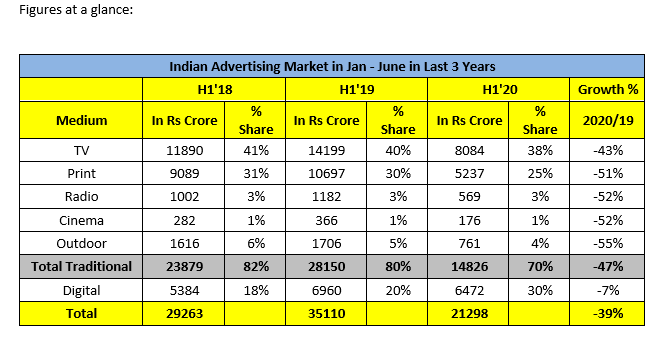

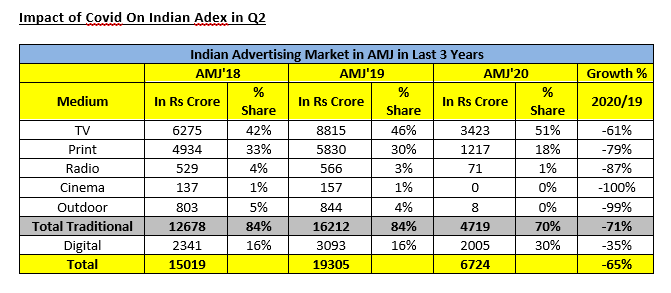

• Traditional media de-grew by 71% in Q2 and 15% in Q1, thus ending up with a 47% degrowth in H1

• Traditional media de-grew by 71% in Q2 and 15% in Q1, thus ending up with a 47% degrowth in H1

• Digital media degrew by 35% in Q2 and grew by 16 % in Q1, thus ending up with a 7% degrowth in H1

• Total Adex in H1 degrew by 39%

• TV and Digital return to growth by June

• Digital now stands at strong No. 2 with a market share of 30%, after TV

• FMCG showed up to be most resilient and its share moved up to 38% compared to 33% in full year 2019

Madison Media has taken the bold step of predicting what the impact of Covid-19 has been on Indian Adex in in H1 2020 and forecasting what it will be in H2. The Highlights of the report were presented yesterday afternoon by Sam Balsara, Chairman Madison World in a webinar that had over 800 participants. There was a panel discussion at the launch event on the topic “Getting the most out of the coming festive season” with Vikram Sakhuja, Partner & Group CEO, Madison Media & OOH, as the moderator, and esteemed panelists included, Amit Syngle, MD & CEO, Asian Paints, Kunal Bahl, Co-Founder & CEO, Snapdeal, Shailesh Gupta, Director, Jagaran Prakashan Ltd, Rohit Gupta, President, Sony Pictures Network, and Avinash Pandey, CEO, ABP Network.

Key findings of the report:

A. Overall:

1. Whilst it is well known that Adex has collapsed in Q2, the drop is as high as 65% because of Covid-19. What is not so well known, is that Adex also contracted in Q1, by as much as 8%. Digital was the only medium which registered a growth of 16% in Q1.

2. In 2019 Adex was at Rs. 67,603 crores; in H1 2020, Adex was only Rs. 21,298 crores, a drop of 39% over H1 2019 or Rs. 13,812 crores in absolute terms. ADEX has not seen a drop as dramatic as this, in anyone’s living memory.

3. Last year on TV, IPL, ICC World Cup and Elections in Q2’19 contributed around Rs 3,000 crores (34% to the TV ADEX in Q2’19) which was wiped out from Adex in 2020.

4. In Q2, Print de-grew by almost 80%, Radio by 90% and Cinema and OOH recorded virtually no billings.

5. The months of April and May were the worst ever when even TV suffered despite breaking records in viewership and time spent by audiences, inspite of original content missing. Even lucrative discounts offered by many broadcasters failed to bring advertisers back and we saw more than half the usual number of advertisers disappear from Print and Radio and a quarter from TV compared to normal times.

6. TV still continues to be the largest contributor to Adex in H1 with 38%, followed by Digital at 30% and Print at 25%.

B. TV:

1) Due to the enforced Lockdown and Work-from-Home policies, Q2 saw a spike in TV consumption despite there not being original content on TV. However this rise in viewership has not translated into TV Adex growth.

2) TV de-grew by as much as 61% in Q2 and 13% in Q1. Overall TV de-grew by 43% in H1.

3) This de-growth is not only because of absence of tentpole properties like IPL and World Cup; even without them the drop in Q2 20 over Q2 19 was as much as 42%.

4) The sharp drop is on account of the fact that many advertisers, 1,171 to be precise, skipped advertising altogether and many large advertisers who continued to advertise, brought down their advertising budgets.

5) TV has been the first to get off the block and June has brought in cheer for TV Adex signifying that some categories cannot afford to stay away from TV advertising for too long to sustain their shares and for fear of losing share to competition.

6) FMCG increased its dominance in TV Adex with a share of 56%, higher than the 2019 figure of 49%. This is primarily due to increase in advertising by newer Covid categories in Personal Hygiene like Sanitiser, Handwash liquids, Disinfectant sprays and multiple products related to Immunity building.

