TV18 Broadcast Limited today announced its results for the quarter ended Sep 30, 2023.

• Viacom18 became the new home of India cricket with exclusive rights of International and Domestic matches organised by BCCI for 5 years; also acquired ISL media rights for 2 years

• JioCinema consolidated its position as India’s leading OTT platform, delivering record viewership for marquee entertainment shows

• News network maintained absolute leadership in the largest markets, with an all India viewership share of 11.4%; Entertainment network share increased by 50 bps to 10.5%

• Viacom18 Studios delivered 2 blockbuster movies – Rocky Rani Ki Prem Kahani and OMG 2

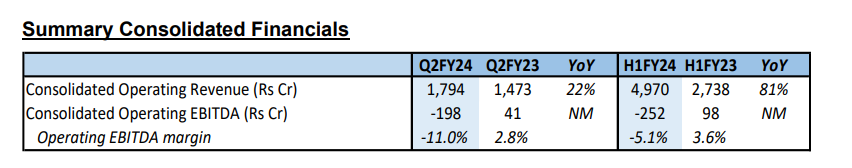

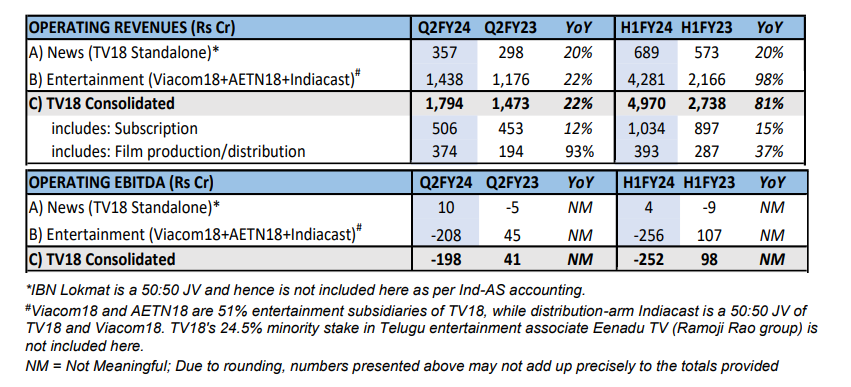

• Consolidated revenue for the quarter grew 22% YoY to Rs. 1,794 crore, driven by the performance of News business, Movie Studio and Sports vertical

• Advertising demand remains guarded due to soft consumer sentiment; festive season expected to bring positive momentum

Highlights

Viacom18 becomes ‘the destination’ for sports in India

• Viacom18, in its quest to become the primary destination for sports in India, continues to aggregate rights of leading sports properties. With acquisition of exclusive media rights for the BCCI International and Domestic matches, it has become the home of India cricket. The rights include international men’s, women’s, and other domestic first-class competitions like Ranji Trophy. Viacom18 acquired both the Indian sub-continent and global television and digital rights for the next 5 years for Rs. 5,963 crores.

• As the most loved sports in India, cricket (BCCI, IPL) will enable the Company to drive a step jump in audience footfalls, especially on JioCinema, as live sports consumption continues to pivot towards digital. Broadcast rights will strengthen the Company’s channel bouquet and will enable it to broaden its broadcast content portfolio and serve quality content to all its viewers. With the new features launched during IPL, Viacom18 has enhanced Indian viewer experience like never before, and it will continue to drive innovations to delight its audience.

• Viacom18 also added Indian Super League, highest level of the Indian football league system, to its portfolio. With a constellation of marquee sports properties like IPL, WPL, Olympics 2024, SA20, Major League Cricket (MLC), Ultimate Table Tennis (UTT), NBA, Diamond League, World Athletics Championships Budapest 2023, MotoGP, La Liga, Ligue1, Serie A, Abu Dhabi T10, FIFA World Cup Qatar 2022, and top BWF events, Viacom18 has established itself as India’s #1 destination for sports.

JioCinema Takes the Entertainment Streaming Game to the Next Level

• JioCinema is quickly scaling up as one of the leading streaming platforms for entertainment content. The second season of India’s most popular reality show in a digital-exclusive format, Bigg Boss OTT, became the biggest ever reality show on digital, with record concurrency and voting during the finale. The season wrapped up with 100 mn viewers consuming 30 bn minutes of content on smartphones and CTVs. User engagement was at an unprecedented level with 5.4 bn votes logged through the season, highlighting the scale and connect of the show with users. The grand finale was the most streamed live entertainment event in India with 23 mn viewers and a peak concurrency of 7.2 mn. During the 15 minutes live voting window for selecting top 2 finalists, 250 mn votes were received.

• Popular network reality shows also saw an exponential growth in digital consumption. Khatron Ke Khiladi S13 saw 2x viewers and 1.5x video views compared to the previous season and Roadies S19 delivered 7x viewers and 4x watch-time of the previous season.

• Original shows released during the quarter also garnered wide reach and engagement. Taali (starring Sushmita Sen) featured in ‘Top 10 OTT Originals of the Week1 ’ for more than 5 weeks in a row. The show reached a record 20 mn viewers in the first week of release. Kaalkoot also featured among ‘Top 10 OTT Originals of the Week1 ’ for 3 weeks in a row and was watched by 25 mn viewers.

