The online retail ecosystem is fast evolving, and increasingly, shoppers no longer simply go to the nearest store. Rather, they grab the nearest digital device. And with the world at our fingertips, why only shop domestically? In fact, digital analytics firm eMarketer projects that online retail sales will more than double between 2015 and 2019 and account for more than 12% of global sales by 2019. Retail therapy is giving way to e-tail therapy.

The online retail ecosystem is fast evolving, and increasingly, shoppers no longer simply go to the nearest store. Rather, they grab the nearest digital device. And with the world at our fingertips, why only shop domestically? In fact, digital analytics firm eMarketer projects that online retail sales will more than double between 2015 and 2019 and account for more than 12% of global sales by 2019. Retail therapy is giving way to e-tail therapy.

To gain a better understanding of how consumers are navigating the connected commerce landscape, the Nielsen Global Connected Commerce Survey polled respondents in 26 countries. We looked at how consumers are using the Internet to make shopping decisions both in stores and online, and we examined what they’re buying, where they’re purchasing and how they’re paying for goods and services.

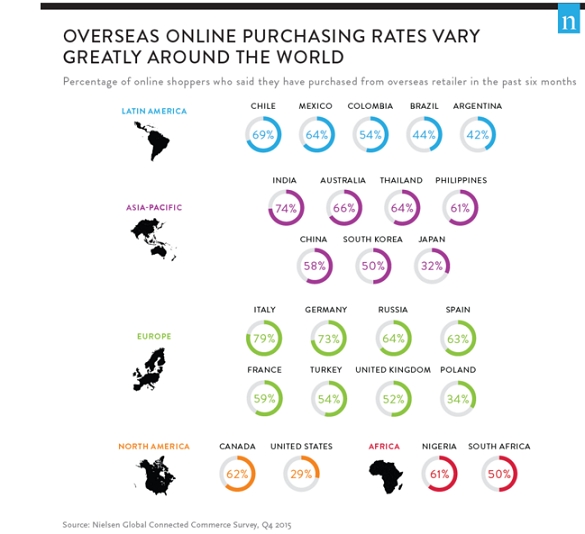

While connected commerce is still largely a domestic affair, with consumers primarily ordering from retailers in their own country, cross-border ecommerce is a growing phenomenon. Shoppers are increasingly looking outside their country’s borders, as more than half of online respondents in the study who made an online purchase in the past six months say they bought from an overseas retailer (57%).

Nearly three-quarters of Indian respondents* who purchased online in the past six months say they bought items from an overseas retailer (74%). But this isn’t just a developing-market trend. Roughly two-thirds of respondents in the Western European countries in the survey say they purchased from an overseas retailer, including 79% in Italy—the highest percentage in the online study—and 73% in Germany.

“Retail has been one of the last holdouts of globalization, but technology is giving consumers access to a world of products previously unavailable,” said Patrick Dodd, president, Nielsen global retailer vertical. “Choice is greatly enhanced by cross-border e-commerce. In many developing markets, the growing middle class is trading up and demanding greater assortment than found at their domestic retailer. For example, these consumers are looking overseas to purchase authentic foreign brands, often at lower prices than they can find in their home country. Meanwhile, developed-market consumers gain access to a range of goods directly from foreign companies at often significant discounts to what they would pay domestically.”

But with huge opportunity comes great challenge. With more choices available to consumers than ever before, the shopping experience becomes a key differentiator between banners. Optimizing the experience starts with a deep understanding of the local market, including local perceptions, delivery infrastructure, technology adoption and use, financial and currency systems and regulatory and customs requirements. In addition, retailers must ensure that products meet quality standards, prices are set reasonably, logistics systems are safe and efficient and after-sales service is optimized for fair refunding/exchanging processes.

Other findings from the recent Global Connected Commerce report include:

The most commonly used payment methods among countries in the survey were credit card (53%) and digital payment systems (43%), but cash on delivery is common in developing markets.

Nearly half of online respondents in the study (49%) say they shop online to get grocery products they can’t find in physical stores.

More than half (57%) of online respondents say they have doubts that e-commerce sites will keep their personal information secure and confidential.

Six-in-10 online respondents say they’ll only shop online for electronics (62%) and mobile products (61%) if it saves them money.