7) An analysis of FCT beamed by various genres shows that all genres have de-grown by atleast 10-20% in H1’20 and some like Music de-grew by 64%, English Movies by 41% and Kannada, Tamil and Telugu languages by around 30%. This drop is much higher in Q2 20 ranging from -2% to -64%.

8) News genre gained maximum attention amongst audiences and TV advertisers for obvious reasons. In fact in week 1 of Lockdown, TV news viewership increased by 250% and came down in June, when it registered an increase of 75%. Despite this impressive viewership, FCT on News genre dropped by 10%, when compared with Q2’19. One must remember, though that Q2’19 saw advertising by all political parties because of Elections.

C. Digital

1) Digital suffered a minor contraction of just 7% in H1, whilst all the others suffered a drop of 40% to 55%. Digital is also the only medium to grow by 16% in Q1 2020, when all others registered a double digit drop.

2) In Q2 2020, Digital de-grew by 35%, yet Digital emerged as a strong No 2 medium with 30% market share second only to TV.

3) Looking at Digital Adex by various verticals, it is more or less equally divided between four major segments; Search, Social, Video & Display with each contributing between 20% to 30% to the total.

4) While there was an explosive spike in video consumption, it did not translate to Ad spends and Video only maintained its share of 30% of Digital Adex, continuing to be the largest contributor.

5) Social media came in next with a share of 26%. Q2 2020, saw a spike in social spends as more brands used social platforms to maintain saliency in absence of other traditional media.

6) Display advertising took a sharp hit, whereas Search maintained itself in third position.

7) E-commerce advertising platforms have made their presence felt registering a 10% share. Affiliate Networks have the balance.

D. Print

1) Print ADEX suffered not just because of lack of advertising money in the market, but also because of the lockdown newspapers could not be delivered to household in many cities in the months of April and May.

2) Whilst most readers could lay their hands on the e-version of their favourite titles, widely in circulation on Whatsapp, quick monetization was difficult.

3) Print de-grew by as much as 79% in Q2 and 17% in Q1. Overall Print de-grew by 51% in H1.

4) In absolute terms, in H1’20 we estimate Print Adex to be at Rs 5,237 crores of which Rs 4,020 crores came from Q1’20 itself. Q2’20 saw only a marginal Adex of approx. Rs. 1200 crores.

5) In terms of volume or space consumed, there is a 53% decline in H1’20 and 77% decline in volume in Q2’20 itself.

6) Categories like FMCG, Auto, Education, continue to be the main cash cows and contributed almost 45% to Print Adex in H1’20. (38% in 2019).

7) Publications across languages show a drop in space consumed, of more than 50% in H1’20. English & Hindi publications continue to contribute close to 60% of the total volume like in recent years.

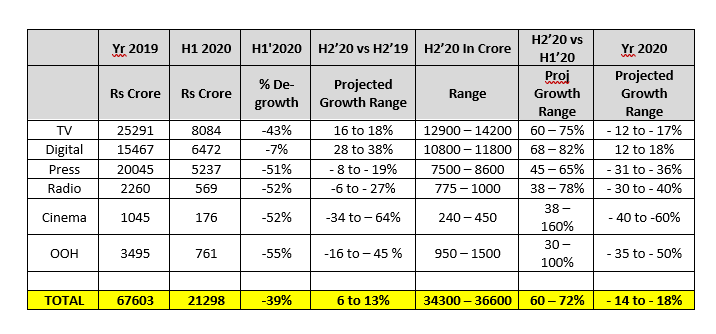

D) Forecast

1) ADEX is likely to recover in H2 20 and grow at a dramatic rate of 60% to 72% of the collapsed H1 half, or grow anywhere between 6% to 13% versus H2 19 on the back of the festival season, which Advertisers are sure to take advantage of , after a lean H1.

2) Despite the dramatic increase in H2, ADEX in full year 2020 will contract by 14% to 18% and ADEX value pessimistically to over 2017 level or optimistically to a little below 2018 level.

3) In 2019, Adex was at Rs. 67,603 crores; in H1 20, Adex did Rs. 21,298 crores, in H2 we expect Adex to do anywhere between Rs. 34,300 to Rs. 36,600, taking full year 2020 Adex to anywhere between Rs.55,000 to Rs. 58,000 crores.

4) TV and Digital have shown early signs of getting back to normalcy and should get back in full form by September or October, aided by the launch of IPL, Bigg Boss and KBC.

5) H2 Adex will primarily depend on Demand coming back in markets which will depend on sentiment and consumers’ outlook of the immediate future, which in turn will depend on when Govt and private offices are allowed to open and work on regular basis.

Says Mr. Sam Balsara, Chairman, Madison World, “We are bullish in our forecast for H2 2020. We believe Advertisers will return to Adex in full form by Q4 to take advantage of the festive Season. Enlightened Advertisers know that they cannot risk being off Advertising for risk of losing Market Share, since Share lost is expensive to regain. Media owners are well advised to be nimble and flexible with existing Advertisers and spare no effort in helping Local and Regional brands become National Brands and help hitherto unadvertised Brands taste the power of Advertising”.