TV18 News Network maintains dominance in key markets; Entertainment network share strengthened viewership share by 50 bps

• TV18 News continued to be the highest reach network in the country, reaching ~190 mn people around the country every week. The network maintained its leadership position in key markets with CNBC TV18, News18 India, and CNN News18 being the #1 channels in their respective genres. TV18 was also the leader in primetime in the Hindi speaking markets, solidifying its position as the network of choice in the region. The network had leadership in 5 regional markets, including UP/Uttarakhand, Rajasthan, MP/Chhatisgarh. News18 Lokmat, the Marathi language channel, climbed viewership charts to become the second ranked channel, driven by the programming initiatives launched over the past year.

• TV network share increased by 50 bps to 10.5%, driven by the performance of Sports and Movies channels. Colors was the #2 channel in primetime with 18% market share and exited the quarter with 2 of its fiction shows featuring in the top 10 list. Colors Kannada continued to be a strong #2 channel in the Kannada genre. Viacom18 Studios released Rocky Rani Ki Prem Kahani and OMG 2 during the quarter, and both the movies were commercially successful as well as critically acclaimed.

Strong growth in revenue as the Company continues to make investments in growth businesses

• TV news network delivered a strong growth in advertising revenue despite the continued weakness in advertising environment. Excluding government initiatives, news industry saw a decline in ad inventory consumption. News18’s revenue growth was underpinned by the strong viewership share that the network has achieved over the last eighteen months which has helped it to improve pricing across the network. TV18’s sharp focus on building IPevents business has also helped it drive growth in revenue.

• Viacom18 saw a sharp growth in advertising revenue in Sports and Digital segments. Sports revenue was driven by the two cricket series – West Indies vs India and India vs Australia. Digital revenue was led by original shows like Bigg Boss OTT, Taali, Kaalkoot and TV network shows like Khatron Ke Khiladi. Advertising demand in entertainment broadcast segment continues to be soft as spending by consumer goods companies and new-age clients remained weak.

• EBITDA declined as the business made investments in growth verticals – Sports and Digital.

Both these verticals require investments in the near term to build a strong consumer proposition which will help the Company rise to the leadership position in the cluttered media landscape. We are building a strong catalogue of entertainment content which will leverage the exponential increase in audience traffic that sports enables. Our endeavour is to make JioCinema the default destination for consumers across the country looking for quality content.

Mr. Adil Zainulbhai, Chairman of TV18, said: “We continue to take giant steps towards building the network of choice for Indian consumers. With India cricket rights, Viacom18 now has the biggest portfolio of sports properties, making it the default choice for sports fans. Our news network has fortified its positions across the markets which bodes well as we head into the festive season followed by elections. Our focus continues to be on providing quality content to audience and as India’s only network with presence across news, entertainment, and sports, we are in a unique position to serve customers across the country and demographic cohorts.”

Operating highlights and financial performance

TV18 (including the subsidiary Viacom18) owns and operates the broadest network of 60 channels in India, spanning news, entertainment, and sports genres. One in every 2 Indians is a consumer of our broadcast content. Digital platforms like JioCinema and CNBCTV18.com are also a part of the TV18 portfolio. It also caters to the Indian diaspora globally through 21 channels in international markets.

News (20 domestic channels, CNBCTV18.com) – TV18 is the biggest News network in India with highest weekly reach and widest presence across Indian languages.

Revenue during the quarter was up 20% YoY, driven by the strong growth in advertising revenue across all the clusters. Growth in ad revenue was on the back of strong viewership gains that the network has achieved over the last year, which has helped to increase the pricing across most channels. Excluding government initiatives, advertising inventory for the news genre was down by 8%, whereas it was flattish for our network. Monetisation of IP-led events also witnessed a strong revenue traction.

Operating Highlights

News18 was the highest reach news network in the country, reaching ~190mn consumers on a weekly basis. In terms of viewership, it was the #2 network with 11.4% market share in the news segment. Network18’s portfolio of English and Hindi channels the overall evening prime-time viewership charts in the respective language markets.

▪ National News: Both our national news channels, News18 India and CNN News18, continued to be the leaders in their respective markets. News18 India had 14.2%2 viewership share in the Hindi genre and was also the leading channel in evening primetime. CNN News18 was the #1 English news channel with 32.8%3 market share in the genre.

▪ Business News: CNBC TV18 continued to be the undisputed leader in the English Business News genre with 80%+4 overall share and 95%+ viewership share during the market hours.

▪ Regional News: 5 of our regional news channels were leaders in their respective genres including 4 regional HSM channels – News18 UP/UK, News18 Rajasthan, News18 Bihar/Jharkhand and News18 MP/Chhattisgarh, making News18 the dominant news brand in the Hindi-speaking heartland.

