As the world has become more globalised and connected, companies have sought to capitalise on the opportunities presented by countries beyond their own. These opportunities are both supply-related like more abundant raw material or cheaper manpower, and demand-driven like growing incomes of larger consumer populations.

As the world has become more globalised and connected, companies have sought to capitalise on the opportunities presented by countries beyond their own. These opportunities are both supply-related like more abundant raw material or cheaper manpower, and demand-driven like growing incomes of larger consumer populations.

As these multi-national corporations (MNCs) have entered new ground, they have often proven, to be a boon for the local markets. Categories see higher levels of innovation, reach and assortment while consumers see an explosion of choices and sophistication. Suppliers get to work with global and standard commercial practices. Moreover, the general population finds greater employment opportunities and so on.

In the last few years we have also simultaneously seen another global phenomenon – the rise of local giants.

In emerging markets across the world, where pace of development has historically lagged the developed nations, consumer needs were met by local home-grown companies before global MNCs stepped in. These home-grown companies made the best use of resources available to them to answer the consumers’ needs and wants, often compromising functionality or form for value.

Local giants are leaders in their markets. They have been around for years, know what their consumers want, and have the local relationships to execute with. Their consumers know them well too, placing them in a position of trust to capitalise on. And these local giants continue to offer formidable competition to global MNCs who have entered their home ground.

GLOBAL MNCS AND LOCAL GIANTS IN INDIA FMCG

Brand Origins (global or local) matter significantly to Indian consumers. As per an online survey conducted by Nielsen across 30,000 respondents in 61 countries where respondents were asked to rate the importance of various purchase criteria including price, quality and the origin of brand (global/MNC or local), Brand Origin, in general, mattered more to Indian respondents in the survey. Only 2% said brand origins were not important to them against a global average of 6%. In fact, 43% of Indians, against a global average of 28%, said that Brand Origin is more important than any of the other purchasing criteria, with Quality and Functionality being two criteria on which Brand Origin was most important.

The Swadeshi phenomenon also rang true; 71% Indians (3rd across countries) said they would buy local brands to support local businesses, versus 59% globally. 69% said that local brands are more in tune with their tastes. Global brands were seen as having more innovative product offerings.

From a category perspective, Indian preferences were in line with other countries – with a preference for global brands when it comes to personal/ beauty care, and local brands when it comes to food (except for Chocolates).

THE ‘WHY’ BEHIND THE BUY

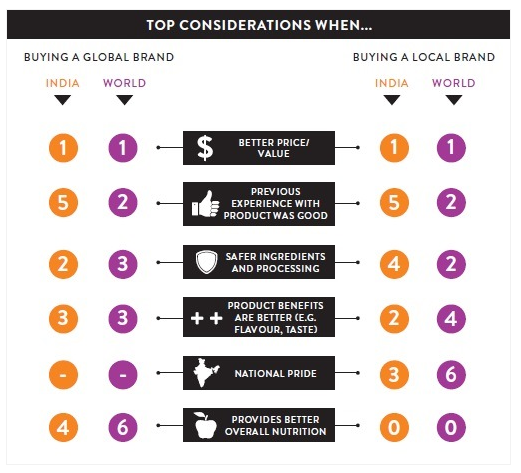

When considering either a global or local brand, consumers both globally and in India, ranked price/value as the primary consideration. The other top factors in consideration were:

Incidentally, promotions did not rank in the Top 5 considerations for consumers; neither did packaging, organic options or environment friendliness.