AppsFlyer’s 17th Performance Index Reveals Increase in App Install Ad Spend, Boosting Spending for Top Media Sources

AppsFlyer has released the 17th edition of its Performance Index, ranking the top media sources in mobile advertising across 5 regions and 6 app categories. The latest version of the Index, which originated in 2015, revealed that non-gaming media investment led to market growth, in which app install ad spend increased 18% year-over-year, with 80% of the top 5 media sources and nearly 60% of the top 20 enjoying a rise in spend.

“In light of recent trends, the split between gaming and non-gaming has never been bigger,” said Shani Rosenfelder, Director of Content Strategy and Market Insights, AppsFlyer. “Gaming continues to have varying trends for marketers, as genres like casual gaming show growth, while hyper casual and midcore categories experience a decline. Gaming studios continue to face challenges in securing investments, although some improvement has been seen. Marketers need to navigate wisely, capitalizing on the rebounding non-gaming sector while cautiously considering amplified investments in gaming opportunities.”

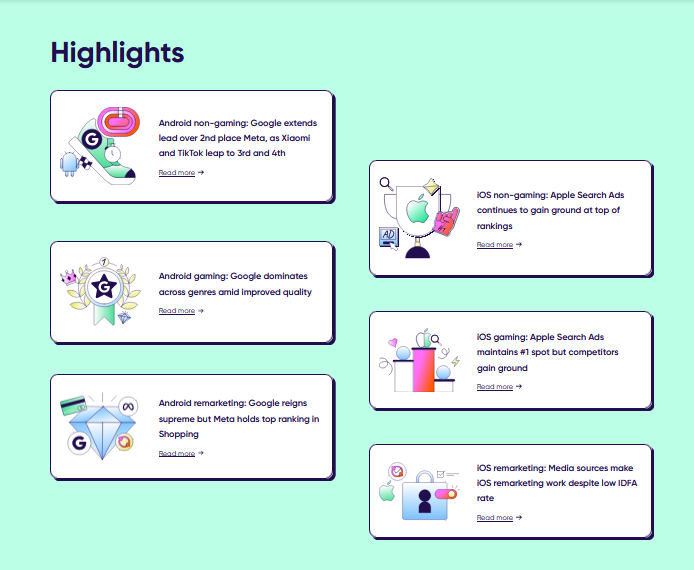

Google extends lead in Android non-gaming, while Apple Search Ads continues to gain ground in iOS non-gaming

Google Ads dominates globally in Android non-gaming with top power, the organic remarketing revenue per user, and volume rankings in nearly every sector, commanding the share of the install market and expanding its ad spend influence. In global rankings, Meta ads maintained its second position, outranking the top five competitors Despite a slight uptick in global retention fueled by growth in India and Eastern Europe, Meta ads witnessed a decline in segment share.

For Android non-gaming, Xiamoi surged to third, rising in the power ranking and holding onto fourth in volume. This included a 22% jump in retention rates driven by India, Eastern Europe, and North America. Meanwhile, Vivo and Oppo experienced a volume drop but climbed in the power rankings to fifth and sixth, respectively, due to enhanced retention scores.

In iOS non-gaming, Apple Search Ads (ASA) continues its control and leads both power and volume segments significantly. Witnessing a surge in North America and Western Europe, ASA experienced growth in its share of wallet while also noting a modest upturn in retention scores. Meta ads held its second global power and volume rankings, trailing only ASA in the number of clients and attributed installs. It gained one spot in the global Utility Group power ranking, and ranked a strong second in Shopping North America. However, its share of wallet decreased in the non-gaming iOS index.

Google dominates across genres amid improved quality in Android Gaming while Apple Search Ads maintains first but competitors gain ground in iOS gaming

Google Ads maintains its stronghold in Android gaming rankings, reigning supreme with top positions in both power and volume across all genres, except for Hypercasual where it secured second place. The search giant continued to widen its lead in the power ranking from second place, bolstered by a 6% improvement in quality measured by the retention score, which attributed to a solid 12% surge in North America.

AppLovin accelerated its ascent in the gaming realm, clinching second and third spots in the power and volume rankings, respectively. Notably, the network also expanded its share of wallet while witnessing a modest 2% uptick in retention score. Unity Ads slipped to third in the global power ranking, backed by strong second positions in Match, Shooting, Strategy, and Tabletop games. Despite this, a decline in its share of wallet was observed within this group. Meanwhile, Meta ads secured the fourth spot in the global power ranking, driven by top-tier placements in Casino, Midcore, and Sports & Racing categories.

ASA maintained its leadership position in the global iOS SSOT index, an new index launched last year that combines SKAdNetwork and traditional attribution, and accurately deduplicates between the two data sources, topping the power ranking due to its exceptional retention score and securing first place across all categories, except for Hypercasual. While commanding the volume ranking at first position, ASA faced competition from AppLovin in the number of attributed installs. Despite a slight dip in share of wallet in H1 2024 compared to the previous year, Apple Search Ads continued to assert its dominance.

AppLovin surged three spots to claim 2nd place in the power ranking and retained its third spot in volume rankings. Witnessing an increase in market share alongside enhanced retention scores in Midcore and Sports games, AppLovin showcased steady progress, although its retention score trailed behind ASA.

Meanwhile, Google Ads made a notable jump, ascending four positions to clinch third in the power ranking, propelled by a remarkable enhancement in its retention score. Despite this achievement, Google Ads experienced a decrease in share of wallet during the first half of 2024.