The intent behind this report is to provide insights into the outlook of Indians towards the COVID-19 pandemic, changing consumer sentiments, and evolving media consumption in India as a result.

The intent behind this report is to provide insights into the outlook of Indians towards the COVID-19 pandemic, changing consumer sentiments, and evolving media consumption in India as a result.

Executive Summary

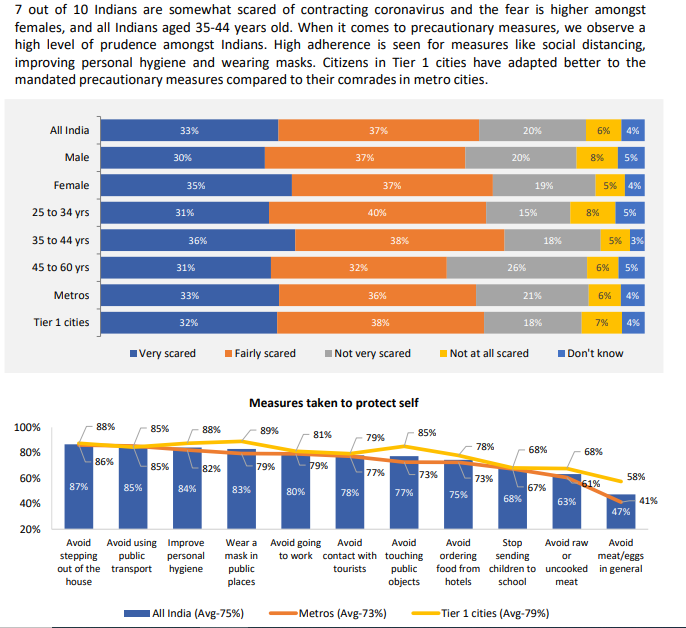

An overwhelming 70% of Indians fear contracting the virus and are diligently adopting precautionary measures to protect themselves.

9 out of 10 feel that the Indian government is handling the unprecedented outbreak fairly well, and want the government to ensure regular supply of essentials; close to 70% want the lockdown to continue till the pandemic is contained.

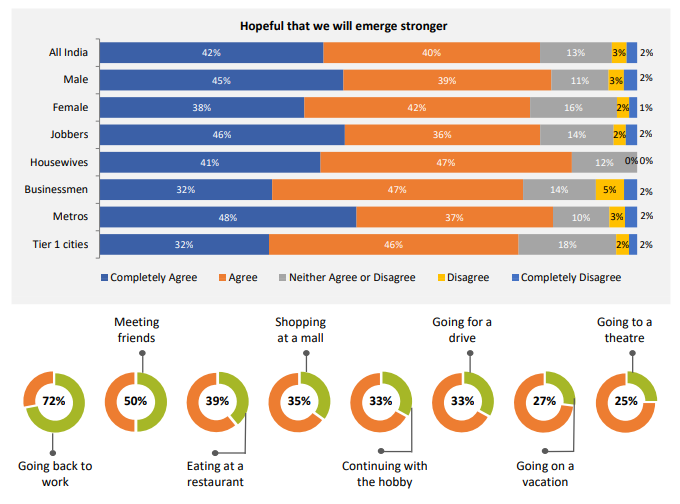

80% are hopeful that the country will emerge stronger and look forward to normalcy being restored soon

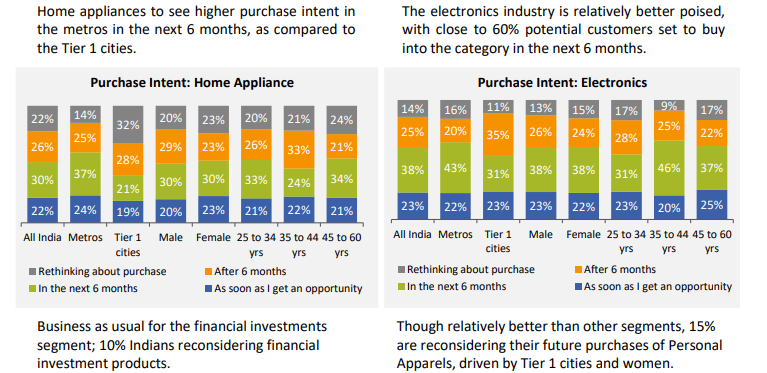

While we observe an uptake in essential consumer goods, the outlook towards speciality and consumer durables categories seems subdued, with many postposing the purchase by over 6 months.

