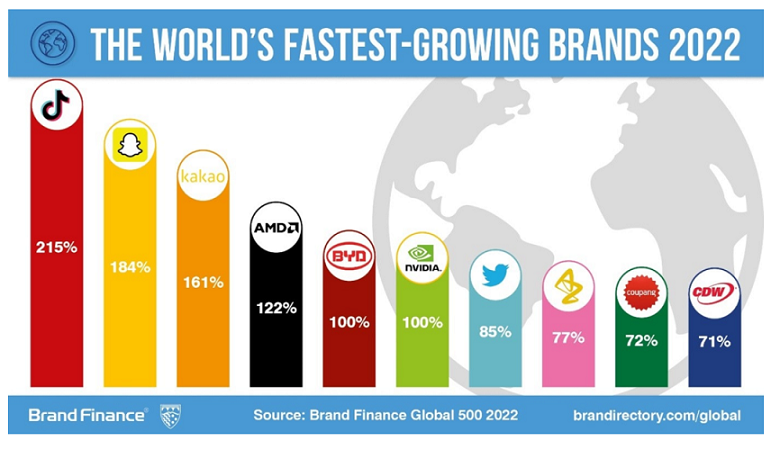

New entrant TikTok named world’s fastest-growing brand, up 215%, leading global revolution in media consumption

New entrant TikTok named world’s fastest-growing brand, up 215%, leading global revolution in media consumption

Apple holds on to world’s most valuable brand title with record valuation at more than US$355 billion, followed by Amazon and Google

Tech remains most valuable industry, while second-ranked retail crosses US$1 trillion mark following 46% brand value growth during COVID-19 pandemic

Development of COVID-19 vaccines sees pharma named fastest-growing industry, while tourism sector remains below pre-pandemic valuation

US and China continue to dominate claiming 2/3 of brand value in ranking, while India sees fastest-growth over course of pandemicamong top nations, up 42%

WeChat named world’s strongest brand for second consecutive year with top score of 93.3 out of 100 and elite AAA+ rating

Microsoft’s Satya Nadella comes out top in Brand Finance Brand Guardianship Index 2022 of world’s top 250 CEOs

Tripling in brand value over the past year, TikTok has been named the world’s fastest-growing brand by a new report published today. With an astounding 215% growth, the entertainment app’s brand value has increased from US$18.7 billion in 2021 to US$59.0 billion this year. Claiming 18th spot among the world’s top 500 most valuable brands, it is the highest new entrant to the Brand Finance Global 500 2022 ranking.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes nearly 100 reports, ranking brands across all sectors and countries. The world’s top 500 most valuable and strongest brands are included in the annual Brand Finance Global 500 ranking – now in its 16th year.

With COVID-19 restrictions still in effect across the globe throughout 2021, digital entertainment, social media, and streaming services saw continued growth, and TikTok’s rise is testament to how media consumption is changing. With its offering of easily digestible and entertaining content, the app’s popularity spread across the globe, however, it also acted as a creative outlet and provided a way for people to connect during lockdown.

At the same time, strategic partnerships, such as its sponsorship of the UEFA Euro 2020 tournament, exposed TikTok to demographics outside of its original Gen Z base. It crossed the one billion user mark in 2021 and became the most downloaded app across Android’s Google Play store and Apple’s App Store.

David Haigh, Chairman & CEO of Brand Finance, commented: “Media consumption has increased throughout the COVID-19 pandemic, but – what is more – the way we consume it has irrevocably changed. In order to compete in this evolving marketplace, media organisations have invested heavily in their brands – from content acquisition through to user experience. TikTok’s meteoric growth is the proof in the pudding – the brand has gone from relative obscurity to internationally renowned in just a few years and shows no signs of slowing down.”

Overall, media brands account for the top 3 fastest-growing brands in the ranking – with another social media app Snapchat (brand value up 184% to US$6.6 billion) and South Korean internet brand Kakao (up 161% to US$4.7 billion) following closely behind TikTok.

