Online shopping grows too

Online shopping grows too

BARC India & Nielsen Media Explain “Impact Of COVID-19 On TV Viewership And Smartphone Behaviour Across India – Edition 9”

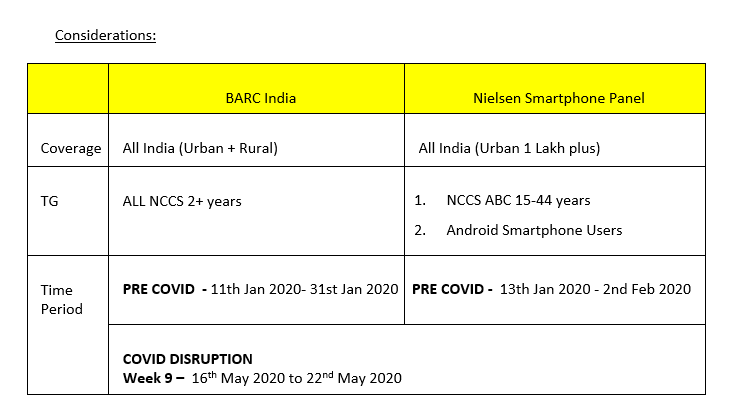

This is the ninth edition of the report on ‘Crisis Consumption on TV and Smartphones’ jointly released by BARC India and Nielsen Media.

BARC India is the official currency on Television Measurement in India and Nielsen Media runs a 12000 strong smartphone panel in India passively capturing smartphone behaviour.

Some of the Key Highlights of TV and Smartphone consumption during the ninth week of Lockdown are as follows: –

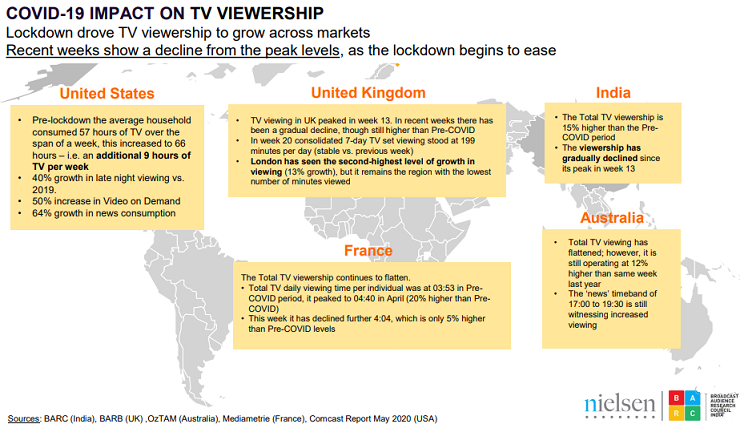

1. After seeing huge peaks in previous weeks, gradual drop seen in TV Viewership (1 Trillion viewing minutes) and Smartphone consumption (3 hrs 43 minutes/day) this week although the consumption is still more than pre-COVID periods

2. TV viewership growth over Pre-COVID levels in NCCS A is higher than NCCS CDE, especially in Megacities

3. Primetime TV viewership is 13% lower than pre-COVID levels (an effect of no original programming) – decline is more in the South (-18%) than in HSM (-11%)

4. Social N/W, Gaming, Education, on Smartphone continue to be at much higher levels vs Pre-COVID Period.

5. News genre stabilises both on TV and Smartphone after seeing peaks in previous weeks while Movies & Originals gain big, grow their share in VOD pie

6. Revival post Lock down evident on Smartphone behaviour – Online Shopping begins to Move up after the COVID led crash.

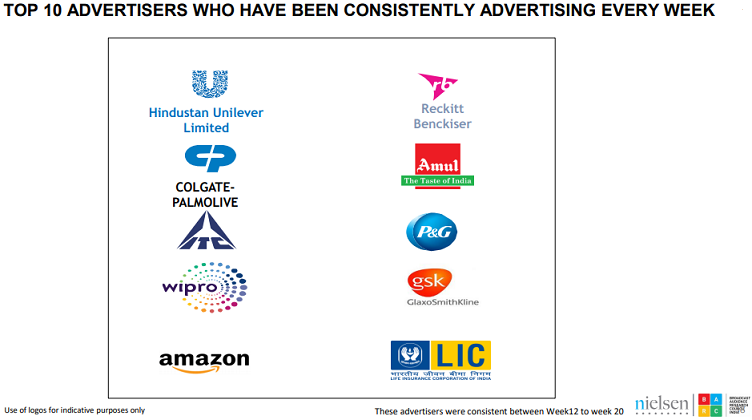

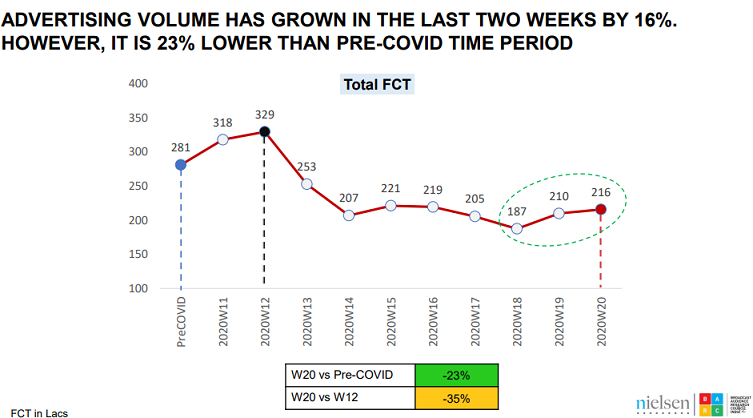

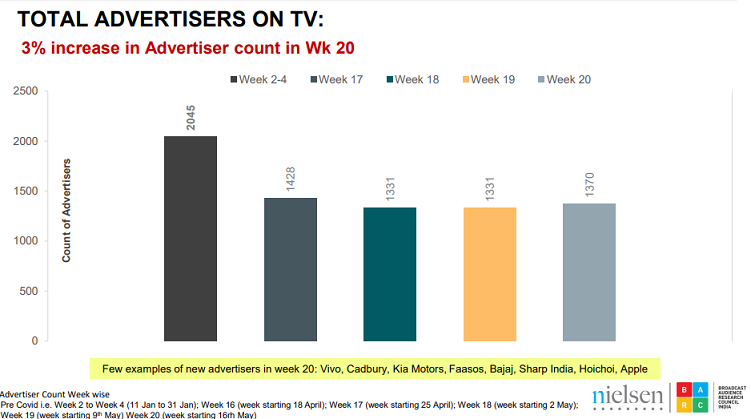

7. Overall AD VOLUME on TV has grown in the last 2 weeks – 16% growth in total FCT in week 20 vs. week 18 – 38% growth in new brands vs. week 18.

8. Top 10 advertisers have been consistent on TV throughout the COVID period (week 12 to week 20). Top 40 show significant growth in Ad Volumes