Over the past year, three of the four major US professional sports leagues have agreed new lucrative domestic TV and digital media rights deals. Major League Baseball (MLB) struck a deal in June 2020 with Turner Sports worth an average of $470m per season.

Over the past year, three of the four major US professional sports leagues have agreed new lucrative domestic TV and digital media rights deals. Major League Baseball (MLB) struck a deal in June 2020 with Turner Sports worth an average of $470m per season.

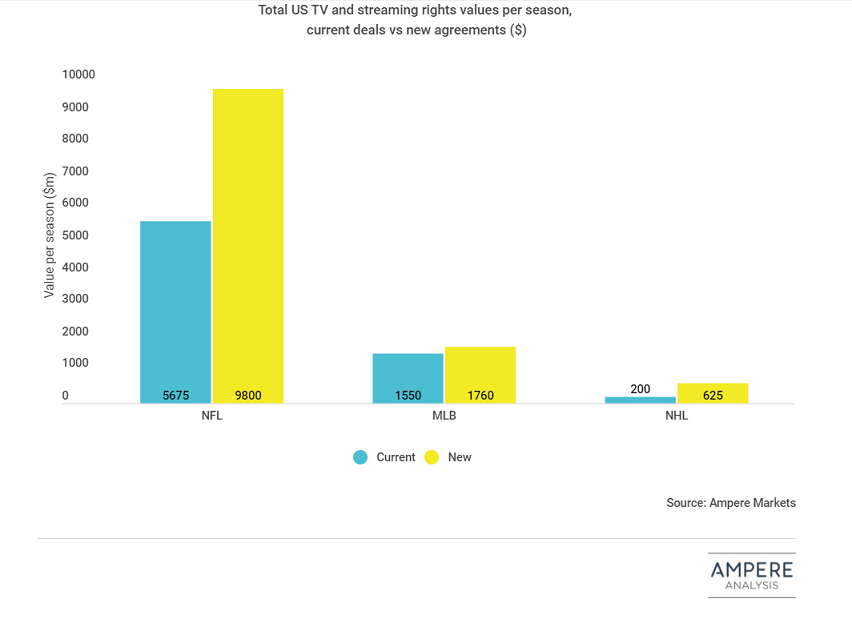

The total MLB media rights value will increase by nearly 15% when all new deals take effect. More recently, the NHL agreed deals with ESPN and Turner for 2021-2028 worth $625m per season, a dramatic increase from the current $200m a season deal with NBC. The NFL has increased its domestic media rights value from $5.7bn annually to $9.8bn, after striking deals with ViacomCBS, Fox, Disney, Comcast and Amazon for the 2023 to 2033 seasons.

These new high-cost rights deals have been agreed against a backdrop of a continued shift in viewing habits towards on-demand content among US consumers, boosted by the pandemic. Sports fans are not exempt from this trend, despite being historically more reluctant to cut the pay TV cord due to the attraction of live sports fixtures on linear TV. Self-reported SVoD viewing time has now overtaken that of scheduled TV channels for sports fans in the US, while sports fans aged 18 to 34 now watch twice as much SVoD content as they do linear TV.

New streaming clauses in these recent rights deals provide opportunities for rights holders to maximise reach among sports fans regardless of their individual viewing habits. NFL rights owners ViacomCBS, NBC and Disney will simulcast most games on their own online platforms such as Paramount+, Peacock, ESPN+ and Hulu. Though Amazon will be the sole broadcaster of Thursday Night Football games, Peacock and ESPN+ will also broadcast select fixtures exclusively. ESPN+ will replace NHL.tv as the platform for out-of-market NHL fixtures, while HBO Max will also broadcast live games from the competition. Fox has an opportunity to use its AVoD platform Tubi to exhibit NFL and MLB content online.

As consumers continue to lose interest in paying premium rates for traditional TV packages, traditional broadcasters are adapting to changing consumer demand by providing these games for sports fans as part of cheaper services. Doing so should help ensure they do not get left behind as the sports broadcasting landscape continues to evolve. The challenge for these broadcasters will be generating enough revenue to justify the increased spending on rights, despite audiences fragmenting across platforms without growing in overall size.