Consumers around the world really care about brand origin. And why wouldn’t they? Shoppers, by and large, have more options available than ever before, thanks to today’s connected world. But when it comes to choosing specific products, do consumers prefer global brands or local ones? The answer depends primarily on the category, and there is a surprising amount of agreement across regions.

Consumers around the world really care about brand origin. And why wouldn’t they? Shoppers, by and large, have more options available than ever before, thanks to today’s connected world. But when it comes to choosing specific products, do consumers prefer global brands or local ones? The answer depends primarily on the category, and there is a surprising amount of agreement across regions.

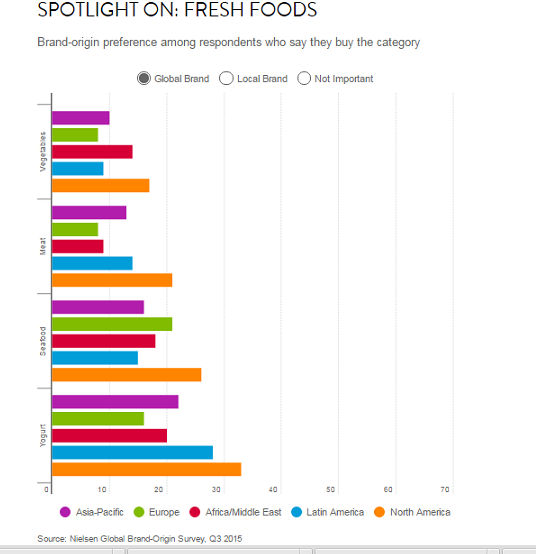

It’s no surprise that when it comes to fresh foods, local brands are the clear favorite. The majority of global respondents who have purchased the category say they prefer local brands to global ones for vegetables (68% vs. 11%), meat (66% vs. 13%), fruit (64% vs. 12%), seafood (57% vs. 18%) and yogurt (52% vs. 22%). The preference for local brands holds for every fresh category in the study and in every region, with only one exception: For yogurt, North American respondents show an equal one-third split between a preference for local and global brands. The remaining third say brand origin isn’t important. And the yogurt category is not the only difference for North American respondents. While a preference for locally sourced fresh foods trumps a preference for globally sourced fresh foods in the region, the percentage of respondents who say they prefer local brands is below the global average for all five fresh-food categories, while the percentage who say they prefer global brands is higher than in any other region.

“Perishability is an obvious factor for purchasing locally sourced foods, but food safety concerns and cost are other important considerations for consumers,” said Patrick Dodd, group president, Nielsen Growth Markets. “Additionally, buying local fresh products increases the likelihood that a product will be more flavorful and, in some cases, more nutritious than one transported from many miles away, as the nutritional value of some foods diminishes with time.”

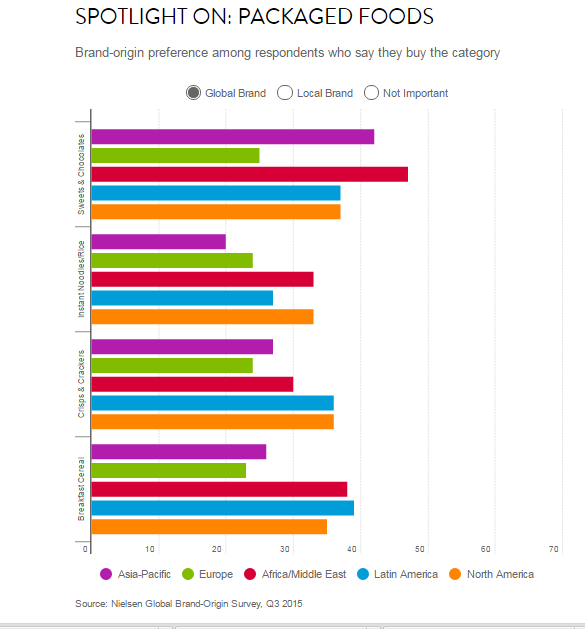

For packaged foods and snacks, the story is somewhat similar to that for fresh foods, even though there is no “perishables” barrier impeding the growth of global brands in this case: local taste preferences dominate. Among global respondents who purchase the category, local brands are preferred to global brands for ice cream (44% vs. 27%, respectively), cookies and biscuits (40% vs. 28%), crisps and crackers (40% vs. 28%), breakfast cereal (44% vs. 29%), instant noodles (47% vs. 24%) and canned vegetables (53% vs. 20%). Sweets and chocolate is the only category of packaged-foods and snacks in the study where global brands are preferred to local ones (37% vs. 33%).

“Winning in packaged-food and snack categories is all about understanding and innovating around local tastes and eating habits,” said Dodd. “Local companies often have a deeper understanding of consumer tastes in their market and can respond more quickly to changing needs. Therefore, they are typically adept at developing products that appeal to these particular preferences. Global brands, in contrast, often capitalize on economies of scale and offer more homogeneous products across markets.”

At the regional level, preferences in Asia-Pacific and Africa/Middle East mirror the global results. Local brands are also preferred in Latin America for all of the packaged-food and snack categories in the study except sweets and breakfast cereal. The same is true in Europe; although, the largest percentage of respondents in Europe say brand origin is not important for sweets, crackers and instant noodles. In North America, preferences are split. More respondents say they prefer global brands to local ones for sweets/chocolates, breakfast cereal, crackers and instant noodles, but local brands are preferred for ice cream and canned vegetables. For most of these categories, however, the largest percentage of North American respondents say brand origin isn’t important to them.