$45.3bn forecast for 2024

The 2024 WOO Expenditure survey captures expenditure globally for OOH across 2023 and give estimates of OOH expenditure for 2024. It is conducted by the use of a short form questionnaire to WOO members and OOH associations across the world and represents the most comprehensive survey of OOH expenditure globally.

Building on data for each year back to 2019, the WOO Global Expenditure survey allows us to track the effect of and recovery from the Covid-19 pandemic alongside local economic conditions and the investment into DOOH as it drives growth for OOH globally. Understanding these drivers of growth in particular markets allows WOO members and OOH Trade Associations to look to other markets for learnings to drive growth in their own markets.

The 2024 survey was completed by 109 members, covering 85 unique territories – collectively representing 95% of global GDP and 78% of global population. Unreported territories are modelled from similar territories based on population and GDP per capita where possible, or are excluded from the study.

Global OOH spend in 2023 reached $41.9bn USD and represented 5.2% of global ADEX – breaking through the $40bn barrier, the 5% barrier and eclipsing the 2019 revenue figure of $36.3bn. OOH spend is forecast to grow to $45.3bn USD in 2024.

Regionally APAC dominates with almost half of global OOH spend at $20.2bn across 40% of global GDP. Europe reports $10.3bn revenue, 25% of the total in line with its share of global GDP. North America ($9.4bn), LATAM ($1.3bn) and Africa ($0.7bn) track behind their share of GDP – although expenditure reporting in Africa is more challenging and is likely to be under-reporting much of the informal economy.

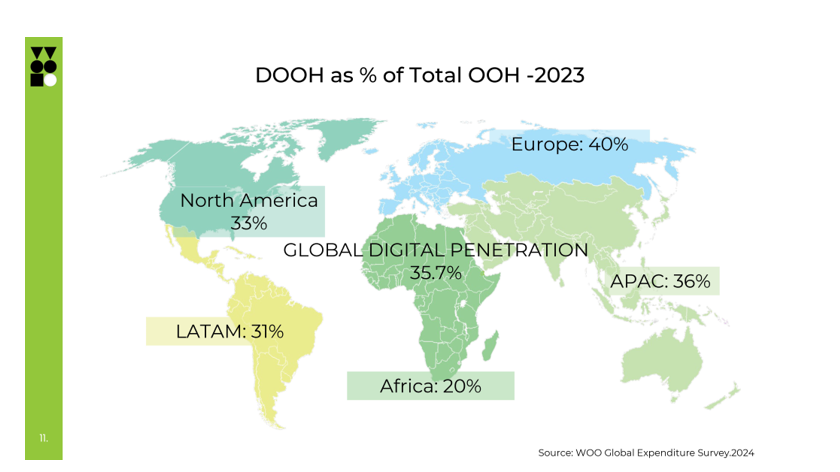

Global DOOH expenditure rose to $16.7bn USD in 2023 representing almost 37% of all OOH revenues and remains the main driver of OOH revenue growth globally.

Investment in DOOH infrastructure varies across the world with Europe ahead of the global average at 39.2%, APAC just under the average at 36.1% North America at 32.9%, LATAM at 31% and Africa at 20.1% of total OOH revenues.

The ‘headroom’ for growth in DOOH is exemplified by territories that have invested heavily in DOOH screens – of the top 10 markets by overall OOH volume: Australia (76% of OOH revenue), UK (65%), Germany (41%), China (40%) and South Korea (40%); lead the way in driving growth through DOOH.

Programmatically traded DOOH grew to a reported total spend of $1.2bn USD globally, representing 8.1% of total DOOH revenues. Although this data is not captured commonly across all markets so may be under representative of the total revenue traded this way. We anticipate significant growth to this figure in the 2025 report through a combination of increasing market adoption and more comprehensive reporting programmatically traded revenue.