After Viacom18 won the digital streaming rights for the 2023-2027 cycle of the Indian Premier League (IPL) at a record-breaking value of INR237.73bn (~$3bn), it was understood that the games would be streamed on Voot Select, the premium tier of Voot, Viacom18’s direct-to-consumer service. However, IPL is instead being streamed on Jio Cinema, an ad-supported mobile streaming application owned by Reliance Jio.

After Viacom18 won the digital streaming rights for the 2023-2027 cycle of the Indian Premier League (IPL) at a record-breaking value of INR237.73bn (~$3bn), it was understood that the games would be streamed on Voot Select, the premium tier of Voot, Viacom18’s direct-to-consumer service. However, IPL is instead being streamed on Jio Cinema, an ad-supported mobile streaming application owned by Reliance Jio.

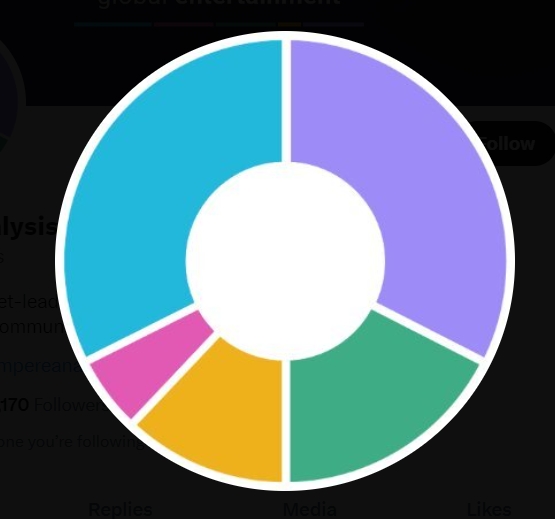

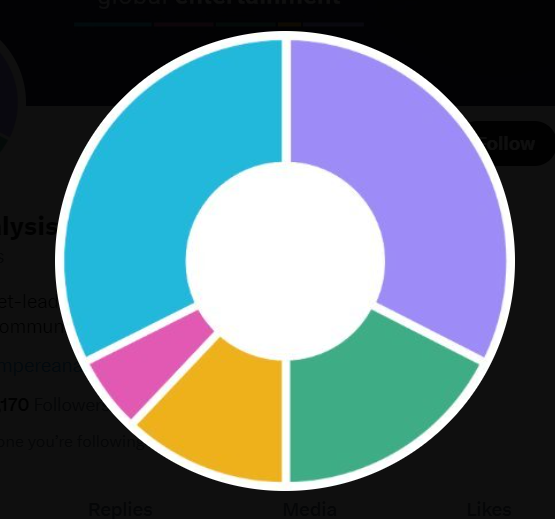

As the major investor in Viacom18, Reliance Jio might reasonably seek to prioritise its own free streaming platform, but the shift has raised questions about the role of Voot. Indeed, the forecast take up of the premium service has now been revised down in response (see chart). The proposed merger of the two services has also been put on hold, with Voot now being earmarked as a backup should Jio Cinema find itself unable to meet the exponential increase in demand for IPL coverage. Cricket is by far the most popular sport in India, with the game on 12th April 2023, for example, two weeks after the season kicked off, attracting 22m concurrent views. Voot’s undecided future also brings into question the launch of Paramount+ in India which was expected as a premium content tier on Voot.

Besides taking over as the host platform, Jio Cinema is also streaming IPL at least for the 2023 season for free. This contrasts to the previous rights holder Disney+ Hotstar’s strategy of putting the IPL almost exclusively on its paid premium tier and has already had a significant impact on the wider Indian SVoD industry. Not only has Disney+ Hotstar experienced heavy customer churn in 2022 Q4, even before the IPL 2023 season started, but also India’s total SVoD market growth in 2023 is now expected to shrink from the original forecast as consumers turn to free ad-funded (AVoD) platforms for content.

Written by Orina Zhao at Ampere Analysis