With customer loyalty harder to win, four ways retailers can revitalize loyalty programs

With customer loyalty harder to win, four ways retailers can revitalize loyalty programs

— Only 37 per cent of respondents globally say that points and rewards are one of the most effective ways to secure their brand loyalty. These programs are generally more popular in emerging economies, especially China (where 54 percent of consumers say they inspire loyalty), Mexico (50 per cent) and India (49 per cent) compared to just (15 per cent) in the Netherlands.

— 74 per cent of Indians suggest that companies need to appeal to customers’ hearts as well as their minds and wallets

Bottom line: Retailers need to get serious about customer centricity − loyalty platforms may help.

Digital disruption and new generational influences are making customer loyalty tough to hold onto these days, but fresh thinking on loyalty programs is key to winning and retaining customers, according to KPMG International’s The Truth about Customer Loyalty report.

With the holidays nearing, KPMG’s survey of over 18,000 consumers in 20 countries, with 1721 being from India explores the nature of customer loyalty and how some traditional loyalty programs, long a mainstay of customer retention strategies, may not be keeping consumers brand-faithful.

“In India, brands and retailers are ready to run miles to acquire a customer. It becomes even more difficult to retain acquired consumers, unless there is a unique value proposition along with related benefits. The fact that over 55 per cent of consumers in India say they will buy from their favourite company even if it is cheaper and more convenient to buy from a rival company is further proof that loyalty endures. Loyal customers can be a reliable repeat source of revenue for retailers/brands” said Harsha Razdan, Partner and Head, Consumer Markets and Internet Business, KPMG in India.

“The study in India revealed that when a consumer is loyal to a brand, 93 per cent will recommend it to their family and friends. 47 per cent will remain loyal, even after a bad experience. This substantiates that retailers today will need to re-imagine and re-invent to continue to lure/excite the new digital tech-savvy consumer. They will need to invest in creating convenient loyalty platforms, educating consumers about the program uniqueness and get the consumer to experience the benefits that the program has to offer. These programs should make the consumer feel special, wanted and proud of being associated with the retailer/brand. Retailers/brands should continue to engage with consumers while ensuring that consumer data and interests are protected.” added Razdan

What Indians feel:

Out of the over 18,000 respondents from 20 countries, 1721 were from India. The maximum number of respondents were millennials (in the 17-36 age group).

— 93 per cent of the respondents who are loyal to a particular brand are very likely to recommend the brand to friends and family, compared to global average (86%).

— 84 per cent of the respondents in India believe in loyalty programs and are more likely to buy new products offered by the company

— 47 per cent of the respondents are not likely to shift to a competitor brand even if they have a bad experience

— 33 percent of the customers in India view loyalty programs as crucial for making purchase decisions

What Engenders Brand Loyalty Today?

Brand loyalty doesn’t only earn companies repeat business from their loyal customers–over 86 per cent of consumers globally, from Gen Z to the Silent Generation, say they would recommend a brand they loved to friends and family.

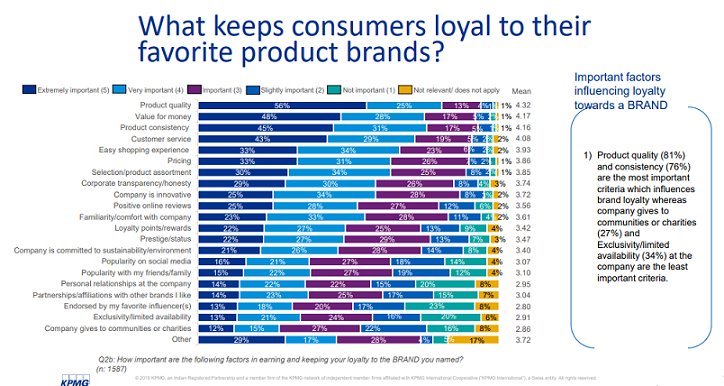

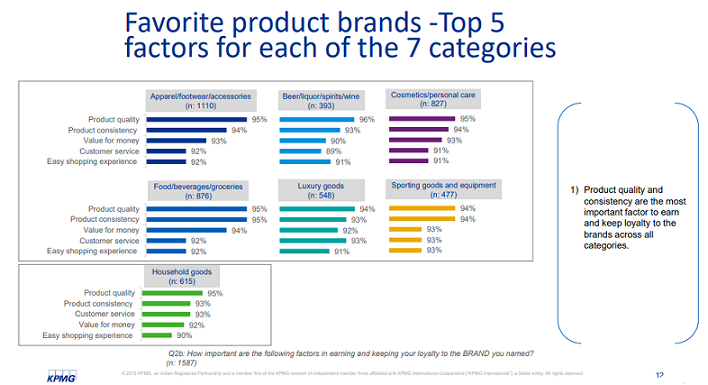

In terms of earning customer loyalty, 59 per cent of the consumers surveyed globally said they are loyal to their favorite brand because of a personal connection compared to 74 per cent in India . 75 per cent consumers globally said their loyalty was driven by product quality compared to 81 per cent in India, 66 per cent consumers globally as compared to 74 per cent in India said their loyalty was driven by value for money and 57 per cent consumers globally as compared to 73 per cent in India said their loyalty was driven by customer service.

Meanwhile, only 37 per cent globally see loyalty programs as an effective way to earn their loyalty. And 55 per cent of consumers who are enrolled in loyalty programs internationally use them infrequently –a few times a month or less. 96 per cent of the millennials surveyed globally said companies need to find new ways to reward loyal customers altogether.

India Vs Global Insights

▪ Six out of ten consumers say they are loyal because they feel a personal connection to a company — in India, 74 percent say as much — suggesting that companies need to appeal to customers’ hearts as well as their minds and wallets.

▪ Only 37 percent of respondents say that points and rewards are one of the most effective ways to secure their brand loyalty. These programs are generally more popular in emerging economies, especially China (where 54 percent of consumers say they inspire loyalty), Mexico (50 percent) and India (49 percent) compared to just 15 percent in the Netherlands.

▪ 59% of global consumers say they are loyal because they feel a personal connection with the company. In India, this stands @ 74%

Here are KPMG’s four recommendations to improve customer loyalty programs:

Revitalize them.

Around half of the surveyed consumers globally agree that companies should find new ways to reward loyal customers. This number stood at 97 per cent for India. Responsible personalization, emotional connection and purpose-driven causes should be key considerations.

Keep it simple.

Make loyalty programs easy to join and simple to use. Globally, 60 per cent agree loyalty programs are too hard to join and/or earning rewards is a challenge. 80 per cent in Brazil and China feel that way, 76 per cent in India feel this way and as do nearly seven out of ten millennials globally. Lengthy registration processes, rules and conditions, technical difficulties with redeeming awards are all likely to turn customers away.

Maintain relevance amid the noise.

Retailers need to ensure their loyalty programs stay relevant to customers. 49 per cent of loyalty program members globally agree they belong to too many programs. This is particularly the case for consumers in China (72 percent), Brazil (70 per cent) and India (61 per cent). Too many programs equate to too many apps, so it’s no surprise that customers forget their memberships, lose track of their points and perhaps decide that the rewards are not worth the effort.

Promote awareness and familiarity.

Regular communication to consumers through social channels, email or advertising can help programs remain top of mind with consumers. More than one in three consumers globally who did not belong to any loyalty programs globally said they were not aware of any. 17 per cent globally compared to 21 per cent in India have not joined a program. Lack of awareness (42 per cent) is one of main reasons stated by respondents in India for them not being part of any loyalty program in India