A brand name can be one of the most valuable assets a company possesses. It can lend credibility to product efficacy and provide an assurance of quality, letting consumers know what they can expect when they buy a product. But because brand building can be costly and time consuming, it can be extremely advantageous for established brands to lend their name to a new item in the same category through line extensions. In fact, line extensions are approximately three to four times more common than “new manufacturer” and “new brand” launches combined.

A brand name can be one of the most valuable assets a company possesses. It can lend credibility to product efficacy and provide an assurance of quality, letting consumers know what they can expect when they buy a product. But because brand building can be costly and time consuming, it can be extremely advantageous for established brands to lend their name to a new item in the same category through line extensions. In fact, line extensions are approximately three to four times more common than “new manufacturer” and “new brand” launches combined.

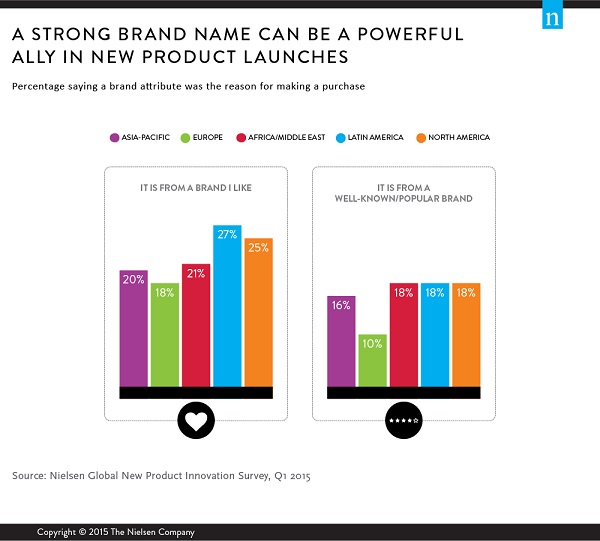

For consumers, line extensions create confidence in a new product’s ability to deliver against promises, and can relieve some of the apprehension often associated with trying something new. Nielsen’s Global New Product Innovation Survey found that nearly six-in-10 global respondents (59%) prefer to buy new products from brands familiar to them, and 21% say they purchased a new product because it was from a brand they like. Consumers in North America and Latin America value brand recognition more than consumers in any other region. In both, it was the second-most important reason (after affordability) that consumers said they purchase a new product.

Brand recognition is particularly influential in developing markets. On average, more than two-thirds of developing-market respondents (68%) say they prefer to buy new products from brands they’re familiar with, compared with 57% in developed markets. In addition, more than one-fifth of developing-market respondents (22%) say they purchased a new product because it was from a brand they like, compared with 17% in developed markets.

“Brands can signify quality and inspire confidence,” said Rob Wengel, senior vice president and managing director of Nielsen Innovation in the U.S. “For a consumer with limited disposable income, the potential loss from an underperforming product is magnified. As a result, they’re often hesitant to take a risk on a product that might not live up to expectations, and are sometimes even willing to pay more for brands they trust. For new products launched without the benefit of a strong brand name, extra care must be taken to provide strong assurance that the product will be perceived as a good value for the money.”

It is important to keep in mind, however, that while a brand extension can provide a strong foundation for success, it doesn’t guarantee it. In fact, if a company doesn’t manage a line extension well, it could actually harm the parent brand. To protect a brand’s reputation, a line extension should clearly link with the core product while also offering consistency, uniqueness and relevance in the market. Line extensions with little differentiation could lead to cannibalization. Likewise, if a line extension varies too dramatically from the parent, it can dilute sales.

CONSIDER CONVENIENCE

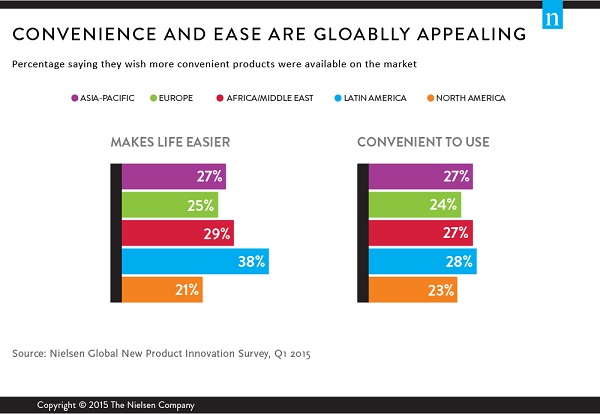

Time pressures and stress are facts of life. Shoppers want products that help restore balance and free up time to do the things they value most. More than one-fifth of global respondents (22%) say they purchased a new product because it was convenient, and slightly fewer (19%) say they purchased it because it made their life easier. Consumers’ desire for these kinds of products is even higher. More than one-quarter of global respondents say they wish more products were available that make their life easier (27%) and are convenient to use (26%).

While convenience-motivated purchasing is rated high in all regions, shopper sentiment differs in regard to the order of importance in certain regions. In Latin America, for example, respondents list convenience after branded, indulgent and family-friendly products, while in Europe, products that offer novelty, indulgence and brand recognition are more important than convenience.

ABOUT THE NIELSEN GLOBAL SURVEY

The Nielsen Global New Product Innovation Survey was conducted between Feb. 23 – March 13, 2015, and polled more than 30,000 consumers in 60 countries throughout Asia-Pacific, Europe, Latin America, the Middle East, Africa and North America. For the purposes of this study, we defined a new product as any item a consumer has never purchased before. The sample has quotas based on age and sex for each country based on its Internet users and is weighted to be representative of Internet consumers. It has a margin of error of ±0.6%. This Nielsen survey is based only on the behavior of respondents with online access. Internet penetration rates vary by country. Nielsen uses a minimum reporting standard of 60% Internet penetration or an online population of 10 million for survey inclusion. The Nielsen Global Survey, which includes the Global Consumer Confidence Index, was established in 2005.

Source:Nielsen