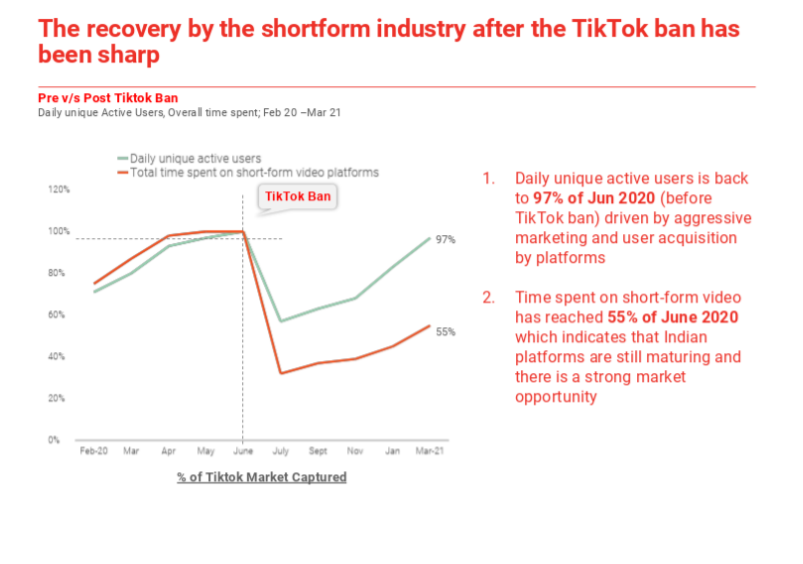

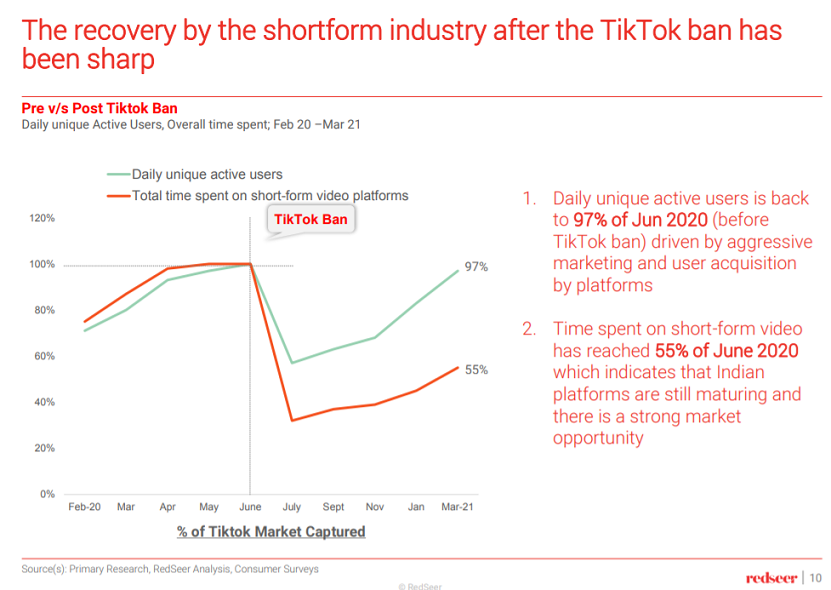

Indian short form apps retain 65-70% of TikTok Users, adding 30-35% new users in the past year, essentially back to 97% of the TikTok userbase.

Indian short form apps retain 65-70% of TikTok Users, adding 30-35% new users in the past year, essentially back to 97% of the TikTok userbase.

Daily active users (DAUs) increased upto 97% as of June 2020 as a result of aggressive marketing and user acquisition by platforms. However, the time spent on the other hand has gradually increased, reaching 55% as of June 2020.

According to the latest Report ‘Short-form video- The Rise of Made in India digital content’ by RedSeer Consulting, Indian Shortform apps have successfully retained 67% of the TikTok era users and have onboarded around 30-35% new users over the past year. This has been a result of increased supplier push and aggressive marketing by platforms.

The new users who are on-boarded are largely from tier 2 cities. This trend is mostly driven by stronger focus of platforms on vernacular content and ‘Bharat’ positioning. Overall, 60- 62% of the shortform users are from Tier 2+ cities. However, the time spent on the other hand has gradually increased, reaching 55% compared to June 2020.

While Indian platforms have come a long way in the last few months, the Indian have more scope to improve their content quality and product experience.But, the study shows that 75% current short-form video users will likely stick to these domestic apps and are unlikely to switch back to Chinese apps even if the ban was lifted

The study has focused on the major Indian shortform apps including Josh, Moj, MX Takatak and Roposo which comparatively had more awareness among the user sets.

“In less than one year post Tik Tok ban, Indian platforms have shown a strong Vshaped recovery, bouncing back to 100% of pre ban daily user base. This shows how platforms were able to design the product, execute their plans and market it aggressively in a very short period of time. This is a strong indicator of how the Indian digital ecosystem has matured in the last few years.

But the job is far from done. The players still have to reach the global and cross sector benchmarks on engagement and retention- which will further grow the monetization potential for the entire ecosystem,” said Ujjwal Chadhury, associate partner at RedSeer Consulting.

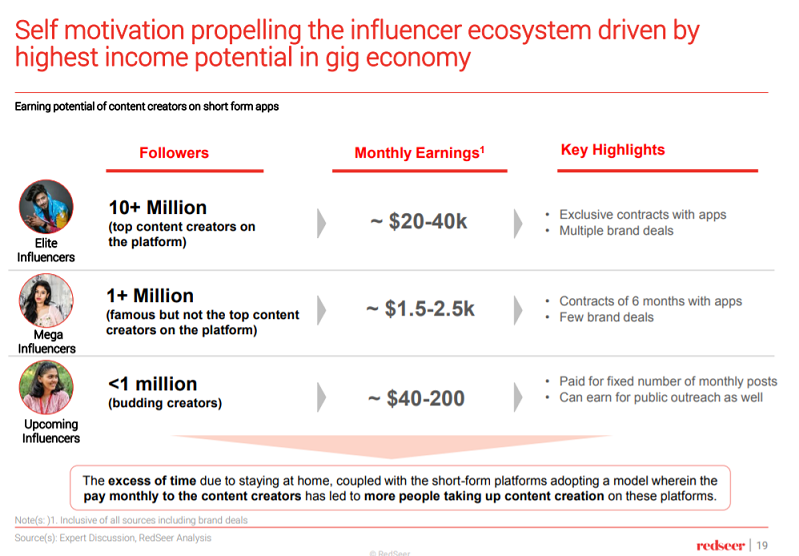

With strong network effects, the user base is growing fast, fuelling ecosystem growth, leading to a large monetization potential for both influencers and platforms. Elite influencers with more than 10 million followers have a monthly earning of around $20,000-40,000. Influencers with 1 million followers can earn upto $1000-2.500 while budding creators with less than 1 million followers can earn $40-200.

According to the study, Josh leads both on influencer and user end driven by strong performance in the Hindi belt and Tier-2+ cities. Moj, has been a strong gainer across consumer and business metrics, when compared to the last quarter. The growth has been driven by regional language markets especially the southern states. On the other hand, Roposo has shown strong performance in Tier-1 cities compared to the smaller ones.

MX Takatak lead in the net promoter score (NPS) in the metro cities. The platform has held challenges and hashtag events similar to TikTok, to gain market share.