Innovation matters. In the consumer product realm, it can drive profitability and growth, and it can help companies succeed—even during tough economic times. On the opposite side of the sales counter, consumers have a strong appetite for innovation, but they’re increasingly demanding and expect more choice than ever before.

Innovation matters. In the consumer product realm, it can drive profitability and growth, and it can help companies succeed—even during tough economic times. On the opposite side of the sales counter, consumers have a strong appetite for innovation, but they’re increasingly demanding and expect more choice than ever before.

Around the world, more than six-in-10 respondents (63%) say they like when manufacturers offer new products, and more than half (57%) say they purchased a new product during their last grocery shopping trip. But success can be hard to come by. Brand competition is intense and shelves are crowded.

The Nielsen Global New Product Innovation Survey polled 30,000 online respondents in 60 countries to understand consumer attitudes and sentiments about the drivers behind new product purchase intent. It’s important to note that in the eyes of the consumer, not every product that’s new to them is new to the market. As such, for the purposes of this study, we defined a new product as any item a consumer has never purchased before.

Economists may have declared the end of the Great Recession nearly six years ago, but times are still tough for consumers around the world. In fact, more than three-quarters in Latin America (78%), two-thirds in Europe and Africa/Middle East (68%) and half in North America (50%) still believe they are in a recession. And these pervading recessionary sentiments may create a barrier to new product trial, as more than four-in-10 global respondents (42%) say economic conditions and recent world events make them less likely to try new products.

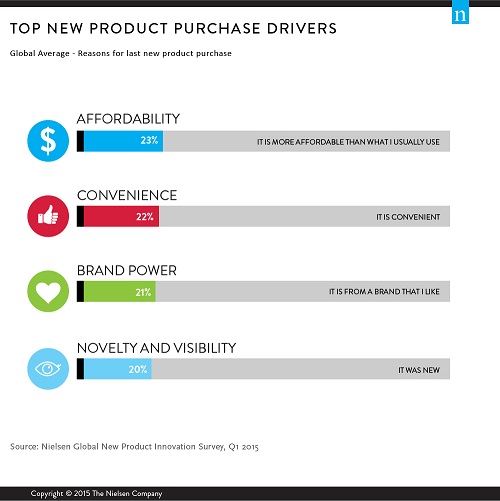

As a result, affordability tops global consumers’ list of reasons for purchasing a new product, but there are regional differences in the order of importance placed on this attribute. In Asia-Pacific, affordability is the third-most important reason for purchasing a new product, behind value and convenience. North Americans place affordability second on their list, behind novelty and tied with brand recognition. In Latin America, affordability is just slightly behind brand recognition as the reason for making a new product purchase.

When it comes to the new products consumers wish were available right now, products at affordable prices was the most commonly cited attribute across all regions—by a wide margin. Forty-three percent of global respondents say they wish more affordable products were available, 14 percentage points above the next-highest attribute. North America showed the biggest differential between the top two desired product attributes—20 percentage points between wanting products at affordable prices (44%) and wanting new food products (24%). Similarly, Latin America showed a 19-point difference between affordable products (60%) and the second- and third-most-desired product types, environmentally friendly and those made with natural ingredients (41% each).

“Consumers need to stretch their money as far as possible, and they’re looking for products that stay within a budget,” said Rob Wengel, senior vice president and managing director of Nielsen Innovation in the U.S. “Savvy manufacturers are those who don’t just sell their products at lower prices or on promotion, rather they build cost-cutting into the product development and design process. Cost-driven innovation requires letting go of traditional assumptions, and it starts with understanding what tradeoffs consumers will make when they can’t afford a product.”

Other findings from the New Product Innovation report include:

In-depth looks at the top regional reasons consumers try new products.

Developed vs. developing regional appetites for new products.

The effectiveness of free samples in new product awareness/trial.

56% of global respondents cite friend/family recommendations as sources of new product awareness.

New Products have cross-generational appeal, and aren’t just for the young.

Source:Nielsen