Surpassing commercial broadcasters for first time, Streaming platforms will outpace commercial broadcasters as a subdued advertising market slows broadcaster growth

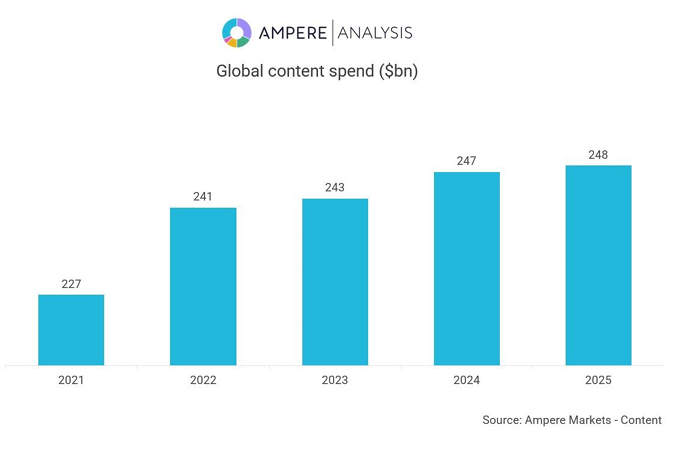

New forecasts from Ampere Analysis predict that global content spend will increase by just 0.4% year-on-year to reach $248bn in 2025. This follows a 2% growth in content investment in 2024 driven by increased ad spend on the US Presidential Election, the Summer Olympics, and the resolution of the 2023 Hollywood Strikes. Streaming services will overtake commercial broadcasters as the front-runners of global content investment, spending $95bn on content this year.

2025: A year of investment in content by streaming services

Streaming platforms continue to capture a growing share of content investment, with studios increasingly focused on online audiences. 2024’s successful subscriber growth from password-sharing restrictions and key sporting events has positioned them to invest heavily in content this year. Ampere’s predicted $95bn spend by ad-funded and subscription-based services equates to 39% of total global investment on content. However, the platforms are expected to ensure investment grows at a slower pace than revenue to maintain attractive profit margins.

Meanwhile, commercial broadcasters tighten their spend

In comparison, US commercial broadcasters are pulling back spending after a year of increased investment fuelled by the Presidential Election and the Summer Olympics. Beyond these one-off events, the decline in content spend reflects a broader trend seen over the past five years as broadcasters face ongoing advertising revenue challenges linked to linear viewing declines. Outside the US, commercial broadcasters continue to demonstrate resilience, maintaining their content investment throughout 2025.

Peter Ingram, Research Manager at Ampere Analysis says: “Spend in 2024 was in line with Ampere’s expectations. The recovery aided by the US election, the Summer Olympics, and the end of the Hollywood strikes met the limitations of macroeconomic challenges and ongoing focus on profitability from major streamers. In 2025, expenditure by VoD services will increase by 6%, making these companies the leading contributors to the content landscape, surpassing commercial broadcasters for the first time. The continued growth of VoD spend, combined with the more cautious outlook of linear broadcasters, highlights the shifting role of traditional television as viewer demand turns to digital platforms and streaming.”