When it comes to taking a risk on a new product purchase, why do consumers choose one product over another? What needs and desires drive new product purchasing, and which attributes are most influential in the path to purchase?

When it comes to taking a risk on a new product purchase, why do consumers choose one product over another? What needs and desires drive new product purchasing, and which attributes are most influential in the path to purchase?

Nielsen’s Global New Product Innovation Survey polled 30,000 online respondents across 60 countries to gauge consumer sentiment about these questions. While new product selection depends on many things, such as life stage, family dynamics and personal choice, macro trends emerged with regards to products that appeal to our heart and our health suggesting there is a gap between what consumers say they are buying and what they wish they could buy if it were available.

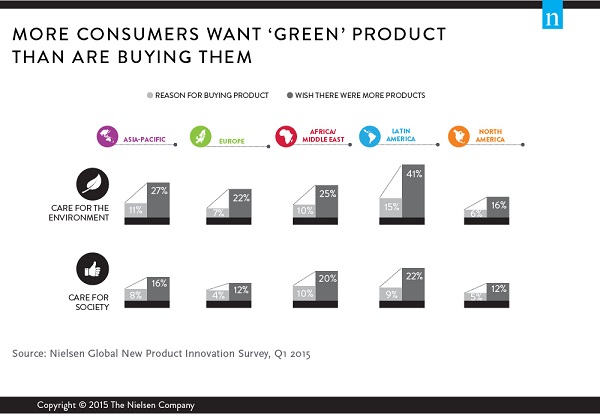

While you’d be hard-pressed to find a consumer who said he or she didn’t care about the environment, when it comes to purchasing new eco-friendly products, words and deeds often part ways. Only 10% of global respondents say they purchased a new product because it was from a brand that cares about the environment. Even fewer (7%) cite corporate social responsibility as a reason for making a new product purchase.

But insincerity may not be driving this gap. In fact, product availability, or rather, unavailability may be partly to blame. Twenty-six percent of global respondents say they wish more ecologically friendly products were available, and 16% wish more products were committed to positive social impact—a 16- and nine-percentage-point gap, respectively, from those who say they purchased a product because of its environmental or social benefits.

“There are a number of barriers to more widespread usage and acceptance of environmentally and socially conscious products, including a perception of higher prices and poor performance along with distrust in sustainability claims,” said Rob Wengel, senior vice president and managing director of Nielsen Innovation in the U.S. “But perhaps even more telling is that consumers are just not finding the ecological products they desire. In many categories, green or socially responsible options don’t exist, are difficult to find or consumers simply don’t know about them. Better product labeling, shelf placement and promotion tactics that encourage trial can go a long way in closing the gap between desire and availability. To ensure consumers are not turned off at the shelf, brands must strike the right balance between ecological and effectiveness claims, testing and optimizing claims and packaging before going to market.”

A HEALTHY OPPORTUNITY

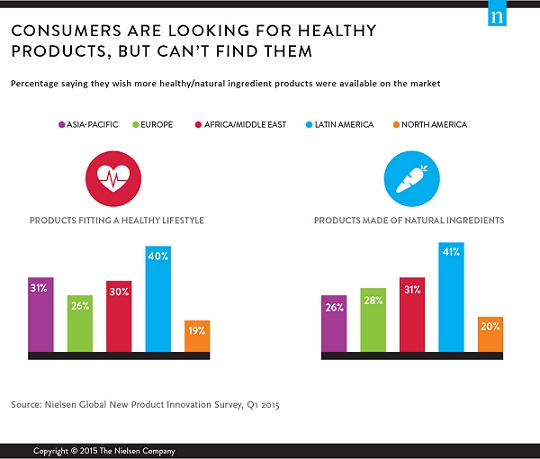

The world is facing a global health crisis—nearly 30% of the global population was considered overweight or obese according to the 2013 Global Burden of Disease Study—and consumers are attempting to take charge of their health. Nearly half (49%) of global respondents in Nielsen’s recent Global Health & Wellness Survey consider themselves overweight, and a similar percentage (50%) is actively trying to lose weight. And they’re looking for help from food and beverage manufacturers to make healthier choices.

On the list of new products consumers can’t find in stores but wish they could, healthy options are second behind affordability in all regions but one. North America was the only outlier; in this region, products made from natural ingredients and those fitting a healthy lifestyle are listed after affordability, novelty and convenience-based products.

“The healthy eating space holds great potential, but manufacturers looking to establish or expand their presence in this area should start by looking at what they can remove from foods rather than what they can add,” said Johan Sjöstrand, senior vice president and managing director of Nielsen Innovation in Europe. “Consumers want to go ‘back-to-basics’ with fresh, natural and minimally-processed options.”

“Stated simply, manufacturers need to make it easy for consumers to eat healthier,” continued Sjöstrand. “Consumption habits are changing for time-crunched consumers who increasingly forgo the traditional three meals a day and eat when it best fits their schedule, which is often on the go. But for many consumers, it’s not enough to be convenient; products must also be healthy and nutritious.”

ABOUT THE NIELSEN GLOBAL SURVEY

The Nielsen Global New Product Innovation Survey was conducted between Feb. 23 – March 13, 2015, and polled more than 30,000 consumers in 60 countries throughout Asia-Pacific, Europe, Latin America, the Middle East, Africa and North America. For the purposes of this study, we defined a new product as any item a consumer has never purchased before. The sample has quotas based on age and sex for each country based on its Internet users and is weighted to be representative of Internet consumers. It has a margin of error of ±0.6%. This Nielsen survey is based only on the behavior of respondents with online access. Internet penetration rates vary by country. Nielsen uses a minimum reporting standard of 60% Internet penetration or an online population of 10 million for survey inclusion. The Nielsen Global Survey, which includes the Global Consumer Confidence Index, was established in 2005.

Source: Nielsen