks have been exacerbated by a sharp drop in the price of oil – which accounted for 70% of Russia’s exports in 2014 – and devaluation of the Ukrainian and Russian currencies. These problems then spread to Belarus, whose main trading partner is Russia by some distance. In 2015 adspend shrank by 45% in Ukraine, 28% in Belarus and 9% in Russia. Russia’s ad market proved more resilient than we feared, and having avoided collapse in 2015 is staging a mild recovery in 2016. We forecast 4% growth in Russia this year, and 12% growth in Belarus, but Ukraine will remain stagnant. The region will be dragged down in 2016 by Azerbaijan, which we forecast to shrink by 12% this year, and Kazakhstan, where were forecast a 38% collapse in adspend.

Overall we expect adspend in Eastern Europe & Central Asia to shrink 0.1% in 2016, after 7.5% decline in 2015, but we forecast growth to pick up to 6.6% in 2017 and 8.1% in 2018.

Japan

Japan behaves differently enough from other markets in Asia to be treated separately. Despite recent measures of economic stimulus, Japan remains stuck in its rut of persistent low growth. We forecast average adspend growth of 1.4% a year between 2015 and 2018.

Advanced Asia

Apart from Japan, there are five countries in Asia with developed economies and advanced ad markets that we have placed in a group called Advanced Asia: Australia, New Zealand, Hong Kong, Singapore and South Korea. We estimate 2015 growth here at 5.3%, the best performance since 2011, but forecast growth to slip back to an average of 2.3% a year through to 2018.

North America

North America was the first region to suffer the effects of the financial crisis, but it was also quick to recover, and adspend in North America was more robust than in Western & Central Europe between 2012 and 2014. This changed in 2015 as the European markets most affected by the eurozone crisis recovered rapidly, while declining network television ratings eroded US adspend growth. US networks have had a good year so far in 2016, thanks to high spending by pharmaceutical and packaged goods advertisers, and expenditure on US social media has accelerated. North America is therefore ahead of Western & Central Europe again: for the former we forecast 3.8% annual growth in adspend to 2018, compared to 3.1% for the latter.

Latin America

Argentina, Brazil, Ecuador and Venezuela (which account for 56% of Latin American advertising expenditure) are currently suffering recession, compounded by rapid devaluation in Argentina and full-blown crisis in Venezuela. In December last year the Argentinean government lifted its exchange rate controls, leading to an immediate 30% devaluation of the currency, followed by further declines this year. Meanwhile Venezuela is running out of basic supplies and is heading for hyperinflation. We forecast Latin American advertising expenditure to shrink 2.7% in 2016, down from 6.3% growth in 2015, followed by mild recovery in 2017 (of 1.6%) and 2018 (of 3.2%).

MENA

The drop in oil prices in 2014 has had a severe effect on the economies in MENA, and has prompted advertisers to cut back their budgets in anticipation of lower consumer demand. Political turmoil and conflict have further shaken advertisers’ confidence in the region. We forecast an 11.8% drop in adspend in MENA this year, followed by further declines of 7.3% in 2017 and 4.2% in 2018, averaging out at a 7.8% annual decline to 2018 – that’s up from the 5.8% annual decline we forecast back in July.

Written by Jonathan Barnard, Head of Forecasting at Zenith