It has long been acknowledged that powerful brands drive stakeholder preference, improving business performance and ultimately increasing shareholder value. However, for the first time the extent of this effect has been quantified.

It has long been acknowledged that powerful brands drive stakeholder preference, improving business performance and ultimately increasing shareholder value. However, for the first time the extent of this effect has been quantified.

Valuation and strategy agency Brand Finance has been tracking the brand values of hundreds and thousands of the world’s top brands for nearly ten years. For the first time it has taken a retrospective look at the share price of the brands it has analysed and their subsequent stock market performance, revealing a compelling link between strong brands and stock market performance.

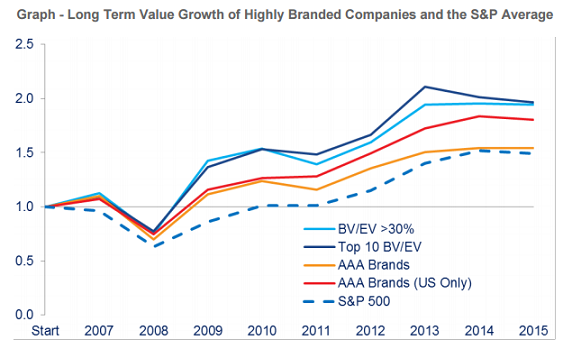

The most striking finding is that an investment strategy based on the most highly branded companies (those where brand value makes up a high proportion of overall enterprise value) would have led to a return almost double that of the average for the S&P 500 as a whole.

Between 2007 and 2015, the average return across the S&P was 49%. However by using Brand Finance’s data, investors could have generated returns of up to 97%. Investing in companies with a brand value to enterprise value (BV/EV) ratio of greater than 30% would have generated returns of 94%. Investing exclusively in the 10 companies with the highest BV/EV ratios would have resulted in a 96% return.

There was a similar effect for brands rated as AAA or AAA+ according to Brand Finance’s Brand Strength Index (BSI™). This is the rating system Brand Finance uses to determine key variables in its valuation model, including the growth rate, discount rate and royalty rate applied to a brand’s revenue information as part of a brand value calculation.

A letter grade or ‘brand rating’, analogous to a credit rating, is awarded to each brand based on the results of Brand Finance’s BSI™ assessment. A strategy based on investment in all AAA and AAA+ rated brands would have led to a return of 54% over the eight years from 2007. However if only top-rated US brands were targeted, the return would have been 87%.

Brand Finance Chief Executive David Haigh comments, “These findings demonstrate the powerful effect brands can have on the long term financial performance and enterprise value of businesses. Anyone tasked with reporting to shareholders should have brand strength and brand value front of mind. In 2016 we intend to develop a range of investment products and indices based on this important insight

Important Information / Disclaimer

Brand Finance does not provide investment advice or recommendations. It is not responsible for any decisions taken by an investor.

This release is issued by Brand Finance for promotional purposes only.

This release is not intended to be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. This release does not itself constitute an offer to subscribe for or purchase any interests or other securities. Any investment is subject to various risks, none of which are outlined herein. All such risks should be carefully considered by prospective investors before they make any investment decision.

You are not entitled to rely on this Release and no responsibility is accepted by Brand Finance or any of its directors, officers, partners, members, employees, agents or advisers or any other person for any action taken on the basis of the content of this release. Neither Brand Finance nor any other person undertakes to provide the recipient with access to any additional information or to update this Release or to correct any inaccuracies therein which may become apparent.

No undertaking warranty or other assurance, express or implied, is made or given by or on behalf of Brand Finance or any of its respective directors, officers, partners, members, employees, agents or advisers or any other person as to the accuracy or completeness of the information or opinions contained in this Release and no responsibility or liability is accepted by any of them for any such information or opinions.

Past performance is not indicative of future results. The value of investments may fall as well as rise and investors may not get back the amount invested. Changes in rates of foreign exchange may cause the value of investments to go up or down. No representation is being made that any of the companies Brand Finance has analysed will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Investors should always seek their own independent financial, tax, legal and other advice before making a decision to invest.

Statements contained in this Release that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Brand Finance. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. In addition, this Release contains “forward-looking statements.” Actual events or results or the actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements.

Certain economic and market information contained herein has been obtained from published sources prepared by third parties and in certain cases has not been updated to the date hereof.

While such sources are believed to be reliable, neither Brand Finance nor any of its directors, partners, members, officers, employees, advisers or agents assumes any responsibility for the accuracy or completeness of such information.

No person, especially those who do not have professional experience in matters relating to investments, must rely on the contents of this Release. If you are in any doubt as to the matters contained in this Release you should seek independent advice where necessary.

This Release has not been submitted to or approved by the securities regulatory authority of any state or jurisdiction.