Commerce media is revolutionizing how ads are bought and optimized. Companies need the right strategy to share in its potential trillion-dollar-plus value.

Commerce media is revolutionizing how ads are bought and optimized. Companies need the right strategy to share in its potential trillion-dollar-plus value.

Key takeaways-

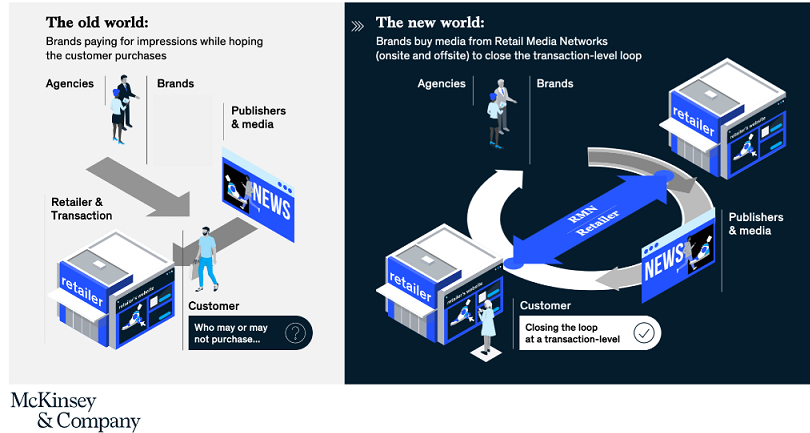

Advertising is being transformed by commerce media, a new form of advertising that closes the loop between media impressions and commerce transactions to improve targeting, provide new audience insights, and deliver more relevant and valuable experiences for consumers.

It has the potential to generate over $1.3 trillion of enterprise value in the United States and create a paradigm shift in digital advertising not seen since the rise of programmatic.

Retail media is the first domino to fall, and is a harbinger of the commerce media trend, with retailers creating high-margin, rapid growth media businesses.

For decades, advertisers have faced challenges connecting their ad spending to actual customer purchases. Figuring out whether they were delivering impressions for the right price in the correct channel was an imperfect science, with many assumptions, data extrapolations, and a cottage industry of measurement solutions. Commerce media changes this by directly connecting audience impressions with omnichannel transactions and business results. By linking content and commerce, brands can better serve their customers through more relevant offers and incentives, all in a privacy-protected way. While building brand relevance and favorability will always be an essential part of the marketing mix, today’s opportunity is to connect impressions to actual sales and feed these results back into true full-funnel marketing models.

Commerce media has its roots in affiliate advertising—partnerships in which publishers link their content to commerce opportunities to provide an enhanced experience for consumers. The category is now rapidly expanding to include retail media networks (RMNs), third-party ad platforms that retailers set up on their websites. It also includes “shoppable ads” that enable people to purchase products through online or mobile ads, and “live commerce” or “shoppable TV,” where viewers can interact with video content and buy products directly from their TV or device screens. In China, where shopping on the live streams of popular influencers has become mainstream, live-commerce media purchases reached $170 billion in 2020, driven by the apparel/fashion and beauty categories. In the future, new forms of this media could include contextual purchasing in the metaverse, which would enable consumers to purchase any product they see whenever and wherever they want.

How did the industry get here? The growth of e-commerce during the COVID-19 pandemic was a catalyst that raised the bar on consumer expectations and produced new signals on customer behavior that advertisers could learn from. Next year, the planned removal of cookies from web browsers is expected to be another tailwind for commerce media. In an increasingly data-driven future, first-party data will become a powerful competitive differentiator.

Retail media networks: A $1.3 trillion domino effect

Over the past two years, retailers have taken significant steps to embrace the commerce-media trend by launching RMNs aided by their large and stable user bases, new real estate for ad placements, and the proliferation of privileged first-party data. What used to be considered a side business generating supplemental revenue from “sponsored products” is now a strategic way for retailers to drive consumer loyalty. In the United States, the growth of RMNs could represent as much as $100 billion in ad spending by 2026. With the overall operating margins of RMNs in the 50 to 70 percent range, companies across the retail spectrum are fully awake to the economic potential. For instance, Amazon has led the way in using its repository of e-commerce data to create an advertising and advertising technology business that now goes well beyond sponsored ads on its own shopping site. Retailers with single-digit margins and those newer to e-commerce may also consider selling off- and on-site sponsored ads a potential strategy.

