Consumer Confidence in Asia-Pacific Continues To Lead Regions, With India Rising For Seventh Straight Quarter

Consumer Confidence in Asia-Pacific Continues To Lead Regions, With India Rising For Seventh Straight Quarter

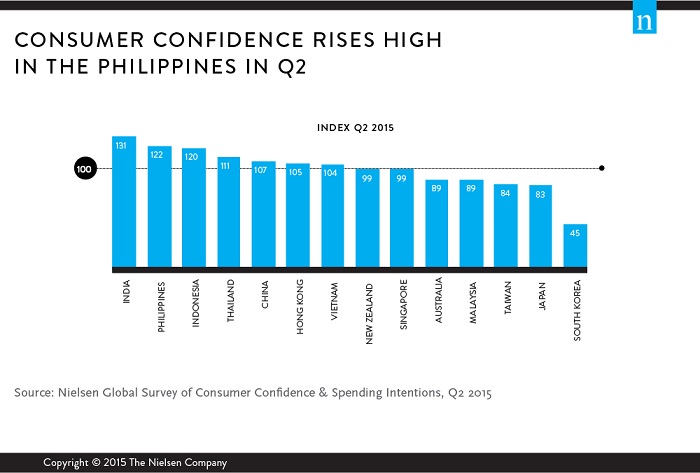

While consumer confidence declined in 10 of 14 Asia-Pacific markets measured in the second quarter by Nielsen, the region still leads all global regions with an index score of 107. Among the four markets that improved from the previous quarter, the Philippines showed the biggest quarterly country-level confidence increase of seven index points, rising to a score of 122—the country’s highest level on record.

Confidence also increased one point each in India (131), China (107) and Japan (83) from the first quarter. India’s rise marks the seventh straight quarter of confidence increases in the country.

“In India, consumer optimism is at its highest level since 2011, which is positive news, but discretionary spending levels are yet to see a huge transformation,” said Piyush Mathur, president, Nielsen India Region. “There are signs of positive growth in consumer spending on consumer packaged goods, indicated by a slight increase in growth from the previous quarters. There has also been a gradual decrease in concerns about job security over the last few quarters along with interest rate cuts, and an increase in intention for home loans—thus enhancing the sentiment on the economy and portraying an optimistic picture for the future.”

“In China, consumers’ desire to spend is growing, especially in the lower-tier cities and in the rural parts of the country,” said Yan Xuan, president, Nielsen Greater China. “Higher income levels and growing e-commerce penetration in these areas in particular represent important steps for increasing domestic consumption. The East China region is leading the country’s economic transformation with the highest confidence and spending intention levels and where online, offline, traditional and specialty channels are converging and driving upgraded product choices.”

Regionally, Vietnam (104) reported the biggest quarterly decline in confidence of eight points, followed by Australia (89) and Malaysia (89), which dropped six and five points, respectively, from the first quarter.

“The Vietnam retail environment has evolved from one of the fastest growing markets in 2012 to one that’s struggling to remain in growth, with sales levels between 2%-3% for most of the last 12 months,” said Vaughan Ryan, managing director, Nielsen Vietnam. “For the first time in well over a decade, Vietnam experienced a negative Consumer Price Index in February, and foreign direct investment was down over 20% in the first quarter from last year. Consumers are feeling less optimistic about their immediate future, but they are confident in the longer term, as most expect the economy will improve in the year ahead.”

“In Australia, there are multiple factors contributing to consumers’ economic confidence declines, and historical movements need to be considered,” said Chris Percy, managing director, Nielsen Pacific. “Weak income growth, a slump in the Australian dollar and rising cost of living is leaving more Australians with no spare cash. That being said, seasonality is also a contributor, as the winter months typically deliver below average results, and while the quarter is notably down compared to the start of the year, consumer confidence is up four points compared to the same period last year.”

“In the Philippines, an upsurge of revenues from the strong business process outsourcing industry, an upswing in the construction sector, and strong consumption spending levels are fueling growth in the country,” said Stuart Jamieson, managing director, Nielsen Philippines. “Fast-moving consumer goods sales were up 9.5% January-April 2015 from last year, with growth across all retail channels. Consumers have more discretionary cash, and they are using it to take vacations with family and friends and dining out.”