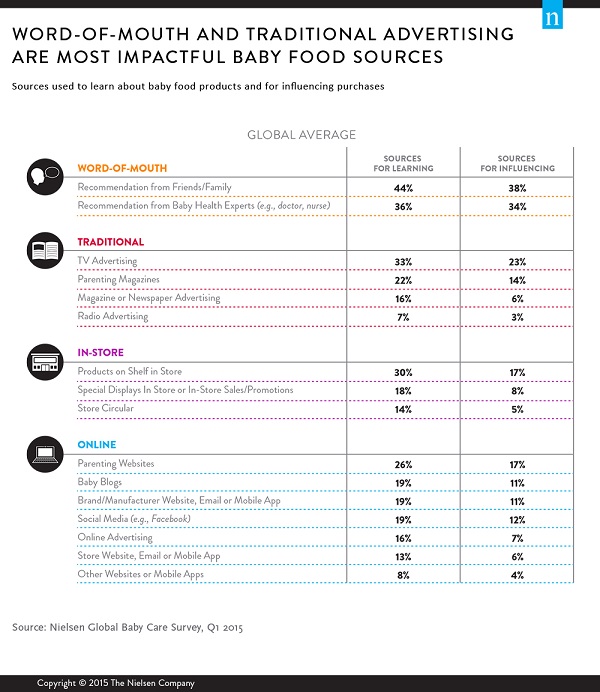

Becoming a parent can be a daunting endeavor, full of many “firsts.” But before first words and steps, come first foods. So who do new parents turn to most for advice about the best baby food/formula to buy for the first time? The short answer is: family and friends. Forty-four percent of global respondents say they learned about baby food from loved ones, and nearly four-in-10 global respondents (38%) say that recommendations from friends and family had the most influence on their purchase decisions.

Becoming a parent can be a daunting endeavor, full of many “firsts.” But before first words and steps, come first foods. So who do new parents turn to most for advice about the best baby food/formula to buy for the first time? The short answer is: family and friends. Forty-four percent of global respondents say they learned about baby food from loved ones, and nearly four-in-10 global respondents (38%) say that recommendations from friends and family had the most influence on their purchase decisions.

But consumers don’t just rely on their circles of friends and family; recommendations from health experts are also highly influential. Thirty-six percent of global respondents say they learned about foods/formula from a baby health expert, and 34% say these opinions influenced their purchase decisions.

Regionally, recommendations from health care experts top the list of most influential information sources in Latin America, cited by 42% of respondents, while their influence is significantly below average in North America, cited by only 18%.

“Marketers must prove their value to not only the shopper but to a broader network of trusted sources,” said Liz Buchanan, director, Global Professional Services, Nielsen. “Product endorsements from doctors, hospitals and health care professionals can hold tremendous clout with parents. As a parent’s first introduction to baby food/formula is often from these trusted advisors, aligning offerings with affiliations can provide an instant gateway to first-time users. But quality and good customer service will keep customers coming back.”

TV ads are also an important source of information, but their influence on decision-making is notably lower. One-third of consumers say they learned about baby foods through a TV ad, but less than one-quarter (23%) say this source influenced purchasing, a 10-percentage point difference. The use of TV ads to learn about new products and to influence purchasing decisions is well below the global average in Europe (22% use, 13% say they’re influential) and North America (20% and 13%, respectively).

Similar gaps between the percentage that use a source to learn about a product versus use a source to influence purchase decisions also exist for the other sources included in the survey. For example, the presence of a product on store shelves is a key source of awareness for nearly one-third of global respondents (30%)—including 36% in North America, where it’s the most commonly cited source—yet only 17% globally say it influenced their purchase decision.

Other findings include:

Almost half of baby food (46%) value sales come from North America and Europe, while Asia-Pacific accounts for 49% of baby food and 53% of formula value sales. More than half (51%) of diaper value sales come from North America and Europe, but the most rapid growth is happening in developing countries.

Asia-Pacific leads global respondents who say they purchase baby care products online.

Organic baby food value sales increased 26% over the past two years in 16 select markets, while non-organic products declined 6%.

Skin protection and comfort are the most important diaper purchase considerations among global respondents.