The ripple effect from this growth is already significant. The ability to match unique customer IDs and ad impressions to stock-keeping-unit (SKU) sales in a privacy-protected way is compressing the marketing funnel and disrupting the entire advertising ecosystem. With $100 billion in ad spend expected to go to RMNs by 2026, the effects are likely to scale, creating potentially far-reaching implications for advertisers, ad agencies, traditional publishers, ad-technology providers, and retailers. Over time, a substantial number of impressions could be tied to SKU-level sales, ultimately changing the way advertising is optimized.

It’s not just retailers who can build “retail” media networks. The first-party data and customer touchpoints owned by hospitality brands, travel and hotel providers, telecommunications companies, banks, and automakers, for instance, may also lend themselves to contextual advertising that consumers opt into in return for more relevant, tailored experiences.

Our research indicates that over $1.3 trillion of enterprise value (EV) is at stake in the United States by 2026. This has potential revenue implications across the advertising value chain-

$820 billion for retailers who develop new, margin-rich media businesses

$280 billion for advertisers in the form of higher returns on ad spending (ROAS)

$50 billion for publishers from new ways of capturing additional ad dollars

$5 billion for ad agencies that deliver high-efficiency performance marketing for clients or help firms set up media planning and buying capabilities

$160 billion for ad-tech providers who offer martech solutions to firms that have no experience as media companies

Disruption and imperatives across the ecosystem

Based on engagements with over twenty retail media networks globally and our survey of more than 180 advertisers across various categories, including CPG, beauty, apparel, and consumer electronics, here is a deep dive into the commerce-media disruption and its impact across the value chain.

Retailers

Even though several retail and e-commerce giants have multibillion-dollar ad businesses, it’s not too late for newer entrants to get into the game by leveraging their first-party customer data. RMN campaigns can reach, for instance, personal-care-product users who haven’t made a purchase in the past six months or millennial moms who make purchases of both organic and keto products. Advertisers are then given feedback (with customer data anonymized) on who bought what in response to which ad. In our survey, nearly 70 percent of advertisers say their performance in retail media is significantly or somewhat better than in other channels