Other notable performers from the media sector include those that offer streaming services, with Disney (brand value up 11% to US$57.0 billion), Netflix (brand value up 18% US$29.4 billion), YouTube (brand value up 38% to US$23.9 billion), and Spotify (brand value up 13% to US$6.3 billion) all seeing increases.

In stark contrast, traditional media brands have seen a continued decline, with people favouring social media platforms and on-demand streaming in their place. Warner Bros is among the fastest-falling brands in the ranking this year (brand value down 33% to US$6.8 billion), and this trend is even more apparent when comparing this year with pre-pandemic valuations. Looking at brand value change over the last two years of COVID-19, three media brands feature among the five fastest-falling brands – Warner Bros saw the biggest brand value loss at 40%, with NBC (brand value US$9.4 billion)and CBS (brand value US$7.4 billion) seeing losses of 38% and 36% respectively.

Apple holds on to top spot with record valuation

Apple has retained the title of the world’s most valuable brand following a 35% increase to US$355.1 billion – the highest brand value ever recorded in the Brand Finance Global 500 ranking.

Apple had a stellar 2021, highlighted by its achievement at the start of 2022 – being the first company to reach a US$3 trillion market valuation. The tech giant’s success historically lied in honing its core brand positioning, but its more recent growth can be attributed to the company’s recognition that its brand can be applied effectively to a much broader range of services.

The iPhone still accounts for around half of the brand’s sales. However, this year saw Apple give more attention to its other suite of products with a new generation of iPads, an overhaul to the iMac, and introduction of AirTags. Its range of services, from Apple Pay to Apple TV, has also gone from strength to strength and become of increasing importance to the brand’s success.

Additionally, Apple knows the importance of being in tune with its customers for maintaining brand equity. Privacy and the environment are salient topics, and Apple bolstered its credentials on both fronts. This is evidenced by a greater transparency of the App Store’s privacy policy, reinforcing the trust customers have in the brand, and the announcement that more of Apple’s manufacturing partners will be moving to 100% renewable energy, as the company aims to reach carbon neutrality by 2030.

David Haigh, Chairman & CEO of Brand Finance, commented: “Apple commands an amazing level of brand loyalty, largely thanks to its reputation for quality and innovation. Decades of hard work put into perfecting the brand have seen Apple become a cultural phenomenon, which allows it to not only compete, but thrive in a huge number of markets. With rumours abounding of its foray into electric vehicles and virtual reality, it seems it is ready for a new leap.”

Amazon and Google also saw good levels of growth, both keeping their spots in the Brand Finance Global 500 ranking behind Apple in 2nd and 3rd respectively. Amazon joined Apple in crossing the US$300 billion brand value mark with a 38% increase to US$350.3 billion, navigating global supply chain issues and a labour shortage in the process.

Google saw a similar brand value growth of 38% to US$263.4 billion. The brand relies on advertising for the vast majority of its revenue, and was hurt at the start of the pandemic as advertising spend dropped due to uncertainty. However, as the world adjusted to the new normal, and with people spending more and more time online, advertising budgets opened back up and Google’s business rebounded, resulting in a healthy uplift in brand value.

Tech remains most valuable industry

The tech sector is once again the most valuable in the Brand Finance Global 500 ranking, with a cumulative brand value of close to US$1.3 trillion. Technology and tech brands have become of ever-increasing importance in the modern world, a trend that has only been exacerbated by the COVID-19 pandemic.

In total, 50 tech brands feature in the ranking, however, the brand value is largely attributable to three big players, with Apple, Microsoft (brand value US$184.2 billion), and Samsung Group (brand value US$107.3 billion) together accounting for more than 50% of the total brand value in the sector.

Closely behind them, Huawei managed to reclaim its place among the top 10 most valuable brands in the world, following 29% growth to US$71.2 billion. Huawei’s smartphone business was hit hard by US sanctions, but it reacted positively by heavily stepping up investment in both domestic technology companies and R&D, as well as turning its focus to cloud services.