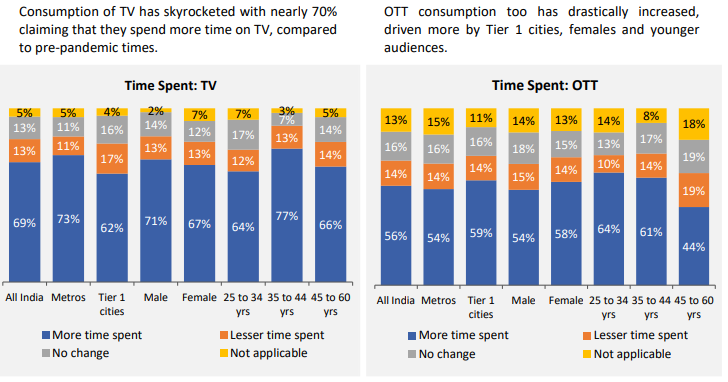

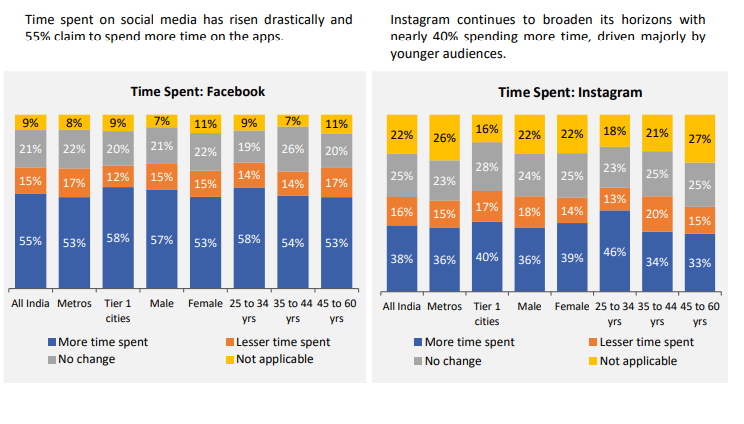

As Indians prepare to brave the storm in social isolation, we observe a huge spike for at-home media consumption, particularly for TV, social media and online video platforms.

The Watchful Indian

Appraising the Government’s Performance

An overwhelming 92% feel that the government is handling the COVID-19 pandemic fairly well. Top 3 measures that they feel the government should take include ensuring supplies of essentials, due diligence on quarantine dealings, and stricter action against protocol violators. Continuing with the nationwide lockdown ranks low amongst the policies, however, 7 out 10 feel that the lockdown should continue till the pandemic is contained.

What’s on Our Minds

An overwhelming 85% of Indians are concerned for their fellow countrymen who are less fortunate than them and survive on daily wages. There also exists high pessimism of a rapid outbreak if people don’t follow social distancing and India not having adequate medical infrastructure to take care of those affected. Close to 60% foresee financial hardships if the pandemic continueslong term.

Holding Fast to Hope

At an overall level, more than 80% of Indians feel that they will emerge stronger once the pandemic is over. Citizens in metros are more hopeful about the resurgence compared to Tier 1 cities, while businessmen are not eagerly enthusiastic as compared to the salaried population. The ongoing lockdown has impacted lives of Indians in myriad ways, and they look forward to going back to work and meeting friends. There are also some encouraging signs for the hospitality industry, which was the first industry to be impacted by the pandemic.

Impact on Speciality & Consumer Durables Businesses

The figures below express recent in-market audiences across various Speciality & Consumer Durable Goods sectors, before the widespread outbreak of the pandemic in India and the resulting lockdown. Nearly 60% of Indians were in-market for personal apparels, which include clothes, shoes and personal accessories. A majority of them intended to buy electronics and approximately 1 out of 4 Indians were looking to buy in the automobile category.