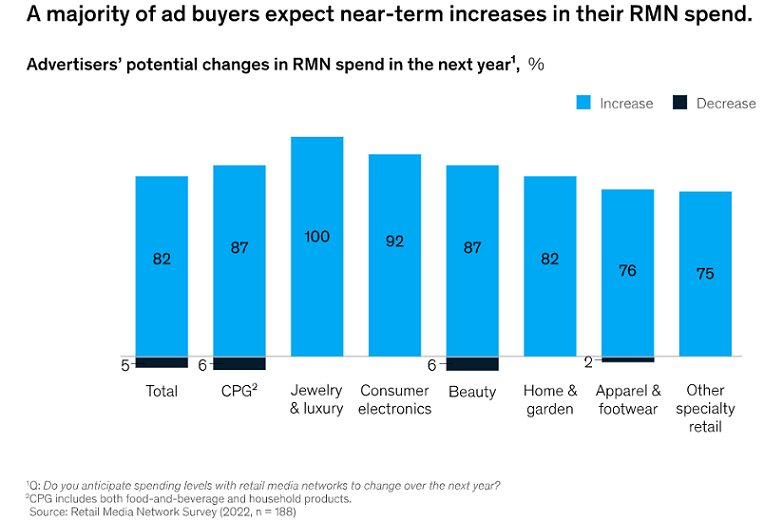

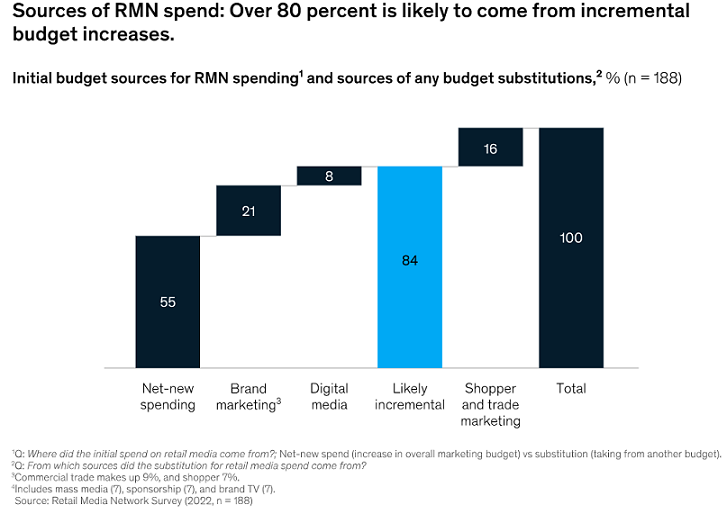

Our survey also indicates that 82 percent of advertisers will continue increasing their RMN spending over the next 12 months, and approximately 20 percent plan to increase it by more than 10 percent. This increased RMN spending will not cannibalize what advertisers already spend on marketing directly to in-store or co-op shoppers, as many retailers fear. More than 80 percent of advertisers say that their spending on RMNs will be funded from new budgetary sources (Exhibit 5). Thus any impact on retailers’ in-store shopper or co-op marketing revenue can be managed.

RMNs offers retailers—including those who feel they’ve missed the boat on shifting digital-ad spending—a significant opportunity to differentiate themselves as media partners. Our survey indicates key pain points still exist for advertisers working with RMNs. Advertisers value several key factors, among them, transparent reporting of an ad campaign’s performance, unique shopper insights, reasonable media costs, and ease of use. Retailers today don’t always fulfill these expectations. Additionally, 71 percent of consumers expect companies to deliver interactions personalized to their needs and interests, yet only 23 percent think retailers are doing a good job at it.

Building an RMN with a compelling value proposition can help retailers to better meet the expectations of both ad buyers and customers. Any of the following actions could be a good place to start:

Relentlessly protect the customer experience. For some consumers, seeing advertising or sponsored product recommendations on a retailer’s website will be a new experience. Retailers will need to regularly assess the impact of the advertising on the customer experience. RMN and e-commerce teams could collaboratively employ test-and-learn processes (such as A/B testing) and fine-tune ad load, format, and content.

Clearly demonstrate campaign performance. Advertiser expectations for RMNs are higher than for other media channels. They want to see that shoppers have interacted with their ads and made actual purchases. Showing a high level of steady growth in return on ad spend (ROAS) is key for building advertiser confidence in a retailer as a trusted media partner. This applies to placements on a retailers’ own sites and also those on platforms owned by their media partners or other marketplaces.

Deliver unique brand and shopper insights. RMNs aren’t just about providing inventory. Advertisers want to work hand-in-hand with retailers to find consumer insights that can inspire product innovation or new market positioning or messaging. Retailers may benefit from investing in the capabilities and martech infrastructure that will upgrade their ability to identify these audience insights—for example, a customer-data platform that builds a single, complete view of each customer.

Strategically segment with different service models. Not all advertisers are created equal. A relatively small number of high-value ad buyers will require elevated levels of service and thought leadership. To form a true partnership with these advertisers, retailers will need to provide rigorous performance reporting; unique shopper insights; distinctive creative services; sales and operational support; access to privileged ad inventories; and highly customized or curated audiences. At the same time, retailers will want to build easy-to-use, self-service capabilities for most advertisers, who will form the backbone of the RMN’s financial performance.

Build a curated partner ecosystem. Building a media business is an entirely new skill for retailers. Advertisers may expect managed-service capabilities, and retailers will likely benefit from partners that help deliver them, such as technology partners, content partners, sales partners, campaign-planning/buying partners, and reporting and measurement partners. To adhere to consumer-privacy laws, some RMNs are exploring partnerships with media companies that use cleanroom solutions. In addition, retailers may want help with accounting, billing, and the assessment of any related legal or privacy ramifications. Having a clear plan for what to in-source versus what should be provided by a partner may help deliver a seamless experience for advertisers.

Advertisers

Given the pace of growth of RMNs and other forms of commerce media, advertisers may need to move quickly to develop a strategy that keeps them ahead of peers. More than 80 percent of advertisers expect to increase their spending on RMNs significantly in the next twelve months. A similar number of advertisers rate retail media as a key strategic priority.

