An industry roundup report by Performics India, a Publicis Groupe India Agency.

Performics India, part of Publicis Groupe India has launched its Banking & Financial Services Round-Up Report 2023. The report reflects on the digital led growth and potential of the Indian Banking and financial services sector. The digital led growth of Indian banking sector in 2023 has been profound, and Performics India’s report offers valuable insights into the factors driving this change, as well as the challenges and opportunities it presents.

The report underscores the role and significance of digital transformation in propelling the Banking sector. With an ever-evolving demographic profile, banks are now compelled to meet the expectations of a new generation that is inherently digital-centric. As fintech companies continue to offer alluring products and services, traditional banks have intensified their efforts to remain competitive in this dynamic landscape.

The report summarizes the remarkable digital journey of India’s banking and finance sector driven by innovative financial products (e.g. BNPL, payments), the emergence of new market players, heightened fintech adoption, and improved financial literacy. This growth has been further catalysed by the rapid surge in digitalization, establishing digital as the primary medium for educating and engaging with the masses. This aspect is corroborated by an analysis of trends in organic search intents across various financial products. The report also identifies interesting trends within the banking and financial services industry such as open banking, voice banking, personalised banking, search trends, Generative AI, the rise of ‘Finfluencers’ and regulatory mechanisms for them.

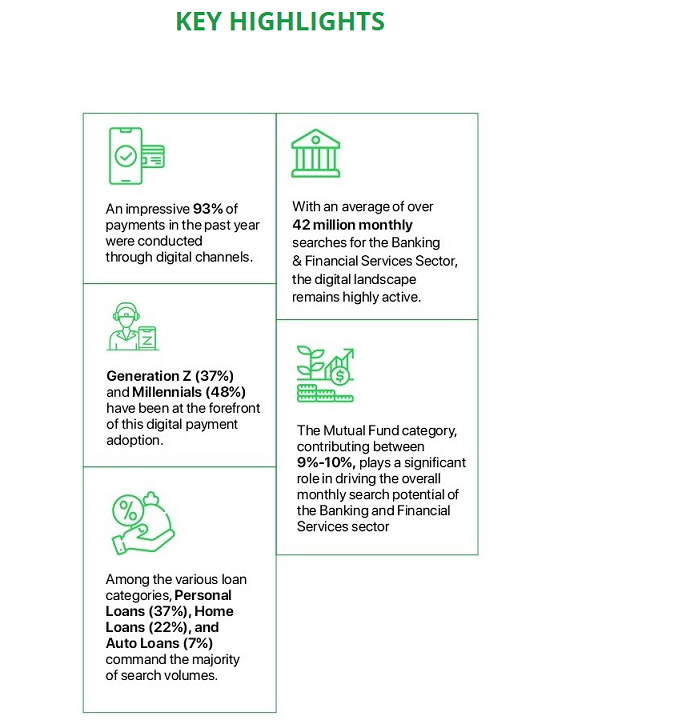

It further highlights the key drivers of Digital Transformation and the growing acceptance of digital payment methods and how it is driving the growth of the banking sector. The report highlights a remarkable shift, 93% of payments in the past year were executed digitally, with QR code transactions surpassing traditional card and cash transactions. The rising trend of biometric payments indicates a growing trust in biometric technology, with consumers increasingly favouring it over traditional cards and devices.

Lastly, the report explores Regulatory Updates and Ethical Practices and its impact on the banking sector, emphasizing the importance of bills like the Digital Personal Data Protection Bill and AI regulation in India. These regulations aim to enhance data protection and promote ethical use of AI, safeguarding the interests of both consumers and financial institutions.

Speaking about the report Lalatendu Das, CEO – Performics India shares “As the financial services sector undergoes profound transformations, the imperative for digital transformation has never been clearer. The Digital Personal Data Protection Bill and other regulatory measures underscore the importance of safeguarding consumer data in this digital age. Open banking, personalization, and generative AI promise to revolutionize how we engage with our customers, making their financial experiences more personalized, efficient, and secure. With growing competition and dynamic customer expectations, it is important for brands to remain at the forefront of these trends and ensure top-notch services and products. Performics India’s BFS roundup report highlights some key updates and insights from the year 2023, equipping our clients with valuable insights to understand the past year’s trends and strategize effectively for the upcoming year.”

Cyrus Shroff, Vice-President – Banking and Financial Services (Performics India) further adds “As we stand on the cusp of an exciting era in the Indian banking and financial sector, the ‘Digital Transformation in the Indian Banking & Financial Sector – Roundup Report’ by Performics India serves as an illuminating guide through the shifting landscape. In an age where digitalization has become paramount, this report showcases the dynamic journey of the sector, driven by innovative products, fintech adoption, and evolving consumer expectations. The Indian banking and financial sector stand at the precipice of remarkable change, and this report offers a valuable compass for all stakeholders to navigate this transformative journey.”