Evolving Media Consumption

During these times of pandemic-induced social isolation and subsequent lockdown in the country, it’s no surprise that people are consuming vast amounts of media. This section provides insights into the changing consumer lifestyles and media consumption.

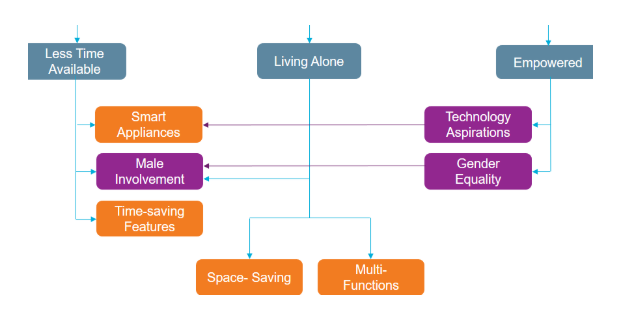

Winds Of Change – Adapting To ‘The New Normal’

Several brands have come to the fore in these distressed times and have engaged with consumers through more humane, empathetic, informative, engaging and reassuring communications. This section sheds light on a few prominent campaigns and initiatives by major brands as they evolve and distil hope and positivity to Indians.

Educating With Right Information

Reckitt Benckisers’s campaign, #DisinfectToProtect aims at educating people on the need for keeping surfaces clean and disinfected to help break the chain of infection. Besides the brand has pledged to donate 1 million liters of Lizol and Harpic to support the frontline workers.

Being Genuine & Empathetic

Ariel’s most successful campaign #ShareTheLoad strikes a cord now more than ever when the entire nation is under lockdown. The campaign very beautifully delivers a social message of removing the stain of gender inequality and is a great example of the ‘Evolving India’.

Transforming From Corporate To Humane

Hindustan Unilever in collaboration with UNICEF has launched a campaign #BreakTheChain which has three powerful themes – social distancing, handwashing and generosity. In addition the brand is committed to make essentials like Lifebuoy soaps, hand sanitizers and Domex cleaners available across India.

Keeping Your Consumers Engaged

Nivea’s latest campaign #ManyWaysToCare is a digital first campaign to build Brand Equity in the current scenario where families are confined to their homes and running out of ideas to engage productively with their kids. ‘Have Fun With Your Kids’ augurs well to entrench the brand in the Consumers lives.

Agility, Safest Harbour In Uncertain Times

Advertisers need to be agile in their media and communications planning. Recent BARC Nielsen report points towards TV viewership being driven by News and Movies. Brands should not be pushy in their content but rather focus on conveying emotions of solidarity, positivity & gratitude.

Acing Influencer & Social Media Strategy

With the lockdown affecting production of regular content, increasing number of brands are collaborating with influencers. Reebok India’s home workout videos with Katrina Kaif, Dettol’s 20s #HandwashChallenge with Riteish Deshmukh and Philips India’s #TrimAtHome initiative with Virat Kohli being few of the noteworthy mentions.

Research Methodology

Pre-designed questionnaire administered online using OMG Connect, which is OMG India’s proprietary online panel. This panel is hosted on YouGov’s online panel with a current sample size of more than 33,000 people spread across India.

Mumbai

Lucknow

Delhi

Bangalore Chennai

Hyderabad

Guwahati

Kolkata

Jaipur

Indore

Pan-India Coverage

The research was conducted to best represent consumer sentiments across India. Research conducted in Metros as well as Tier 1 cities across the length and breadth of the country.

Centres –

Metros: Delhi, Mumbai, Chennai, Bangalore, Hyderabad & Kolkata.

Tier 1 cities: Lucknow, Jaipur, Indore & Guwahati.

Sample size – Total sample size of 300 spread across research centres.

Broad TG selection to cover population across age groups, genders and professions 25+ years, Male/Female, NCCS AB, salaried/business/housewife.