Retail continues to thrive

The retail sector has cemented its position as the second most valuable in the Brand Finance Global 500 ranking, crossing the US$1 trillion mark for the first time.

Prior to the pandemic, retail was the third most valuable sector behind banking, but a boom in e-commerce has seen it pull away whilst banking has remained stagnant. Over the course of the pandemic, retail has been the fastest-growing large industry in the Brand Finance Global 500 ranking, with a brand value increase of 46% – outpacing the tech and media sectors which grew by 42% and 33% respectively.

This year, one of the sector’s top performers, Walmart, continued to see brand value growth and reclaimed its spot in the top 5, with the retailer climbing from 6th to 5th following a 20% increase in brand value to US$111.9 billion. Walmart already had a top-tier physical presence, and at the start of the pandemic it invested in e-commerce capabilities – which has continued to pay dividends.

Retail also saw the most new entrants in the ranking this year at nine brands, meaning almost one in four new entrants have come from the sector. The majority of the new retail brands are supermarkets – many of which adapted to the new normal by making themselves more accessible through online shopping and click and collect. Germany’s Edeka is the highest ranked of the nine, entering the ranking at 340th place with a brand value of US$6.5 billion.

David Haigh, Chairman & CEO of Brand Finance, commented: “The initial impression of lockdown may have been that retail would suffer, but those that have shown the agility to adapt and utilise technology have impressed with solid gains. The transformation of the industry to meet its customers’ evolving needs has sown the seeds for both short- and long-term prosperity.”

Pharma brands see healthy growth

Pharma brands have been in the limelight since the start of the pandemic as the world turned to the sector for COVID-19 tests and vaccines. As a result, unsurprisingly, the sector has seen faster growth in the Brand Finance Global 500 over the last two years than any other sector. The number of pharma brands in the ranking has doubled from four to eight, with brand value increasing by 94% to US$54.0 billion.

All eight brands featured are more valuable than they were in 2020, with those that produced COVID-19 vaccinations seeing the biggest increases. Johnson & Johnson remains the most valuable, with a 24% brand value increase to US$13.4 billion. New entrant to the ranking AstraZeneca secured the title of the sector’s fastest-growing, with a remarkable 77% rise in brand value to US$5.6 billion, followed by Pfizer as the second fastest-growing at 58%, pushing its brand value to US$6.3 billion.

David Haigh, Chairman & CEO of Brand Finance, commented:

“The production of effective vaccines has been integral to getting the global economy back on its feet. This has resulted in not only an increase in revenues, but also improved global awareness and reputation for brands in the pharmaceutical industry, which raises interesting questions about their potential applicability in adjacent sectors.”

Tourism brands show signs of recovery

The brand value of the tourism industry overall is still down when compared to pre-pandemic valuations, hampered by the number of brands featured in the Brand Finance Global 500 falling from 15 to 9. However, in a promising sign of recovery, all of the brands from the industry that do appear in this year’s ranking have seen positive brand value growth.

The hotel sector recorded the fastest level of growth, with the two brands in the ranking, Hilton (up 58% to US$12.0 billion) and Hyatt (up 26% to US$5.9 billion), now being more valuable than they were pre-pandemic. Airline brands all saw an uptick in brand value as international and domestic travel increased, though none recovered to their pre-pandemic level yet. The story is similar for online booking platform booking.com (US$8.7 billion) and car rental firm Enterprise (US$7.1 billion).

David Haigh, Chairman & CEO of Brand Finance, commented: “It is a promising sign to see recovery in the tourism sector despite intermittent restrictions still in place across the world. The bounce-back was no doubt hindered by variant outbreaks, however, as the world adjusts to living with COVID-19, there is no reason the tourism industry cannot take flight once again.”

US and China still dominate

Breaking the results down to country level, brands from the United States and China continue to dominate the Brand Finance Global 500. Over two-thirds of the total brand value in the ranking is attributable to the two countries, with the US accounting for 49% (US$3.9 trillion) and China for 19% (US$1.6 trillion).

