The way we view the economy and what’s in our wallets can have a direct impact on our willingness to spend and save. As such, it’s no surprise that changes in consumer confidence can influence the actions consumers say they take to save on household expenses. In the second quarter, as global consumer confidence declined one index point to a score of 96, saving strategies continued to permeate the mindset of consumers around the world.

The way we view the economy and what’s in our wallets can have a direct impact on our willingness to spend and save. As such, it’s no surprise that changes in consumer confidence can influence the actions consumers say they take to save on household expenses. In the second quarter, as global consumer confidence declined one index point to a score of 96, saving strategies continued to permeate the mindset of consumers around the world.

“Even as sentiment about consumers’ own personal situations has risen in recent years, there is still a widespread concern among consumers about recession,” said Louise Keely, senior vice president, Nielsen, and president, The Demand Institute. “In fact, six years after the official end of the Great Recession, more than half (54%) of global respondents still believe their country is in recession. So while global consumer confidence has been rising slowly to reach near optimistic levels in the past year, there is still evidence that consumers feel uncertain about their countries’ futures. Retail sales activity has been slower to respond, reflecting that lingering uncertainty.”

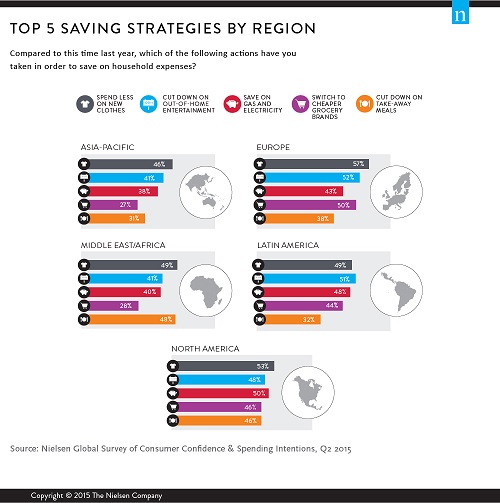

Anemic consumer spending levels are reflective of the fact that nearly two-thirds (65%) of consumers around the world are in a saving—rather than a spending—mindset. This cautionary outlook is most prevalent in Latin America (79%), followed by Middle East/Africa (69%), Asia-Pacific (66%), North America (59%) and Europe (58%), as more than half of respondents in these regions say they are actively taking action to save on household expenses compared with a year ago.

While saving strategies differ across regions, there are some common practices globally. Among those who say they are taking actions to save, spending on clothing and out-of-home entertainment costs are the top two areas earmarked for reduced spending. Cutting back on gas and electricity costs, along with spending less on take-out meals and switching to cheaper grocery brands, are other top saving priorities. Expenses that affect transportation, annual holidays/vacations, at-home entertainment and the replacement of major household appliances are somewhat more protected.