▪ CNBCTV18.com delivered a strong all-round performance with growth across all consumer and operating metrics. Along with providing updates and analysis of economy and financial markets, it is also capturing the young consumers with its ‘CNBC NextGen’ vertical. Entertainment (Viacom18’s 38 channels, JioCinema + AETN18’s 2 infotainment channels) – TV18’s entertainment portfolio had a viewership share of 10.5% in the non-news genre during the quarter.

Entertainment (Viacom18’s 38 channels, JioCinema + AETN18’s 2 infotainment channels) –

TV18’s entertainment portfolio had a viewership share of 10.5% in the non-news genre during the quarter.

Strong growth in operating revenue was driven by Movie, Sports and Digital segments. Sports revenue was driven primarily by the two cricket series (West Indies vs India, India vs Australia). Digital (JioCinema) revenue was driven by advertising on original shows like Bigg Boss OTT, Taali, Kaalkoot and TV network shows like Khatron Ke Khiladi.

▪ Excluding Sports and Digital, the network saw a decline in advertising revenue due to higher number of non-fiction shows and events in the base quarter. Absence of these properties also led to a lower content cost for the TV business. Overall advertising environment for TV continues to be soft as consumption demand for FMCG and consumer durables, the primary driver for advertising, continues to languish. Advertising spends by new-age clients remained weak due to the still soft funding environment, posing a challenge in driving growth. Advertising demand for entertainment business was also impacted by multiple cricket series during the quarter which captured a higher share of advertising spends.

▪ Increase in operating costs was primarily driven by higher programming costs in Sports and Digital segments, excluding which the costs were down. The two segments are in an investment phase and had an impact on reported EBITDA as the Company continues to invest in these growth initiatives.

Operating Highlights

▪ JioCinema was the #1 broadcaster-OTT app in the country during the quarter with an average of 210mn Monthly Active Users as per the data from Data.ai.

▪ Entertainment: JioCinema witnessed a strong traction on the entertainment content launched during the quarter. The second season of Bigg Boss OTT became the biggest ever reality show on digital with record concurrency and voting during the finale. The season garnered 100 mn viewers and time-spend of 30 bn minutes. 5.4 bn votes were logged through the season with 250 mn coming in the15-minutes live voting window during the finale. The grand finale was the most streamed live entertainment event in India with 23 mn viewers and a peak concurrency of 7.2 mn.

Popular network reality shows also saw an exponential growth in digital consumption. Khatron Ke Khiladi S13 saw 2x viewers and 1.5x video views over the previous season and Roadies S19 saw 7x viewers and 4x watch-time over the previous season. Original shows released during the quarter also garnered wide reach and strong engagement. Taali reached a record 20 mn viewers in the first week of release and Kaalkoot was watched by 25 mn viewers. JioCinema Premium, home to HBO, Max Original, Warner Bros., and NBCU content, witnessed strong growth in consumption. The Super Mario Bros. Movie, Shazam! The Fury of the Gods, Fast X, and Shark Tank USA S15 were some of the popular releases during the quarter.

▪ Sports : JioCinema’s first India cricket series (vs Australia) featured multiple language feeds, multi-cam options and an expansive panel of in-house pundits, and reached ~90 mn users. JioCinema also started streaming ISL, India’s premier football league, the rights of which it had recently acquired. The platform is also the destination for a range of sports events including premium properties like Football, Tennis, MotoGP as well as emerging events like Premier Handball League, Global Chess League, Squash World Cup, Khelo India University Games and Olympics Esports.

.

▪ Colors was the reach leader in the Hindi GEC genre and was the second ranked channel in the prime-time band. Colors’ marquee reality show, Fear Factor: Khatron Ke Khiladi, was the #1 non-fiction show during the quarter. Shiv Shakti and Parineeti were amongst the top-10 fiction shows in the genre. The channel has seen a 17% growth in non-primetime viewership in the first half of the fiscal.

▪ In the pay Hindi movie genre, Colors Cineplex climbed the channel rankings by one position as the viewership share increased by 50 bps to 8.5%. The channel aired 14 World Television Premieres, including movies such as Bhediya and Vikram Vedha. FTA channels, Colors Cineplex Superhits and Colors Cineplex Bollwyood, delivered a viewership share of 14.4% in the FTA genre.

▪ Colors Kannada continued to be the #2 channel in the genre with 22.7% viewership share. Colors Super added 3.1% to our Kannada portfolio, taking the total share to 26%. Colors Marathi was the #3 GEC in the genre with 15.0% viewership share.

▪ Viacom18 was the undisputed leader in niche genres – Kids, Youth and English. Nickelodeon franchise dominated the Kids category with 30%+ market share and 8 of the top 20 properties. MTV maintained its position as the #1 channel in the youth genre, with highest viewership among the core audience segment (15-21 HSM Urban). MTV Roadies S19 and Hustle 3.0 delivered reach and engagement on both TV and Digital platforms. English genre was completely dominated by Viacom18’s portfolio of channels.

▪ Viacom18 Studios delivered two blockbuster films, Rocky Aur Rani Ki Prem Kahaani and OMG2. It also distributed Paramount’s blockbuster film Mission Impossible in India. Viacom18’s digital content brand, Tipping Point, produced Kalkoot which was launched on JioCinema and received excellent response from viewers.