India’sBrandZ™ Top 50 Brand Valuation rises 30% over threeyears

India’sBrandZ™ Top 50 Brand Valuation rises 30% over threeyears

• Locally-grown Indian brands increased 32% in value during that period, while global brands with local presence grew by 19%

• Overall brand value of Top 50 saw a modest dip of 2% in 2016

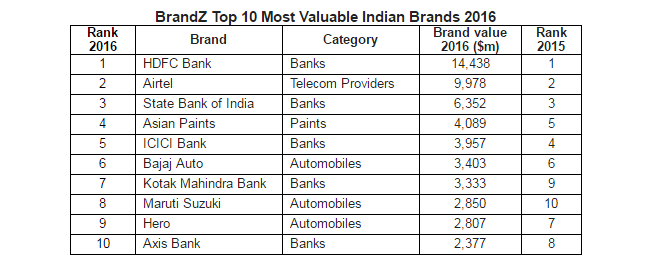

The total value of India’s most valuable brands has risen by 30% over the last three years, with the Top 50 brands now worth $90.5 billion, according to the third annual BrandZ™ Top 50 Most Valuable Indian Brands ranking released today by WPP and Kantar Millward Brown. HDFC bank stands firmly at number one for a third consecutive year with a brand value of $14.4 billion following a 15% growth over the past year.

The past year was a year of consolidation for the BrandZ India Top 50, primarily due to a decline in brand value of state-owned banks, bringing the total brand value of Top 50 down marginally by 2%. Despite this, brands in the financial sector still made the largest contribution to the overall value, but significant growth was also seen across multiple other sectors including auto and consumer goods. The airline sector made the BrandZ India Top 50 rankings for the first time with IndiGo and Jet Airways positioned at 26 and 36 respectively.

Indian entrepreneurship and innovation, factors which produced the strongest gross domestic product (GDP)[1] growth of any major industrialized economy, also drove a rise amongst local Indian brands. The number of brands of Indian origin increased from 35 brands in the Top 50 in 2014 to 38 brands in 2016. This is due to a growth in popularity for locally grown Indian brands which appeal to Indian tastes and traditions but also prove that local brands are capable of creating high quality products and services that can compete with global brands.

Increased access to the internet has been an enabler for change in India. Access to the internet and increased mobile penetration has seen the aspirational gap and purchasing patterns between rural and urban Indians narrowing with even the most remote of villages now connected. With geographic boundaries being erased, rural India offers enormous opportunity to reach a large population that is steadily rising in income and hope. Increased internet access has also been an enabler for ambitious entrepreneurs, providing a low barrier to entry due to the digital nature of many new brands and an increasingly sophisticated audience.

Key highlights of the 2016 BrandZ Top 50 Most Valuable Indian Brands study include:

· Financial brands continue to dominate. With 10 brands in the Top 50, accounting for 38% of its value ($34.28 billion), the financial sector has built brand value by making a consistent effort to serve consumers better. Private banks make up three of the fastest risers: HDFC Bank (No.1, +15%), Kotak Mahindra Bank (No.7, +39%) and IndusInd Bank (no.12, +18%).

· Airlines enter the BrandZ India Top 50. With the entrance of IndiGo (26) and Jet Airways (36), the airlines category gains representation in the BrandZ India Top 50 Ranking for the first time. This year, an automobile brand has also made an entry in the Top 50 ranking with TVS (48).

· Retail sector debuts on BrandZ India Top 50. For the first time in three years, a retail brand has secured a position in the Top 50 ranking, Reliance Retail (50) signalling a strong growth in the sector.

· Local Indian brands gaining ground. Over 5,000 years of rich cultural inspiration and tradition is gaining ground as locally-grown brands are inculcating national pride amongst consumers. An example of this is the growth of emerging brand Patanjali from an Ayurvedic products brand to a full-fledged FMCG brand.

· Brand Contribution Leaders ranking remain strong. Cosmetics brand Lakmé ranks first in Brand Contribution, with all the 2015 Brand Contribution leaders returning for 2016, illustrating the stability that a strong brand offers. Focusing on the core essence of a product after distilling price and other purchasing influencers, the Brand Contribution Index suggests that the consumers’ decision to use a particular brand is based on emotional affinity, distinctive and trendsetting characteristics, and high recall.

· Quality over quantity. Indians are choosing to trade up and selecting quality over quantity, and have benefited from price promotions as the online shopping space continues to gain prominence and fuel aspirations amongst rural Indians. Premiumization is a growing trend affecting multiple categories including mobile phones, beauty parlours and services on public transport.

· Brand loyalty is weakening. Internet penetration has risen sharply as the number of people living in rural areas accessing Internet almost doubled over the past year, with almost 69% of urban internet users using the internet every day. This access educates consumers while providing them access to larger diaspora of premium brands available at affordable prices.

David Roth, CEO EMEA & Asia, The Store WPP commented: “The 2016 BrandZ study shows the extent of change India has witnessed and its continuing potential. India has relaxed ownership rules across key industries and is making doing business in India easier, parliament has taken unprecedented steps to replace a complicated mix of national, state, and local taxes with a single Goods and Services Tax (GST). India does branding India’s way. This country is so multifaceted, it needs to be viewed through a wide-angle lens, which is what this report and its insights provides and why it’s of such value to marketers building valuable brands in India.”

Dinesh Kapoor, Kantar Millward Brown’s Managing Director, South Asia said: “Over the past year, brands have had to work hard to hold on to their position in the Top 50. 20 brands have witnessed a drop in their ranking within the Top 50. Brands which have managed to sustain their ranking over the past two years have only been able to do so by increasing their brand value by over 35%. For these brands, it is critical that they identify fundamental insights about consumer needs and also assert their difference from the competition. Innovation helps create the perception of difference while meaningfully different brands build salience with great creative advertising and a strategic media mix. Brands that are meaningful, different, and salient inspire love. Love has a multiplier effect that helps accelerate brand value growth.”

Ranjan Kapur, Country Manager, WPP India, added: “Brands, these days, need to find ways to support the national agenda, and help to develop a more modern, prosperous and equitable society. Their focus needs to remain on building trust amongst consumers by connecting with the country’s sense of responsibility. Successful brands in India help in building India as a nation.”