Marketing organizations could consider four actions to develop impact with commerce media, especially RMNs:

Create partners internally and externally. Working with RMNs is a marketing-led effort for most of our surveyed companies. But because retail media has direct implications for both product inventory and innovation, the participation of sales teams is key. In our survey, only 30 percent of respondents said they make sure to have joint visibility and accountability between marketing and sales.

It is also essential to bring retailers along as partners. The first step in achieving strategic goals—whether boosting sales among a particular segment, re-engaging with lapsed customers, or meeting sales targets for a new product—is to articulate the goals clearly. Demonstrating a willingness to pilot new product offerings with retail media networks could be a valuable way for advertisers to elevate their importance within an RMN.

Don’t lose sight of the big picture. Although RMNs present opportunities to drive growth, it’s essential to evaluate ad spending holistically. Marketing should be assessed and optimized across brand, trade, shopper marketing, and traditional media. Benchmarking tools could help identify how an advertiser’s marketing spend allocation compares with its peers’.

When engaging with RMNs, advertisers may want to broaden their aperture beyond a retailer’s owned and operated sites and mobile apps. Our surveyed companies allocate 30 percent of their spend with retailers to onsite ads, 45 percent to offsite, third-party sites and apps, and the remaining 25 percent to direct marketing and in-store marketing.

Set clear expectations. With 70 percent of advertisers reporting enhanced returns from their RMN ad spend compared with returns from other channels, advertisers should hold their retail media partners to a high standard. A pet-food company, for instance, achieved a 437 percent ROAS during a three-month keyword search campaign. If an advertiser doesn’t see significant results, it may be a sign to re-evaluate expectations and approaches.

Gain new business insights. Insights derived from retail-media data could be a source of new inspiration for advertisers. After several rounds of testing on different creative iterations, for example, a beauty company discovered a customer segment it didn’t realize it had: consumers interested in Korean skincare routines. Using this information, the company launched a new line of products to match this audience’s interests.

Robust reporting and measurement capabilities, therefore, are assets for retailers seeking to deliver higher performance and new insights. Before committing or increasing their investment with retailers, advertisers will want to know these capabilities are in place. This will allow them to audit their spending and do real-time reporting on how campaigns perform. Such a test-and-learn approach could result in midstream improvements and potentially help inform future campaigns and investments.

Publishers

Traditional media companies face a double dose of disruption. The planned disappearance of cookies will make it harder for them to track the performance of campaigns, potentially weakening their value proposition to advertisers. They also risk losing ad dollars to RMNs, which are better able to measure ROAS.

However, media properties can reach consumers at the point of purchase and compete with RMNs. Just as retailers or other companies that facilitate transactions are becoming more like media companies, publishers and media providers can move toward commerce. To do so, they may want to innovate in several ways:

Become more like a retailer. Build e-commerce capabilities or create a marketplace to understand consumers’ shopping behavior, and optimize it as a platform for targeted advertising opportunities.

Engage with audiences in the lower funnel. Incorporate live-commerce elements, such as hosted livestream shopping, to create innovative engagement experiences and bring audiences with specific purchase intent onto publisher properties.

Partner with RMNs on data sharing and cocreation of content. Instead of reinventing the wheel, publishers can partner with RMNs to utilize their ad inventory. They can also supply RMNs with innovative marketing content to boost engagement and drive purchases. For instance, several publishing companies have partnered with e-commerce providers to create “shoppable” recipes and meal-planning tools.

The era of commerce media is just beginning. Retailers are blazing the trail with high-quality, high-visibility, and highly matchable audiences that can benefit from more targeted and relevant advertising. Many leading companies have meaningful data on unique, hard-to-reach audiences, which could be used to create such advertising. Although the buying landscape is shifting quickly, there is still ample room to build a high-margin business of significant size. Retailers could assess their customer base and find ways to help advertisers enhance their consumers’ experience.

As companies approach the commerce-media opportunity, they must keep the customer as their North Star. Consumers already want personalized experiences and advertising that’s truly useful. Very soon, they will also expect to be able to complete purchases within the context of a TV show, online content, or virtual reality. Companies that find suitable customer use cases and forge strategic partnerships to deliver these experiences could reap substantial rewards. They will also help shift advertising’s mission from audience delivery to the acceleration of business growth.

Source:McKinsey