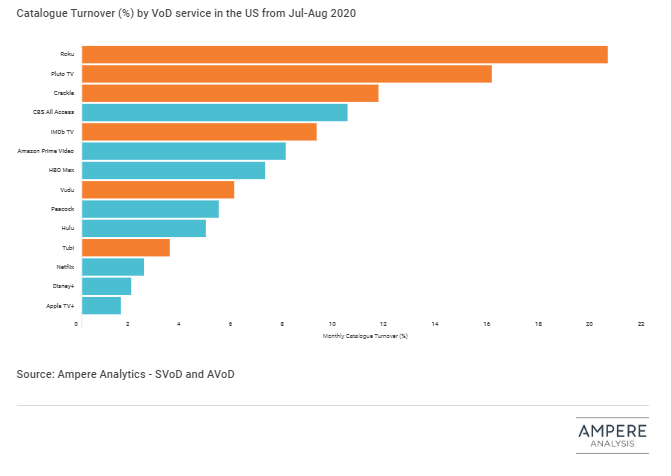

As usage of advertising-funded video-on-demand (AVoD) services continues to grow in the US, data from August 2020 shows that AVoD services are refreshing their catalogues at faster rates on average than subscription counterparts. On average, SVoD services from major studios and international platforms turned over 5% of their catalogues between months, which was calculated from looking at the proportion of all titles available across August and July that were either removed or added during the period. Meanwhile, on average AVoD services turned over 11% of content across the time period, meaning a typical AVoD service refreshes its titles twice as frequently as on SVoD.

As usage of advertising-funded video-on-demand (AVoD) services continues to grow in the US, data from August 2020 shows that AVoD services are refreshing their catalogues at faster rates on average than subscription counterparts. On average, SVoD services from major studios and international platforms turned over 5% of their catalogues between months, which was calculated from looking at the proportion of all titles available across August and July that were either removed or added during the period. Meanwhile, on average AVoD services turned over 11% of content across the time period, meaning a typical AVoD service refreshes its titles twice as frequently as on SVoD.

Different dynamics are in play across the major subscription services in the US. Both Disney+ and Netflix have stable catalogues with long-term licensing deals (centred around in-house content), meaning that monthly changes typically involve a 2-3% change in catalogues, focused around a small number of high-profile original releases and recent-release acquisitions. There are also similar dynamics in play for each of Hulu and Peacock, but as hybrid services, that include ad-funded and catch-up content from network channels, each typically has a higher catalogue turnover rate of closer to 5% of content each month, driven by these shorter-term windows. Meanwhile, Amazon Prime Video typically has a very stable core catalogue, similar to Netflix and Disney+, but has a higher proportion of older titles coming on the service each month, partly due to the capability of independent studios to upload library movie and TV titles on a “pay-as-you-play” model via Amazon’s Video Direct service.

When looking at AVoD services, however, a clear divide emerges. On the one hand, while titles present on services such as Tubi and Vudu might be typically slightly older and of lower critical quality on average than those on SVoD, the services themselves have consistent catalogues centred around long-term licensing agreements. On the other hand, however, Crackle, the Roku Channel and Pluto TV all have significantly higher monthly refresh rates, of between 10-20% of the entire catalogue. These AVoD services are very different in both composition and style from other major services, with content often themed into a fast channel format, and with titles “screened” on a more irregular basis, that is closer to a broadcast TV model in nature.

At a time when all broadcasters face a shortage of new content coming onstream amid widespread production lockdowns from COVID-19, these “fast-channel” AVoD services may face increased competition as they seek to secure the titles needed to refresh their catalogues.

Source: Ampere Analytics