The universal breadth and appeal of sports continues to present brand sponsors with significant upside, both through exposure and how well consumers regard brands’ involvement. Combined, sports activations are doing more than boosting brand awareness—they’re leading to higher conversion rates.

The universal breadth and appeal of sports continues to present brand sponsors with significant upside, both through exposure and how well consumers regard brands’ involvement. Combined, sports activations are doing more than boosting brand awareness—they’re leading to higher conversion rates.

The higher conversion rates reflect:

Increased brand sponsorships following the global ad pullback in 2020

A high level of trust among fans with respect to sponsorships

Brand advertising increased throughout 2021, with an increased focus on traditional, mass reach mediums like TV and radio. Along those lines, Nielsen Sports tracked a 107% increase in sponsorship spending globally in the early part of 2021, with activations increasing as global sports continued to rebound throughout the year.

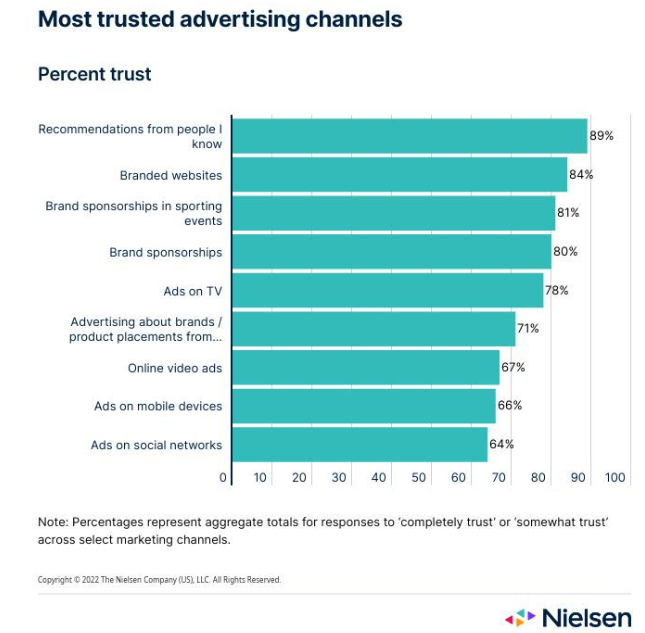

From a fan perspective, the increased investment is likely money well spent, as consumers view brand sponsorships in sporting events as very trustworthy. According to our recent Trust in Advertising Study, only recommendations from people and branded websites rank higher in consumer trust.

Combine the high level of trust with the strong correlation between visible sponsorship messaging and purchase behavior, and brands have plenty to gain. In a recent analysis of 100 sponsorships between 2020 and 2021 in seven markets across 20 industries, Nielsen found that the sponsorships drove an average 10% lift in purchase intent among the exposed fanbase.

The transition from building awareness to conversion speaks to the growing importance of sponsorships throughout the full marketing funnel, and this trend will continue. Nielsen’s experience base shows that on average, a 1-point gain in brand metrics such as awareness and consideration drives a 1% increase in sales. Upper-funnel efforts also generate an array of ancillary benefits that can drive the efficiency of sales activations.

In the sports industry, sponsorship activations have transitioned from simply raising brand awareness to actually converting consumers into customers. Across 13 industries Nielsen measured during the pandemic, the increase in purchase intent is greater than brand familiarity among fans exposed to the sponsorship. As brands return to more balanced marketing efforts in many industries, Nielsen expects the pace of this trend to decelerate, but sponsors and rights holders have structurally improved their ability to generate call-to-action from fans.

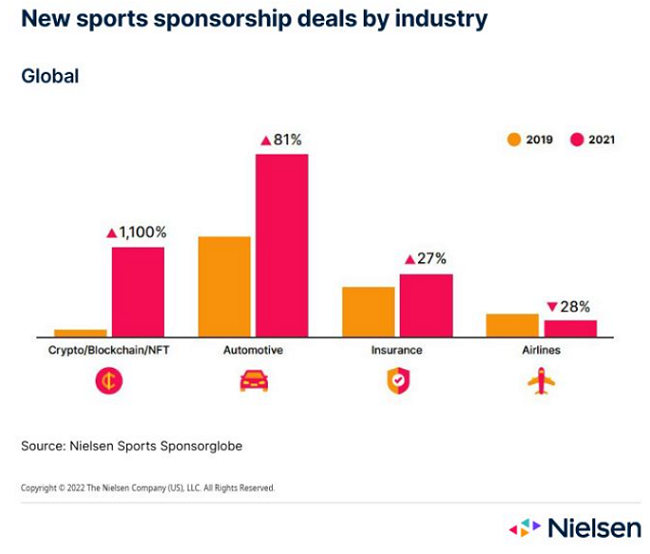

In looking across the landscape, the cryptocurrency industry has amplified its sponsorship presence more than any other industry over the past two years, mirroring its increased exposure in other areas of the media landscape, such as TV and social media.

Crypto, despite its recent proliferation into consumers’ lives, has some ground to gain before becoming ubiquitous with consumers and their finances. To extend their efforts beyond brand awareness through stadium naming rights and logo patches, the time will come to transition consumers from awareness to intent. Again, the sports industry is ideally positioned for this, as awareness and intent are typically higher among sports fans than the general population.

Crypto brands will, just as any brand would need to, solidify their unique value propositions and evolve their relationships with fans from one-way to two-way conversations backed by education and trust-building.