For most urban consumers, going out for a meal is one of the simple pleasures of life.

For most urban consumers, going out for a meal is one of the simple pleasures of life.

However, Nielsen estimates based on data from the National Sample Survey Organisation (NSSO), which captures consumption patterns of more than 400 items across India, show that most Indian households don’t have the financial means to indulge in eating out.

Still, a sizeable number of Indians living in cities spend significant amounts on meals they don’t have to cook themselves. For marketers looking to reach these hungry consumers, understanding how income and age feed spending habits around dining out of home is crucial.

How much do Indians spend on Eating Out

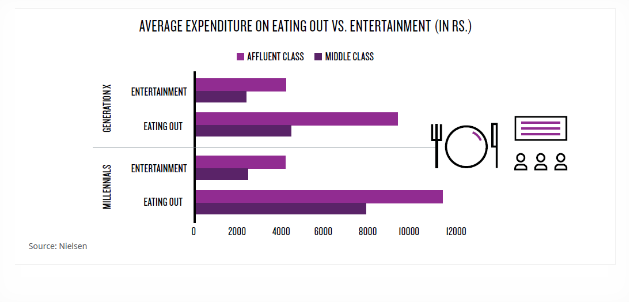

On average, urban Indians spend INR 6500 per year on eating out, with a wide gap in average expenditure between different income groups. The affluent class spends almost twice as much as the middle class on eating out, though even the latter’s spends are significant. Not just in terms of expenditure, but even in terms of the percentage of urban households that dine out, the affluent income group almost doubles the middle class figures.

On an average, nine out of 10 urban Indian households in the richest segment of the population (the fifth quintile or Q5), who eat out, set aside a monthly minimum of INR 1000 for discretionary spending including dining out. In an example of the yawning gap between expenditure of different income groups, figures show that the average expenditure per outing for households in the top quintile (Q5), which comprise the richest 20% of the population, is three times that of the next quintile (Q4). Also, the top one percentile of households spend a noteworthy INR 6,400 each time they dine out.

Dining out Versus other spends

Trends in eating out are evolving, and there has been a consequent rise in formats like quick-service restaurants, cafes and convenient delivery services. Clearly, eating prepared, cooked food is now a convenient proposition for urban consumers and Millennials alike. Both urban Millennials and Gen X consumers spend more on groceries than eating out. But for urban Millennials, the ratio of the average expenditure on eating out compared to the average spend on groceries is two-thirds. In comparison, the figure for Gen X is only a third.

When compared to expenditure on entertainment, Millennials spend more on eating out. Young Indians, who comprise the middle-income Millennial generation newly entering the workforce, spend three times as much on restaurant visits than on any form of entertainment including cinema, theatre and other recreational activities.