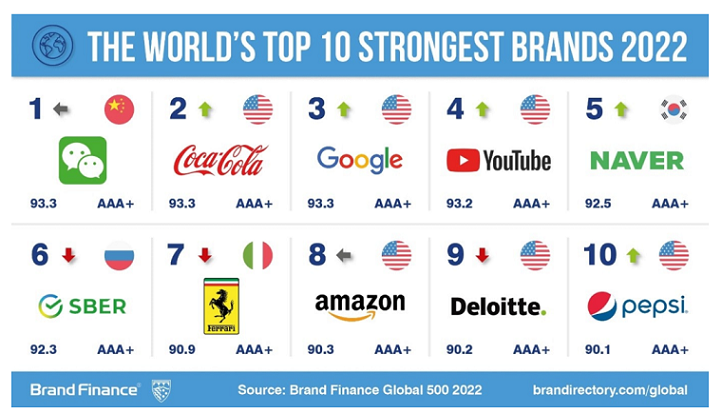

WeChat retains world’s strongest brand title

Apart from calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Certified by ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in more than 35 countries and across nearly 30 sectors.

According to these criteria, WeChat remains the world’s strongest brand, retaining the title for the second consecutive year, with a Brand Strength Index (BSI) score of 93.3 out of 100 and a corresponding AAA+ rating.

WeChat plays an integral part in day-to-day life in China, with its all-encompassing set of services allowing customers to message, video call, order food, and shop. It also played an integral part in the country’s fight against COVID-19, with more than 700 million people using its services to book vaccinations and tests. The app’s entrenchment in people’s lives helps it achieve strong scores in reputation and consideration among Chinese consumers, according to Brand Finance’s research.

In line with the trend seen in the brand value ranking, four out of the top 5 strongest brands now come from the media sector, compared to only two before the start of the COVID-19 pandemic. Joining WeChat at the top of the ranking is Google, climbing from 39th to 3rd with an impressive BSI score of 93.3, followed closely by its Alphabet stablemate YouTube, which rose from 27th to 4th with a BSI score of 93.2. South Korean brand Naver rounds off the media brands in the top 5, jumping a remarkable 99 places to 5th with a BSI score 92.5.

Brand Guardianship Index

The annual Brand Finance Brand Guardianship Index has been expanded and now ranks the world’s top 250 CEOs. This year’s top brand guardian is Microsoft’s Satya Nadella. Mr Nadella, who also became Chairman this year, has been credited with overhauling Microsoft’s fortunes by changing its culture towards one of teamwork, innovation, and inclusivity, and instilling a growth mindset throughout the business.

The top 10 of the ranking is dominated by brand guardians from the tech and media sectors. Tim Cook sits in a well-earned 2nd place, having overseen Apple’s record-breaking year, which saw it become the first company to achieve a US$3 trillion market valuation. Mr Cook is joined by the brand guardians of a number of household brand names, with Tencent’s Huateng Ma (4th), Google’s Sundar Pichai (5th), and Netflix’s Reed Hastings (7th) all featuring at the top of the ranking.

David Haigh, Chairman & CEO of Brand Finance, commented: “Ultimately, the role of a brand guardian is to build brand and business value. Our ranking recognises those who are building business value in a sustainable manner, by balancing the needs of all stakeholders – employees, investors, and the wider society. More and more, the CEOs ranked in the Brand Guardianship Index must work in partnership to build a sustainable future, redefining the role of a CEO from ultra-competitive entrepreneur to collaborative diplomat.”

AMD CEO Lisa Su is a new entrant in 10th place, making her the highest-ranked female in the Brand Guardianship Index 2022. Dr Su’s leadership of a tech company is unfortunately a rarity, with most being run by male CEOs. This is reflected in the ranking, with only five female CEOs in the top 100. With diversity and inclusion becoming ever-increasingly important to society as a whole, we hope to see the promotion of female leadership in the C-suite in the future.